Rubbery suburb median prices: Pete Wargent

I noted recently that it pays to be wary when studies invariably reveal that the "strongest" property price growth over a carefully specified time period proves to be in a random suburb located somewhere to the west of White Cliffs which you've almost inevitably never heard of.

Most likely the sample size for the data series is inappropriately miniscule, and the movements in median price are thus inclined to lurch around accordingly.

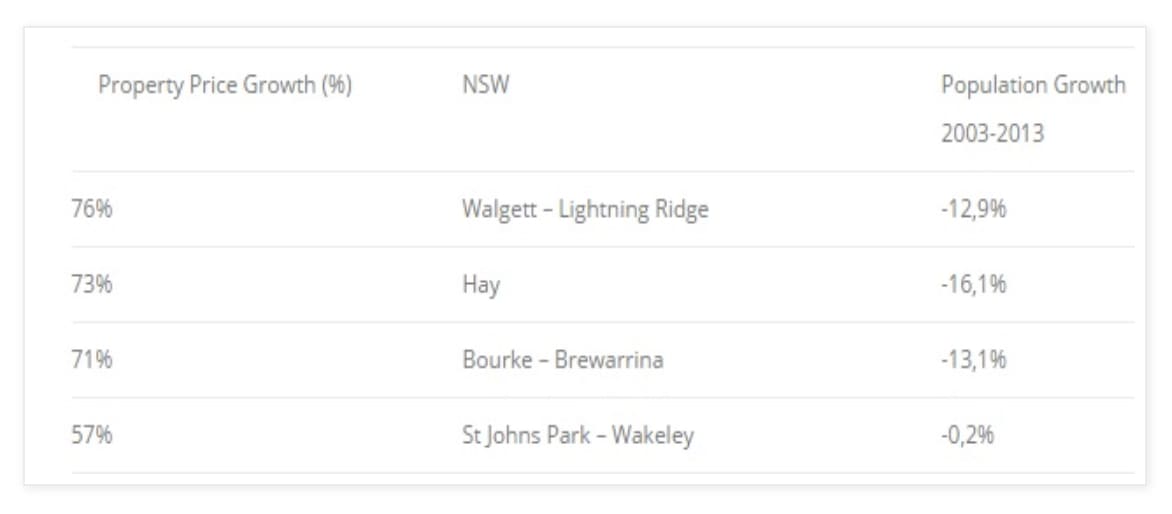

There was recently some debate, for example, as to whether property prices have actually been soaring even in regional New South Wales towns where the population has been in decline.

Sure, low interest rates have sparked a boom in Sydney property prices...but out in the sticks and even where the population is declining? I don't believe so - that wouldn't make any sense at all!

Regional median prices

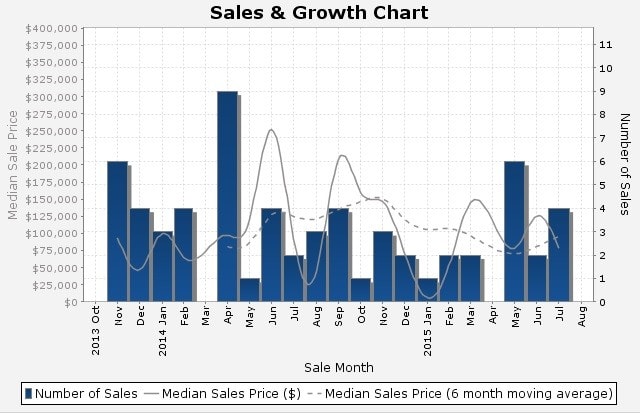

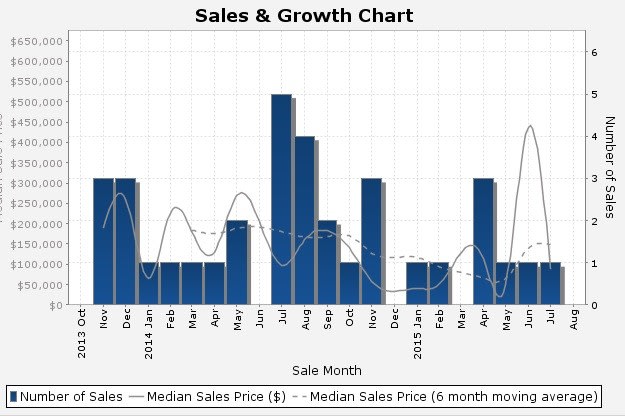

Check out in the two charts below the median price data for Lightning Ridge and Walgett which were two of the quoted suburbs where the median prices have apparently boomed by more than +75 per cent over the past decade despite being home to reportedly declining populations.

