Lending lifts, confidence at 7-month lows: CommSec's Savanth Sebastian

GUEST OBSERVER

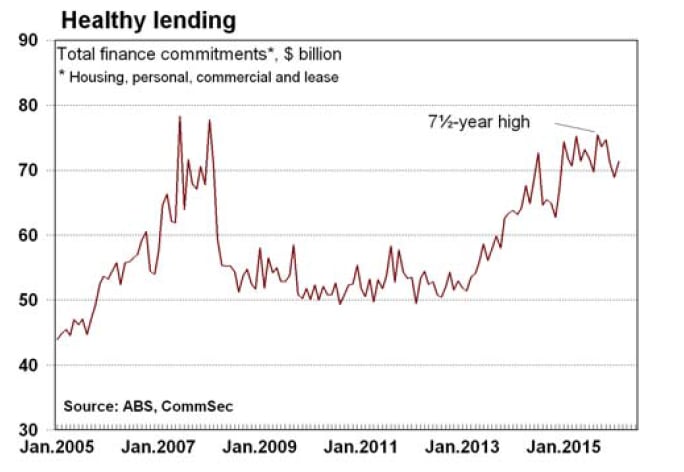

Total new loans (personal, business, housing & lease) rose by 3.5 percent in February after a 3 percent fall in January. Lending was just 5.5 percent shy of the 7ó-year high recorded in September.

Total lending is down 0.7 percent on a year ago.

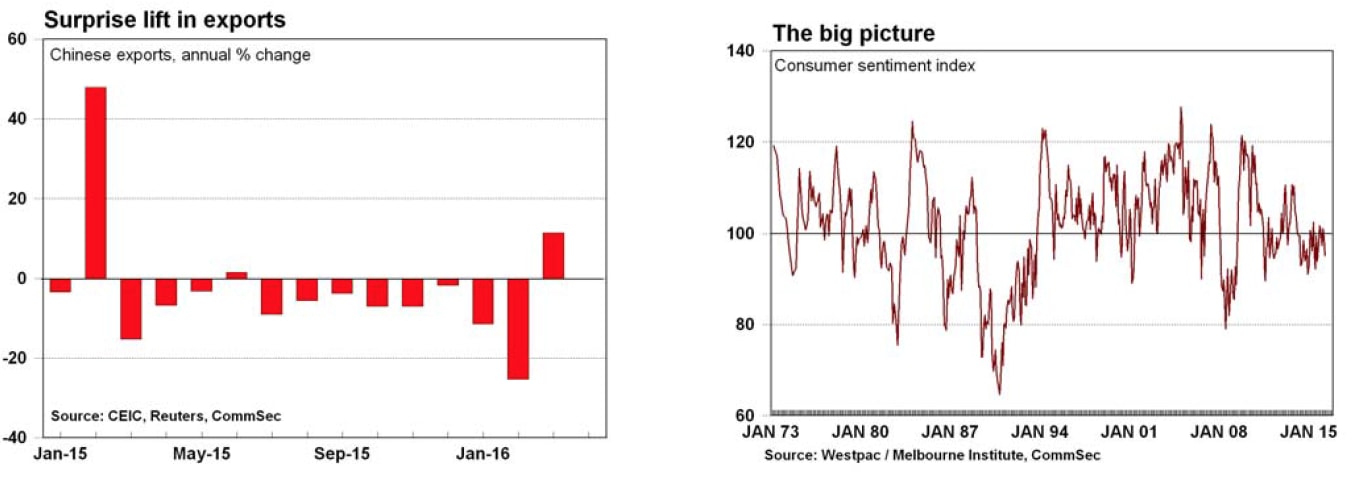

Consumer sentiment: The Westpac/Melbourne Institute index of consumer confidence fell by 4 percent in April to 95.1 – a 7-month low. A reading of 100 is the dividing line separating optimism from pessimism.

