Property hot, but volumes not: Pete Wargent

Pete WargentDecember 17, 2020

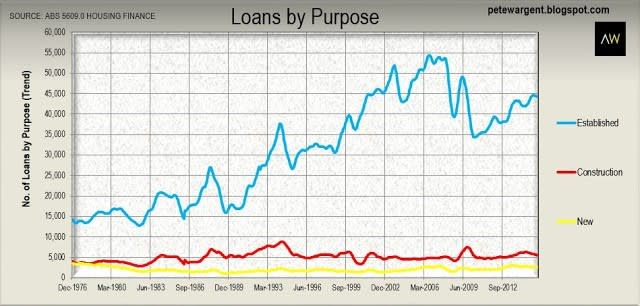

Although commentary often tends to focus on the dollar value of loans written in the housing market (which in the case of Sydney have been going through the roof) the actual number of home loans being written in Australia on a monthly basis is still some way below the levels seen across 2006-8.

In Sydney home loan volumes have even been tracking well below where they were in 2003 when the headount of the harbour city was considerably smaller, though the past two months of figures have recorded a big surge which is not yet fully reflected in the trend data.

Looking at the high level figures the trend in home loan volumes has generally been up for the three most populous states since 2012, but transaction volumes can hardly be said to be high compared to where they have been in the past.

Volumes have been trending down in Western Australia since July 2014, while the trend in the Northern Territory for want of a better word has "crashed" by a third since September and is threatening to soon take out the lowest levels seen in more than a decade.

Home loan activity levels in South Australia are...flatlining.

A similar pattern is also evident when looking at the below chart of home loans by property type, with home loans to purchase established properties in a multi-year uptrend but still not even close to previous heights.

Stamp

There are a number of reasons for these muted home loans volumes, not least the more significant market share of investors seen through this cycle in Sydney and Melbourne in particular.

I'll offer another: stamp duty.

With rising property prices already pushing the boundaries of detached housing affordability in Sydney and Melbourne close to breaking point, stamp duty - a levy which is ratcheted up as the purchase price increases - acts as a further disincentive to trade.

This has long been an issue in London at the premium end of the market, where plainly ridiculous rates of stamp duty above GBP 925,000 absolutely discourage buying and selling, and instead encourage owners to sit on prime location sites for as long as they feasibly can.

I can't speak for others, but certainly whenever I've written a stamp duty cheque to the OSR the last thing I am thinking of is subsequently selling a property, and indeed neither my wife nor I have ever sold a property in 19 years, in part for that very reason.

While stamp duty can serve one useful purpose in making the market more stable and less attractive to "flippers", it also discourages labour market mobility and creates a royal pain in the tail for homeowners who are required relocate for work.

Arguably both homeowners and investors are becoming more inclined to such buy and hold strategies while accepting that there will be inevitable market downturns, in part because the transaction costs are so punitive: buy, hold, and hold some more.

First homebuyers

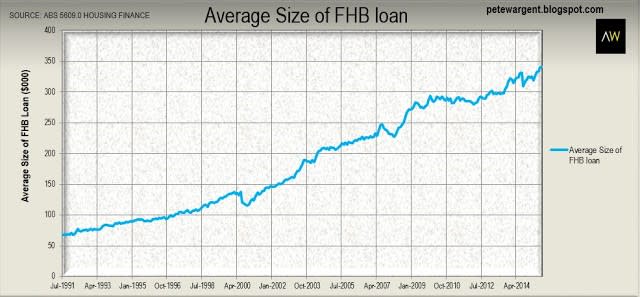

On a related note, the share of first homebuyers loans in the market has trended down to 15.4 per cent, which is at least a couple of full percentage points below what was seemingly becoming the norm before the financial crisis struck (whereupon market incentives led to an enormous spike in first homebuyer market share).

We know that the data may be incompete, but affordability - and specifically the deposit hurdle - is playing an obvious role here too, nudging a proportion of first time buyers towards buying an investment property as a first step onto the housing ladder instead of a place of residence.

Stamp duty is a key consideration for first homebuyers or new market entrants too.

It is often said or implied that first homebuyers should start with an entry level property and then look to trade up later, but with the average first homebuyer loan size now passing $340,000, new entrants to to the market must be seriously considering how many times in their lives they want to be trading property. I know that I would be.

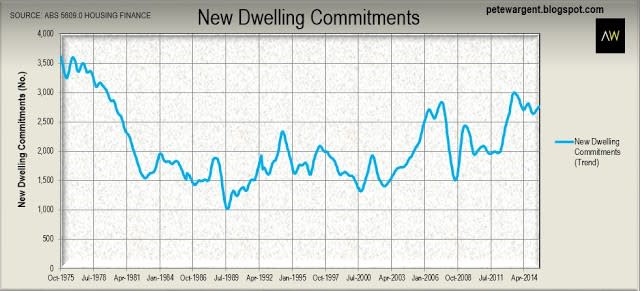

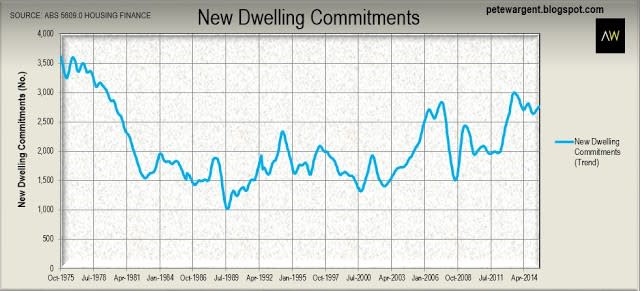

Dwelling starts to peak in 2015

A number of forecasts and indicators have suggested that dwelling starts could peak in 2015, and the new dwellings data does not contradict them, although with so many new builds being sold offshore to Asia through this cycle arguably this data series is a less useful indicator than it once was.

Construction loans written to owner-occupiers have also been trending down in recent months.

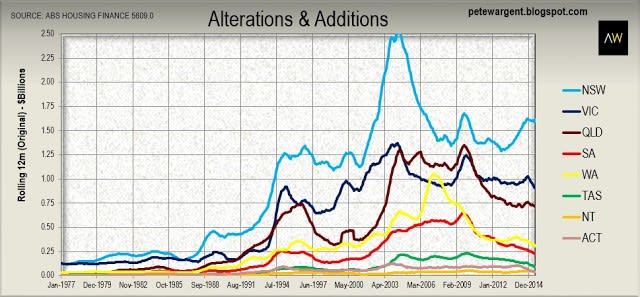

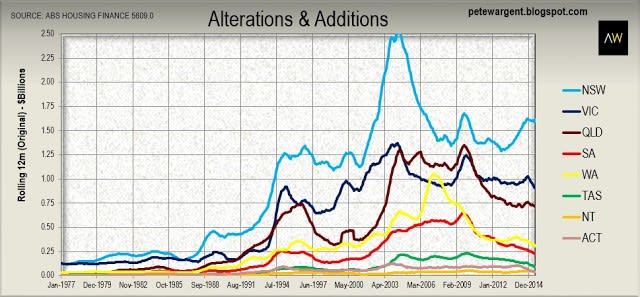

On the other hand the rise in property prices and associated equity gains has for some time been predicted to cause a renovations boom. Certainly this is what we witnessed through 2003 as the preceding Sydney market boom approached its peak.

There has already been a decent uplift in renovations activity in Sydney, but the "alts & adds" figures to date have barely even hinted at much going on elsewhere.

Driving around Brisbane it certainly "feels" as though there is more renovation work underway, but this may just be good old anecdotal evidence giving a bum steer.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.