What's really happening with foreign buyers and property? Pete Wargent

The Foreign Investment Review Board released its Annual Report for 2013/14, which made for interesting reading.

The most remarkable point of note was how accurately it conformed with expectations, coming in almost bang on - exactly in line - with previous guidance.

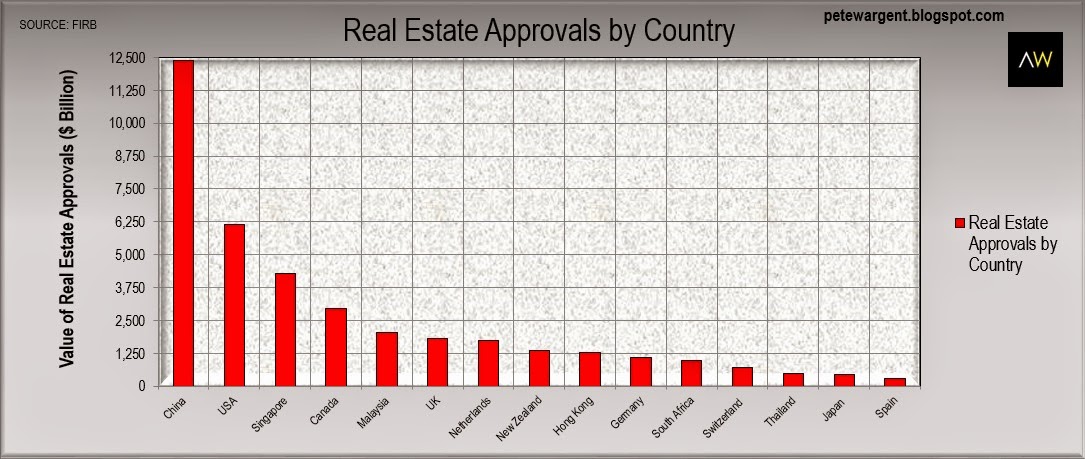

The 2014 Annual Report made history confirming that as expected China was by a huge margin the most influential investor in Australia with a thunderous $27 billion.

By way of comparison the nearest competitor was the US at just $17.5 billion.

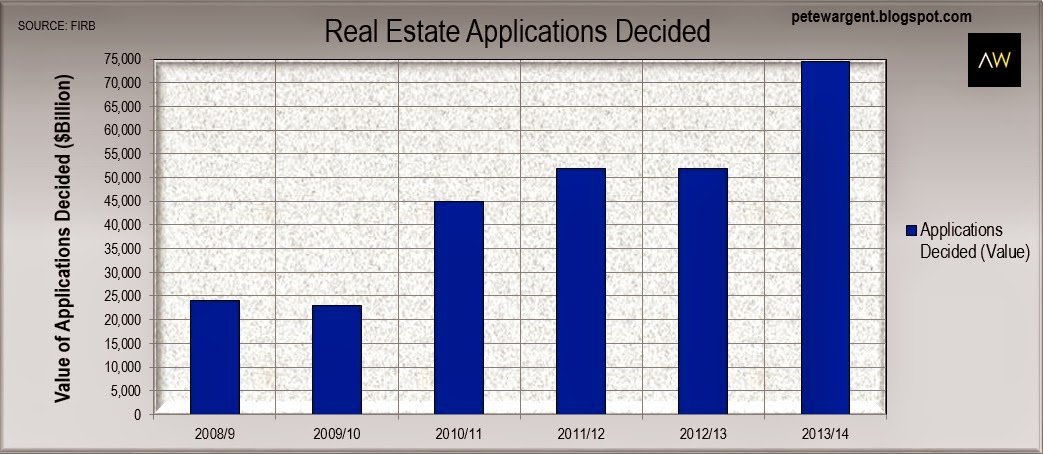

Unsurprisingly the main destination for foreign investment was real estate at $74.6 billion, a massive $22.7 billion increase on the prior year.

And, as I covered here last week, proposed foreign investment in residential real estate did indeed more than double in fiscal 2014, from $17.2 billion to $34.7 billion.