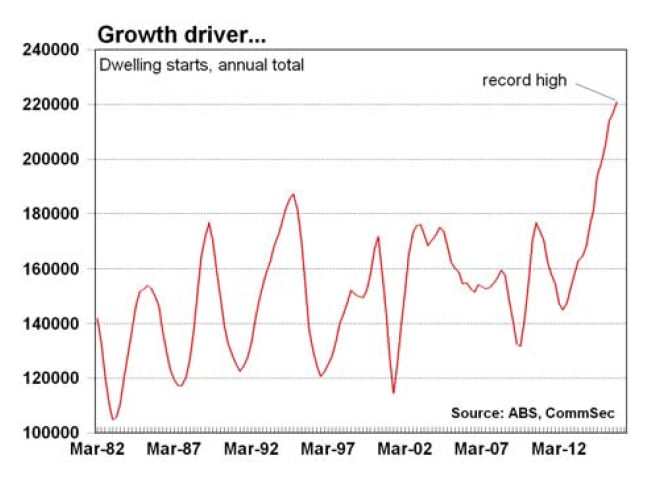

Dwelling starts: Starts fell by 5.1 percent in the December quarter after lifting by a revised 2.3 percent in the September quarter. Work started on a record 220,845 new dwellings over the year to December, well above the decade average of 164,317 dwellings.

China trade data: The trade surplus narrowed from US$32.59 billion to US$29.86 billion in March. Exports were up 11.5 percent over the year (forecast: +2.5 percent) while imports were down by -7.6 percent (forecast: -10.1 percent).

The lending figures have implications for finance providers, retailers, and companies dependent on consumer and business spending. The consumer confidence data is important for retailers and consumer-facing businesses. Building & building material companies are affected by dwelling starts including Boral, James Hardie, Adelaide Brighton, Brickworks, AV Jennings Limited, Devine Limited and Beacon Lighting.

What does it all mean?

A mixed bag in terms of the data flow. Aussie consumers have certainly become more cautious, with confidence levels sliding to 7-month lows. The result mirrors the four-week slide in the weekly consumer sentiment survey.

Unfortunately elections cause consumers and businesses to hold back on spending, employment and investment plans, and that is the risk to the positive momentum that has built up in recent months. Interestingly not even a stronger Australian dollar has been able to prop up consumer confidence. No doubt policymakers would be hoping that the slide in confidence is a temporary situation.

Encouragingly the lending data was more upbeat alongside better exports figures out of China. The last couple of months of Chinese data need to be studied with caution given the timing of Chinese New Year.

However the latest data certainly suggests that activity levels are lifting and no doubt will give investors a degree of optimism, particularly in light of the recent surge in commodity prices.

The lift in borrowing across the economy in February essentially negates the prior month’s weakness. Overall, lending is healthy - no doubt driven by housing but leasing has also been strong. The hope would be that business borrowings continue to lift - driving investment and supporting medium term growth.

The generational low interest rates will be supportive of further borrowing – but there is no guarantee. The interesting point for the Reserve Bank though is whether another cut in the cash rate would serve any purpose.

Borrowers are cautious about taking on more debt. And lower interest rates compress bank margins, affecting profits and potentially investment, employment and shareholder returns.

What do the figures show?

Lending Finance

Total new loans (personal, business, housing & lease) rose by 3.5 percent in February after a 3 percent fall in January. Lending was just 5.5 percent shy of the 7ó-year high recorded in September. Total lending is down 0.7 percent on a year ago.

Housing finance: The seasonally adjusted measure of construction and new purchases rose by 1.7 percent in February while alterations & additions rose by 2.7 percent. Home loans are up 15.6 percent on a year.

Commercial finance : The seasonally adjusted series for the value of total commercial finance commitments rose by 5.6 percent in February after falling by 2.6 percent in January. Revolving credit commitments rose by 10.6 per cent. Fixed lending commitments rose by 4 percent. Business loans are down 5.6 percent over the year.

