Our mortgages are getting bigger: Pete Wargent

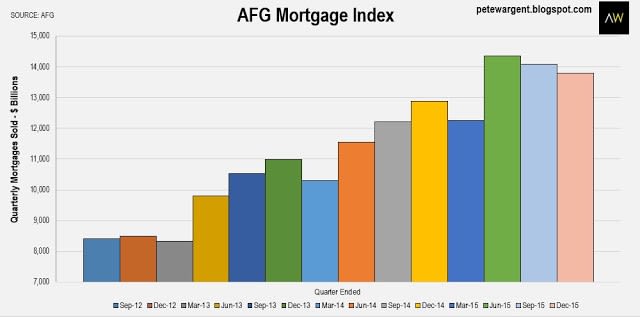

Australia's largest and most recently listed mortgage aggregator Australian Finance Group (AFG) released its December 2015 quarter Mortgage Index, which now again includes figures at the state level.

The index, which is not seasonally adjusted, showed a solid 7 per cent increase in the volume of mortgages sold from the prior corresponding period, up from $12.9 billion in December 2014 to $13.8 billion last quarter.

This was in spite of the investor share of the market continuing to decline, with this sector slinking back down to a 6 year low.

Investor loan volumes are expected to stabilise from here, with the impact of tighter lending rates for investors and tougher lending criteria now largely baked in.

Click to enlarge

The investor segment of the market had clearly become overheated in 2013, contributing to slowing rental growth.

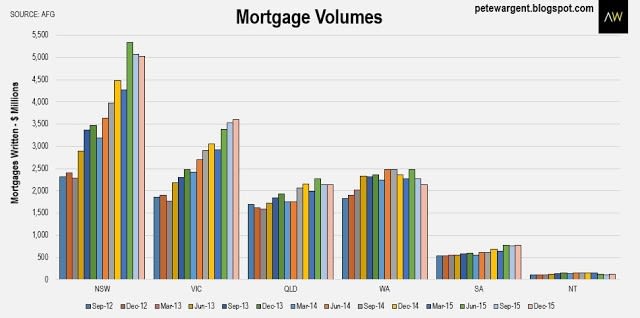

State versus state

At the state level, AFG recorded more than $5 billion of mortgages written in New South Wales for the third time, as the state saw mortgage volumes up by 12 per cent from one year ago.

The data series adds further weight to the suggestion that the Melbourne market may be set for a bright 2016, with mortgage volumes in Victoria up by nearly 18 per cent over the year in rising to a new high, despite the final quarter of the year being a short one due to the Christmas break.

Mortgage volumes written also increased by 13 per cent over the year in South Australia, but have declined in Western Australia (-10 per cent) and the Northern Territory (-21 per cent respectively).

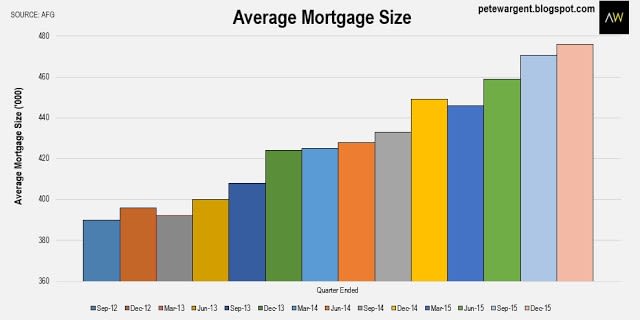

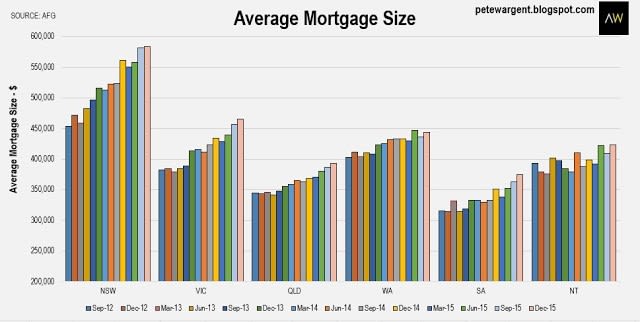

Mortgage sizes have soared

The average size of mortgage written continues to rise, up by 20 per cent over the past three years to a fresh all-time high of $476,479.

The average size of mortgage written in NSW increased to a new high of $583,708, with mortgage sizes also rising by around 7 per cent over the past year in Victoria, Queensland, and South Australia.

The wrap

While AFG's index may be distorted by changes in market share, meaning that users should be wary of premature extrapolation, the figures do provide further hints as to what to expect in the year ahead.

It is evident that markets will increasingly be driven forward by owner-occupiers rather than investors, while the market in Melbourne continues to defy...well, people like me, I suppose, who felt that the market have may peaked some years ago.

Overall, APRA's cooling measures appear to have worked and the property market seems to have calmed after the frenzy we saw around April and May last year, particularly in Sydney.

That said, mortgage volumes - and particularly mortgage sizes - have to date remained very high, with owner-occupiers plugging most of the gap being left by investors. Accordingly, we might expect to see a more sustainable and balanced market going forward in 2016.

That said, mortgage volumes - and particularly mortgage sizes - have to date remained very high, with owner-occupiers plugging most of the gap being left by investors. Accordingly, we might expect to see a more sustainable and balanced market going forward in 2016.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.