As you can see there are so few sales in any given month - indeed, there are zero transactions in many instances - that even the smoothed 6mMA average median prices can comfortably more than double (or halve) in the matter of only a few months.

The median price data is to all intents and purposes meaningless.

The median price data is to all intents and purposes meaningless.

Like-for-like sales

If you want to work out what is really happening to house prices in a suburb, you ideally need to look at resales of the same properties.

If you want to work out what is really happening to house prices in a suburb, you ideally need to look at resales of the same properties.

And even then you need to find like-for-like sales or else improvements can skew the data viciously higher.

Take the below 1,000sqm block in Lightning Ridge which according to my sales history database appears at first blush to have increased in value to by an outlandish 1,400 per cent since 2003!

Until, that is, you realise that the owner has recently developed the block with two brand new homes - a 4 bedroom house and a 2 bedroom home - with a combined rental of $550/week.

This is fairly typical of price action which skews the median price data upwards, but it is clearly manufactured rather than endogenous growth.

This is fairly typical of price action which skews the median price data upwards, but it is clearly manufactured rather than endogenous growth.

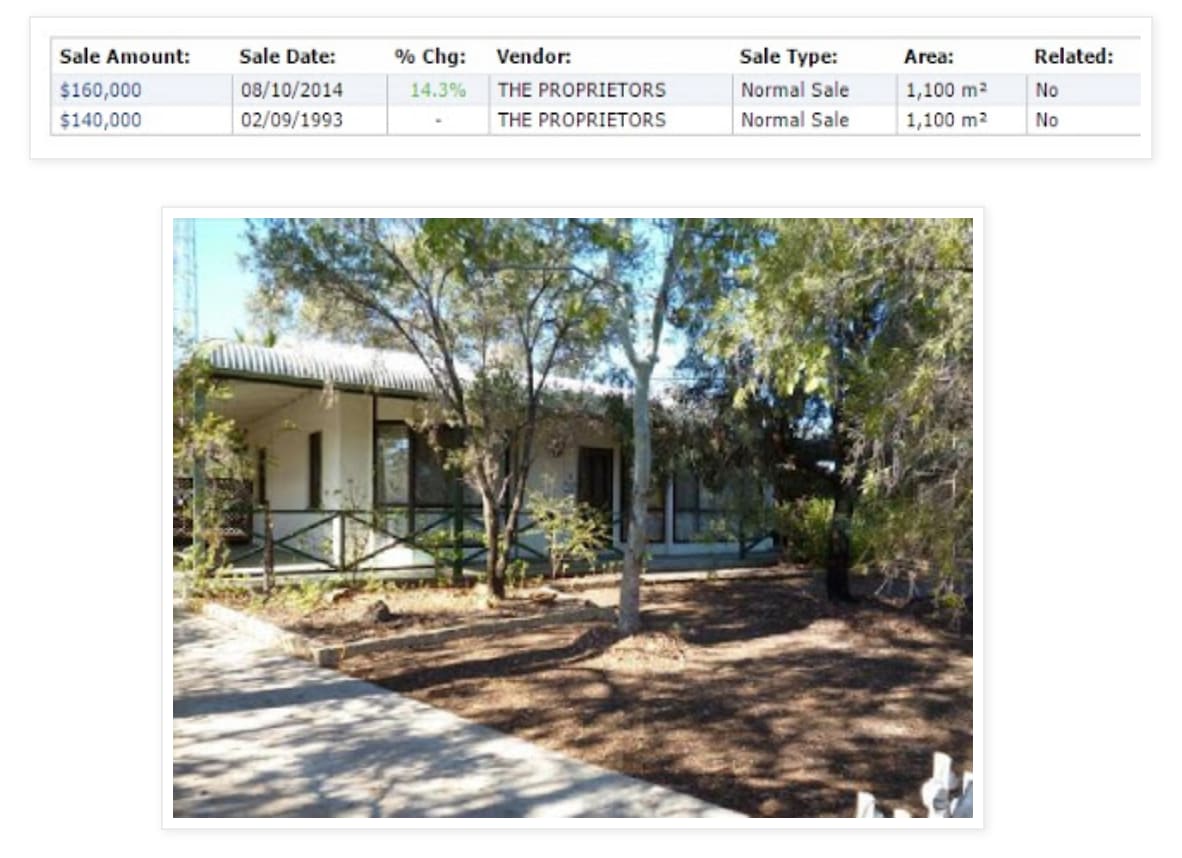

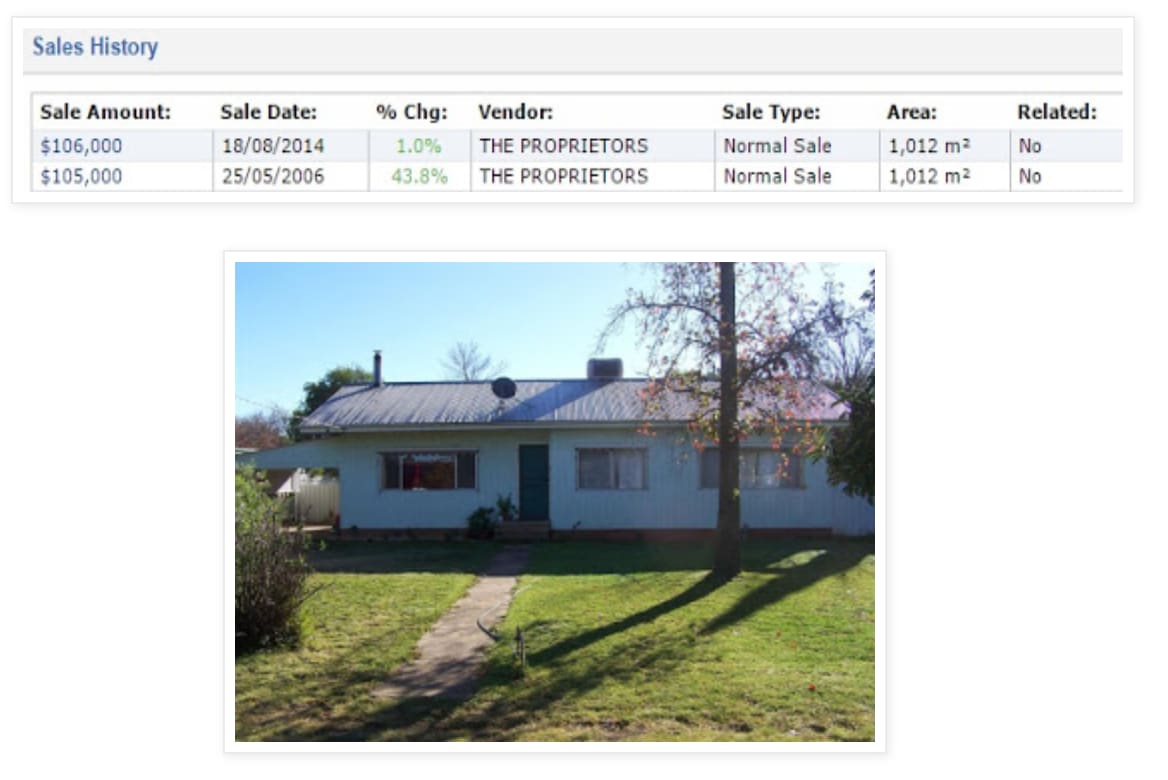

If you look at genuinely like-for-like sales in Lightning Ridge, however, such as the below recent sale on a 1,110sqm block, you'll find that capital growth over the past quarter of a century or so has been much closer to zero per cent.

