Unemployment falls back to 6.2%: Pete Wargent

The ABS released its Labour Force data for August 2015, which came in somewhat better than had been expected.

The market had feared material downward revisions to employment figures following amendments to population growth assumptions, but happily in the event the impact was fairly benign.

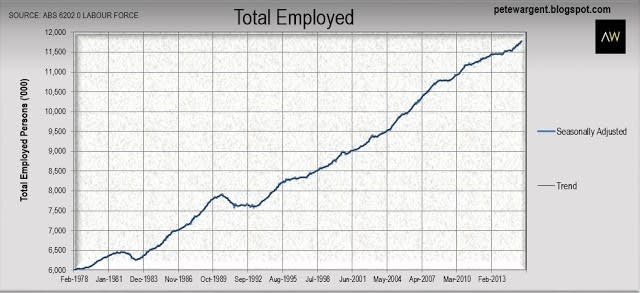

It is nevertheless worth looking at the revised data in the long run employment chart below to show the new shape of the chart...which is to say, essentially very similar.

Total employment was revised down, but over the year total employment still increased by +235,000 or +2.0% (up from +1.8% in the year to July), an impressive headline figure and the strongest annual increase in the seasonally adjusted data series since April 2011.

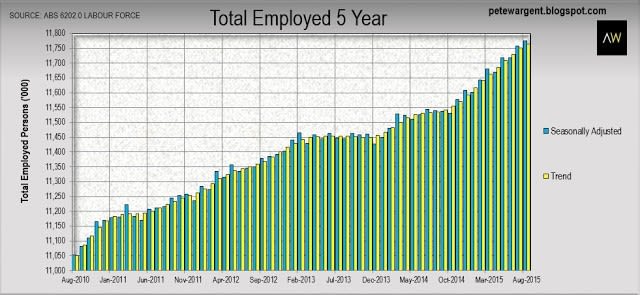

Handily this rate of employment growth is now far ahead of the rate of population growth, which following the latest Arrivals & Departures (see link for more) figures I now estimate to be tracking at only around +1.3%.

Employment rose by +17,400 in August following an upwardly revised gain in employment of +39,200 in August, which is a fine result in the circumstances and well ahead of market expectations of +5,000.

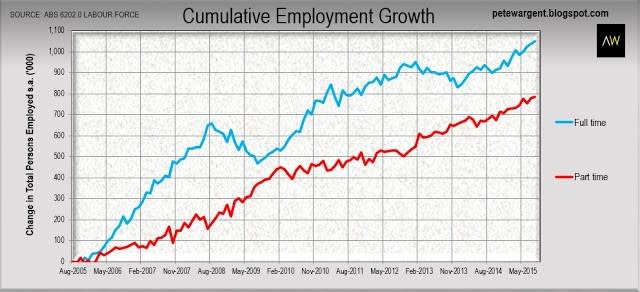

Full time jobs accounted for most of the monthly gains, and over the past year there have been more full time jobs created (+130,700) than part time positions (+104,200) - although as you can see below part time employment is taking a more significant role in the labour force than it once did.

State versus state...& the unemployment rate

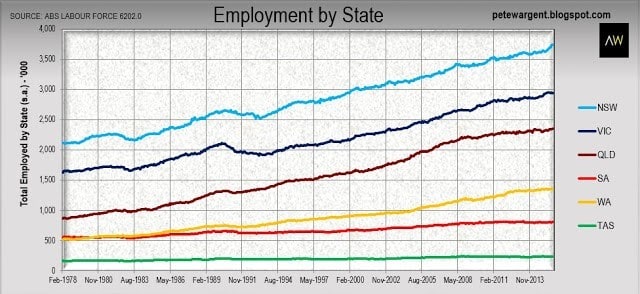

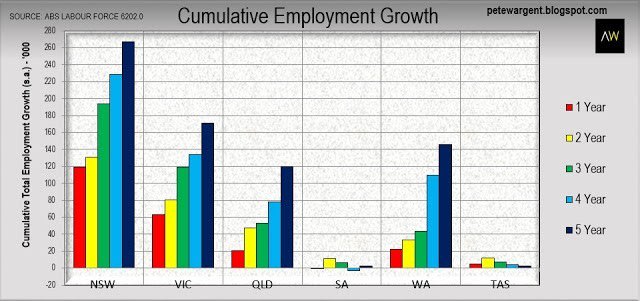

The net employment gains in August were mainly accounted for by Queensland (+11,200) and New South Wales (+9,200), with the New South Wales economy adding a thunderous +118,800 jobs over the past year, more than half of the total for Australia, and overwhelmingly full time positions.

Victoria (+63,000), Western Australia (+22,100) and Queensland (+20,700) also added net employment over the past year, but South Australia has gone backwards over the same time period.

I have been warning here for at least a couple of years now that the longer this ugly dynamic continues and without a kickstart for the local economy the greater the fallout could be in terms of South Australian unemployment.

Amazingly there were more full time employed persons in Q4 2007 in South Australia than there are today.

The below graphic shows that while the New South Wales economy has added a stonking +267,200 jobs over the past five years, the two southern states combined have added essentially none.

Amazingly there were more full time employed persons in Q4 2007 in South Australia than there are today.

The below graphic shows that while the New South Wales economy has added a stonking +267,200 jobs over the past five years, the two southern states combined have added essentially none.

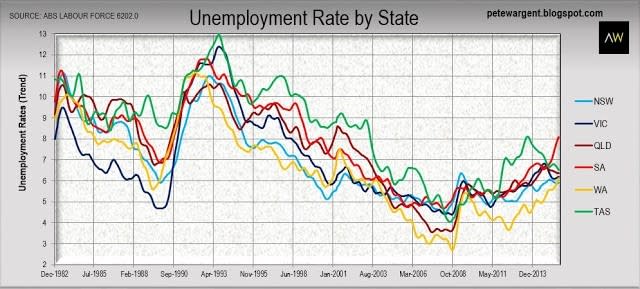

That said, with the depreciating dollar the outlook for Tasmania has improved considerably over the past 18 months, and without sigificant population growth to be absorbed the trend unemployment rate in the Apple Isle has declined from a peak of 8.1 per cent in August 2013 to just 6.5 per cent today.

That's great to see.

That's great to see.

Unfortunately the same cannot be said for South Australia where the trend unemployment rate has spiked alarmingly from 6.6 per cent to 8.1 per cent and rising in less than a year.

Concerningly it appears likely that there may yet be worse to come as the "Holden effect" takes its toll across the suburbs of Adelaide, with mining and manufacturing two of the worst hit sectors of the labour market.

The unemployment rate in resources rich Western Australia has also continued to trend up to 6.1 per cent from just 3.7 per cent in June 2012.

New South Wales has been the clear standout despite soft regional employment growth, with low interest rates allowing the Sydney economy and housing market to fire on all cylinders.

At the national level despite some statistical noise along the way the trend unemployment rate has now been steady for the past 12 months at 6.2 per cent.

With the rate of employment growth comfortablt outpacing the rate of population growth, has the unemployment rate therefore peaked for this cycle? Perhaps, but the jury is still out on that one.

The wrap

This was a robust result with the economy adding a sprightly +235,000 jobs over the past year and with corresponding important implications for monetary policy settings.

Had the unemployment rate jumped higher as had been anticipated by some analysts prior to this release then the Reserve Bank may well have been inclined to pull the trigger on further interest rate cuts.

Fortunately in the event the labour force figures were considerably better than had been feared and markets now appear fairly certain that interest rates will stay on hold at 2 per cent through October.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.