Let's take a look at what this means for our property markets.

All real estate proposals

Across all classes of real estate, the number of proposals in 2014 was...whoa.

And the increase in real estate applications decided by value was...whoa!

Note that these figures include all classes of real estate.

This all forms part of a very real dichotomy for our real estate markets.

On the one hand competition from developers is adding unprecedented upwards pressure on land values in the largest capital cities, particularly after the signing of the China-Australia Free Trade Agreement (ChAFTA).

Developers from China, Hong Kong and elsewhere are consistently overpaying for sites in Sydney and Melbourne, inevitably pushing up prices.

On the other hand, we are seeing a resultant boom in the number of high rise apartments being approved, sold offshore and constructed, and this is set to put further downward pressure on unit rents.

Residential approvals

With regards to residential property specifically, both the number and value of proposals approved leapt dramatically in fiscal year 2014.

A large proportion of approvals continue to be for assets of under $1 million in value.

If you check this blog back to its inception you will find that one of the chief reasons that I long ago picked out Sydney real estate as the out-performer was that I believed eventually the Aussie dollar must return from the stratosphere, and foreign investment would explode in Sydney and Melbourne.

The timing of currency movements and the impacts thereof are impossible to predict accurately; but that time is now.

State by state

Anyone with a working pair of eyes and a few frequent flyer air miles under their belt would know that Melbourne, Sydney and south-east Queensland see the overwhelming bulk of foreign investment in residential real estate.

New South Wales (39%) and Victoria (41%) accounted for 80% of foreign residential approvals by dollar value in 2014, with Queensland (11%) and Western Australia (5%) mopping up most of the remainder. South Australia accounted for just 0.4%.

It is important to recognise that most of this investment in residential real estate was approved for new dwellings (11,338 approvals), rather than for existing property (7,915), vacant land (3,150), redevelopment (534) or developer approvals (103).

By country

Finally, as projected China has come from the borders of oblivion to be far and away the away the greatest foreign investor in Australian assets.

To be blunt, this could come as no surprise whatsoever to anyone who works in the industry, the ever-increasing volume of inquiries (both residential and commercial) forcing a few people over time to change their opinions, including myself.

China was by an enormous margin the biggest investor in real estate, manufacturing and mineral exploration, and will soon become the leading investor in Australian services industries too.

If you believe that this trend is going to tail off any time soon, think again.

After the signing of the ChAFTA, the behemoth Chinese Greenland Group stated that it sees "no ceiling" to the level of funds it is prepared to invest in Australia, with agriculture next on the hit list.

The commercial space is seeing a spate of enormous deals being written.

In the past year both the Hilton Hotel and the Sheraton on the Park in Sydney have both been taken out by Chinese investment groups Bright Ruby and Sunshine Insurer for Group $442 million and $463 million respectively, while Goldfields House at 1 Alfred Street in Circular Quay also went recently for $425 million.

The wrap

Approved foreign investment in residential real estate more than doubled in 2014 and will continue to play a huge role in Australia over the years ahead, driven predominantly by Chinese capital.

This is helping to drive a record increase in dwelling supply, albeit largely of highrise apartments.

Clearly the new dwellings market in the most populous capital cities is increasingly being shaped by offshore funds, and the trends by country present not-so-subtle hints as to what is happening in the established property market too.

There are now approaching 400,000 Chinese born Australians, and there around 1 million people in Australia of Chinese ancestry.

2014 also saw yet another huge increase and a record number of Chinese short-term arrivals at around 800,000.

More than 750 business investment visas have been issued to qualifying "Significant Investors" since 2012, most of them to wealthy Chinese as intended.

Multiple pathways - as well as the evident desire - clearly exist for foreign-sourced capital to find its way into established property too, and my view is increasingly that this is happening, particularly in Sydney, and probably Melbourne.

I expect if you asked others who work in property "at the coalface" in these two cities they would tell you the same.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His book 'Four Green Houses and a Red Hotel' is out now.