McGrath downgrades FY16 forecasts: Bell Potter

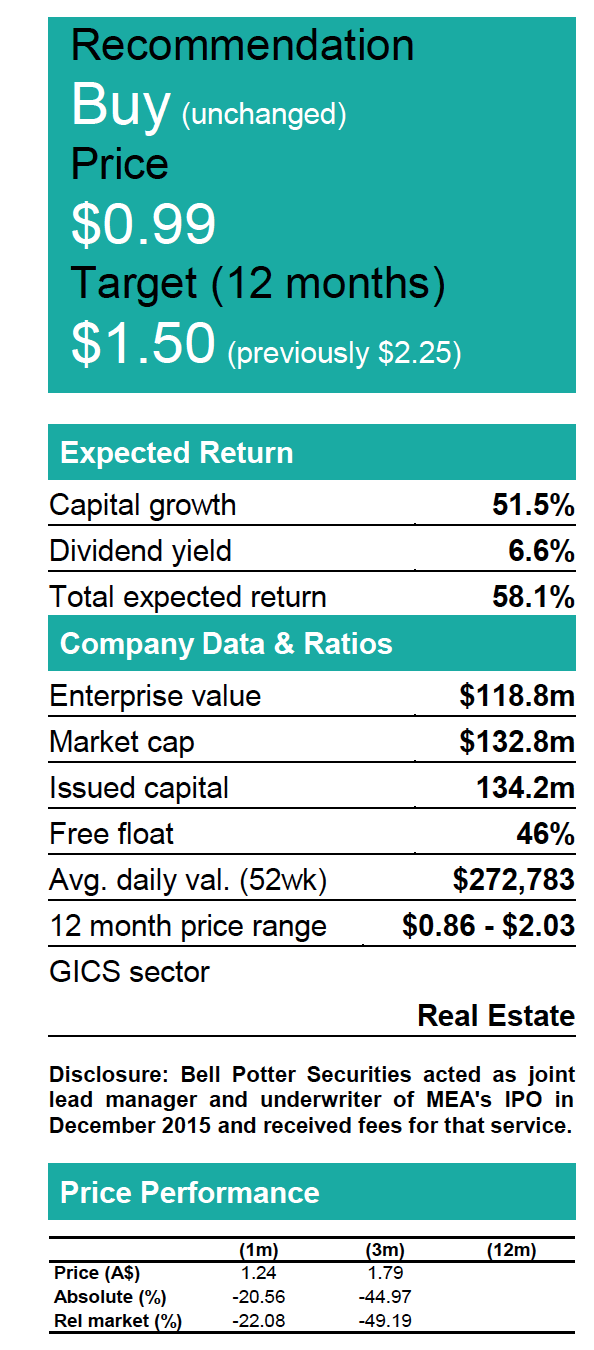

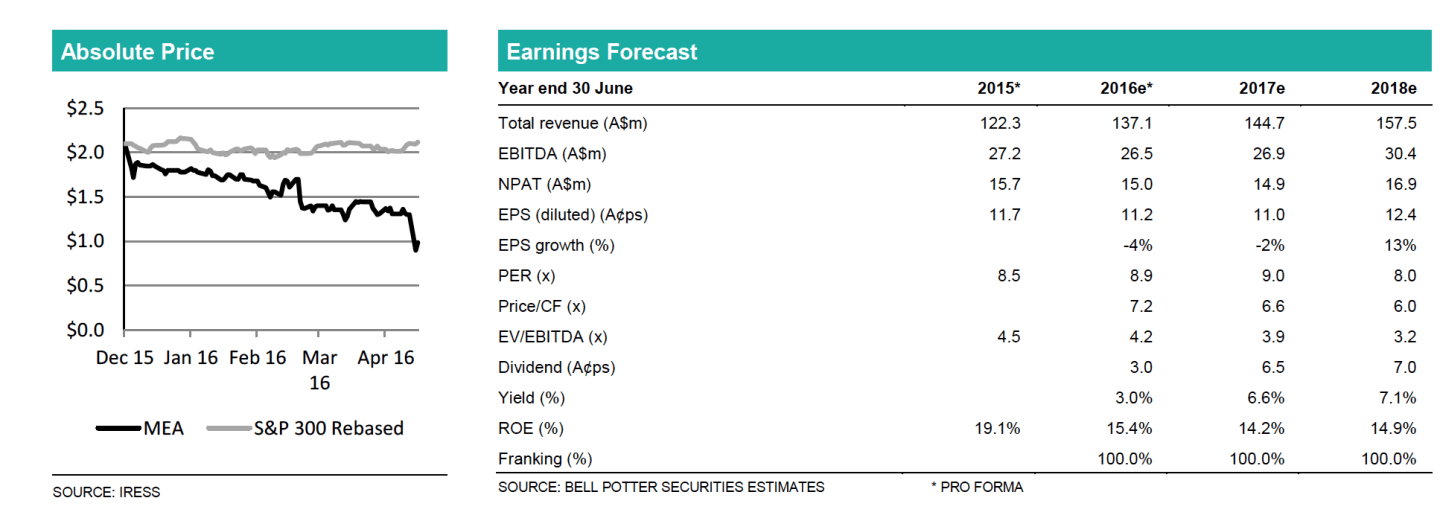

Listed real estate services provider McGrath has downgraded FY16 forecasts due to weaker than expected market conditions and said EBITDA figures will be $4 to 5 million lower than the prospectus forecast.