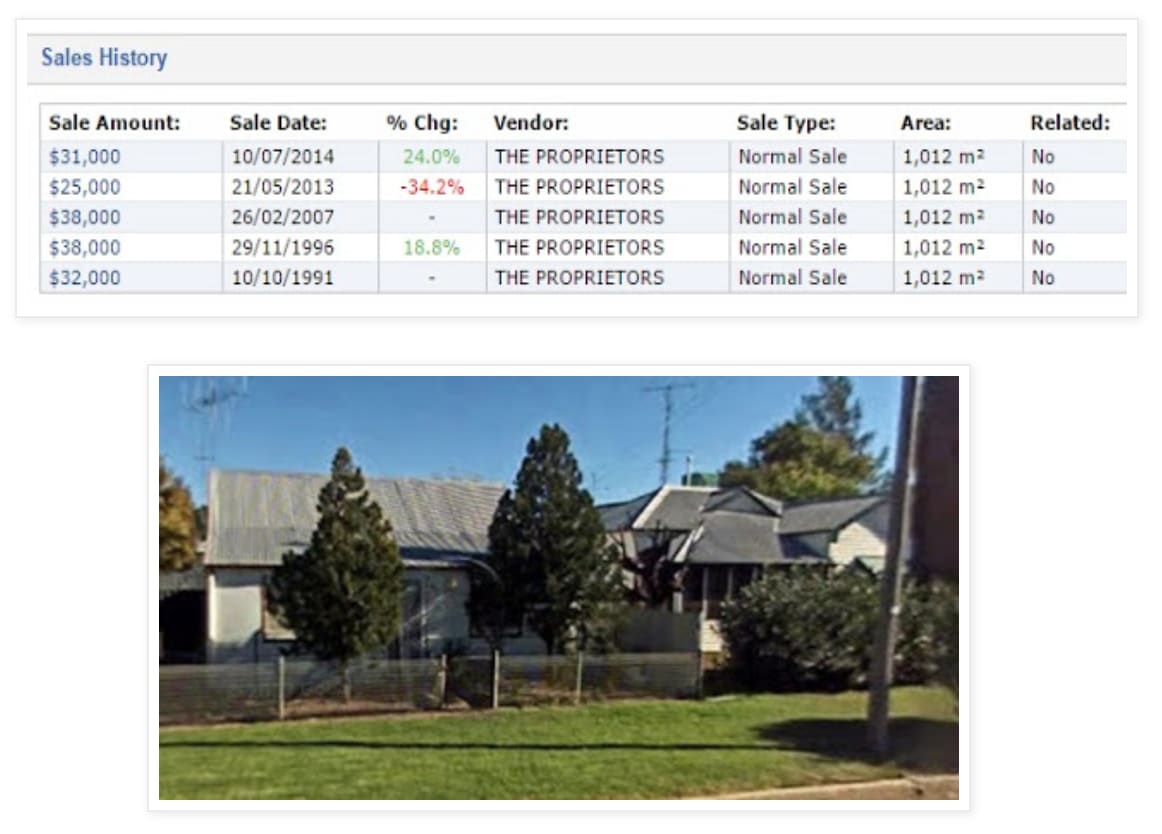

And it's a similar story in nearby Walgett, with the below house having achieved capital 'growth' over the past 25 years of negative $1,000.

As for booming prices in Hay, which was another suburb quoted as having boomed by more than +70 per cent despite a declining population, there also appears to be very little exciting to see here when you look at like-for-like resales over time, with total capital growth since 2006 on this example property of only $1,000.

Click to enlarge

Yet anothern NSW suburb which is quoted as having soared in value by more than +70 per cent despite its declining population was Brewarinna.

Over the past year the suburb has recorded median price growth of precisely +25.00 per cent - with the median price having increased to exactly $100,000 - apparently impressive numbers, even if they do appear to be suspiciously round in nature.

It's only when you realise that the entire data series is based on the grand total of eleven home sales that you realise how meaningless the median price data really can be.

The wrap

Now don't get me wrong, I am very much on board with the argument that easy credit flows can be and is one of the primary drivers of dwelling prices.

Indeed, it is the very fact that today folk can borrow money at a 4 per cent cost of capital instead of double digit mortgage rates which is perhaps the most significant factor in rising dwelling prices.

What I am saying, however, is that median dwelling prices in regional towns should be treated with a great deal of caution, if not dispensed with altogether.

As a penultimate point, I would also question whether a Sydney suburb where the population has ticked down by -0.2 per cent really has a "declining" population, when this is more likely to be simply a shift in the composition of households.

Indeed, it is the very lack of population growth in some landlocked suburbs - reflective of the fact that they are fully built out - which makes them more appealing for investment purposes.

On a related note, you'd have a tough time convincing the residents of, say, orange, Dubbo, Lismore or Parkes of their supposedly declining populations, whatever the suburb level or LGA stats may say...but that's a debate for another day!

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.