Personal finance : The seasonally adjusted series for the value of total personal finance commitments fell by 3.1 percent in February after falling by 1.3 percent in January. Revolving credit commitments fell by 9.8 percent and fixed lending commitments rose by 1.3 percent. Personal loans are down 11.9 percent over the year.

Within personal fixed finance commitments, loans for new cars were up by 17.2 percent on a year earlier while loans for used cars were up 4.3 percent. Loans for residential blocks of land were up by 10.8 percent on a year ago.

Lease finance : Lending fell by 3.3 percent in February and was up 9.2 percent over the year.

Consumer sentiment:

The Westpac/Melbourne Institute index of consumer confidence fell by 4 percent in April to 95.1 after sliding by 2 percent in March. The confidence index is down 1.1 percent on a year ago.

The current conditions index fell by 1.1 percent while the expectations index fell by 6 percent.

Four of the five components of the index fell in April:

The estimate of family finances compared with a year ago was down by 3.9 percent;

The estimate of family finances over the next year was down by 6.6 percent;

Economic conditions over the next 12 months was down by 5.5 percent;

Economic conditions over the next 5 years was down by 6 percent;

The measure on whether it was a good time to buy a major household item was up by 1.1 percent.

Gender & demographics: Men (index reading of 99.2, down 5.1 percent) were more optimistic than Women (91.2, down 3.3 percent). The sentiment index for young people rose by 10.7 percent to 109.6 in April. Across the other demographics: 25-44 years (index 99.4, down by 3.6 percent); 45 years plus (index 88.7, down 7.8 percent).

Housing outlook: A good time to buy a dwelling? – Index down 9.2 percent in the month and down 12.3 percent on the year.

State sentiment levels: NSW (down 10.3 percent), Victoria (up 0.7 percent), Queensland (up 7.4 percent), Western Australia (down 12.2 percent) and South Australia (down 5.9 percent).

Dwelling starts

Dwelling starts (commencements) fell by 5.1 percent in the December quarter after lifting by a revised 2.3 per cent in the September quarter. House approvals fell by 5.4 percent and apartments fell by 3.8 percent. Work started on a record 220,845 new dwellings over the year to December, well above the decade average of 164,317 dwellings.

Across Australia, starts in the December quarter rose in five states: NSW (up 1.6 percent); Victoria (up 4.7 percent); Queensland (up 4.9 percent); South Australia (down 4.8 percent); Western Australia (down 5.7 percent); Tasmania (down 2.8 percent); Northern Territory (up 2.1 percent); and the ACT (up 2.9 percent)

In the year to December, dwelling starts were higher than the decade average in all the states & territories except for Western Australia (down 12 percent) and South Australia (down 9.5 percent). Starts were at record highs in Victoria (68,943), and NSW (59,016).

Dwelling starts in NSW in the December quarter were 62.9 percent above the decade average.

Chinese trade data

The trade surplus narrowed from US$32.59 billion to US$29.86 billion in March. Exports were up 11.5 percent over the year (forecast: +2.5 percent) while imports were down by -7.6 percent (forecast: -10.1 percent).

What is the importance of the economic data?

Lending Finance is released monthly by the Bureau of Statistics and contains figures on new housing, personal, commercial and lease finance commitments. The importance of the data lies in what it reveals about the appropriateness of interest rate settings, confidence and spending levels in the economy.

What are the implications for interest rates and investors?

The Reserve Bank will maintain its ‘easing bias’ as it attempts to gauge how the economy is tracking. No doubt the lift in the Australian dollar to above US77c following the release of the China trade figures would cause policymakers some angst if it was maintained. Tomorrow’s labour market figures and inflation (April 27) will be the key data points ahead of the May Reserve Bank Board meeting.

It’s important not to ‘over-think’ consumer confidence. For most punters, the Aussie dollar, interest rates, petrol prices, home prices and the job market are the key factors determining whether someone is positive or negative on supposedly ‘economic’ issues.

Savanth Sebastian is an economist for CommSec