Lower than expected listings and sales volumes in the first half of April drove the weaker forecast, along with listings in the newly-acquired Smollen Group which are now expected to be 25-30 percent lower in Q42016 than previously forecast, according to Bell Potter.

The latest Bell Potter report on McGrath said the downgrade is disappointing given the company was tracking to budget for the first 9 months of FY16 and more so given it was largely attributed to the recently acquired Smollen Group.

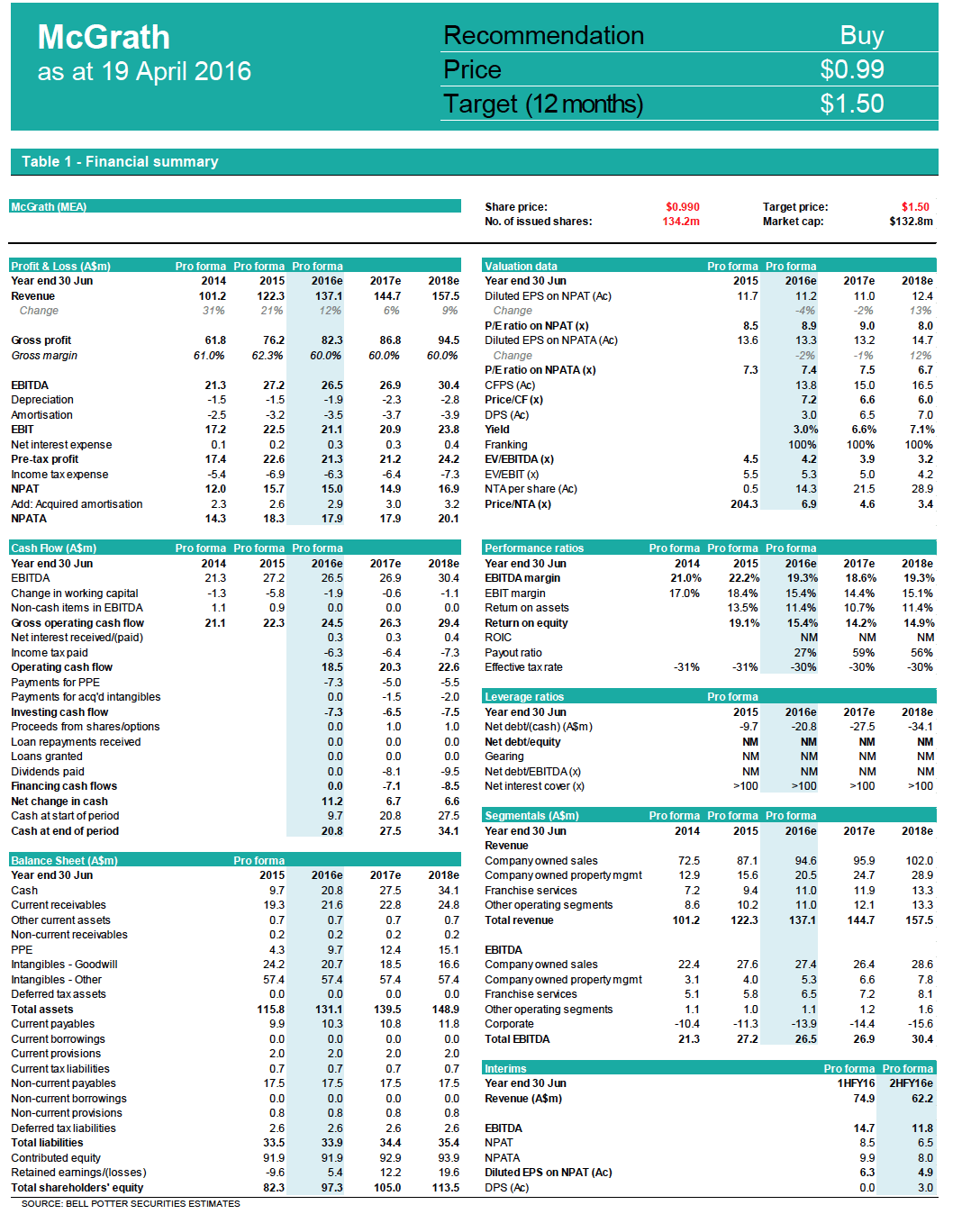

The Bell Potter report stated they have downgraded EPS forecasts in FY16, FY17 and FY18 by 15 percent, 25 percent and 24 percent respectively, with the revised FY16 EBITDA forecast of $26.5m within the guidance range of $26-27m.

"The majority of the downgrades have been in the company owned sales division, with reductions in sales per agent and EBITDA margin reflecting the tougher market conditions experienced in Q4 which are likely to extend into FY17 and FY18," it said.

"Given the severity of the 4Q slowdown our earnings downgrades are higher in FY17 and FY18. We now expect FY16 revenue of $137m compared to the revised guidance range of $136-140m, and EBITDA of $26.5m compare to revised guidance of $26-27m."