RBA: Location, location, location! Pete Wargent

An extraordinary speech in Sydney from the Reserve Bank's Luci Ellis which could almost be an advertorial for what experienced property investors already know - when it comes to property investment, location really is everything.

The supply of prime location land, explains Ellis, is essentially fixed, yet with a growing population in Australia the demand for it grows by the year.

The inevitable result therefore has been that inner ring land values and therefore house prices continue to rise faster than those in the outer suburbs, and not only by a small margin.

Ellis explains that even releasing more land around the capital city fringes may not be effective at bringing down inner ring house prices since the prime location land which everyone seems to want to get their hands on remains fixed in both place and supply.

Research by the Reserve Bank shows that place is nearly always more important than spacewhen it comes to driving property prices, and buyers will always pay a premium for inner suburban housing.

Moreover, significant increases in demand cannot be absorbed by new supply of prime location land, quite simply because there is none.

In the words of Ellis: "The newly buily supply is simply not the same as the existing stock, because it is somewhere else".

Indeed. I wrote about this very same issue - "substitutability" - some time ago.

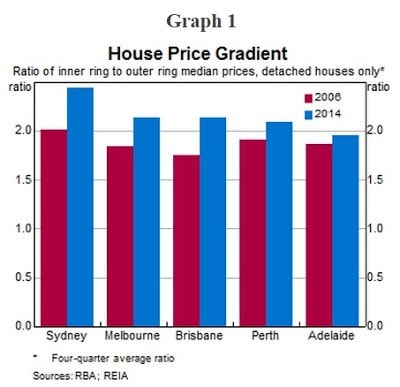

There is nothing particularly new about this idea, of course, but the Reserve Bank provides the research to prove the point by comparing the growth in "prices of inner ring properties to those further out, particularly in Sydney".

The gap in the relative price action performance is both material and ongoing, with the data from 2006 to 2014 proving the point and ending any arguments.

Within the above framework if outperformance is what you are seeking it obviously helps to find suburbs which are set to improve in some way (for example, a gentrifying location, or set to benefit from a new light rail link).

Over recent cycles, house prices have also outperformed apartment prices in most capital cities, although with initial rental yields often 1 per cent or more lower on average for inner suburban houses generally the growth needs to be stronger to compensate for the weak initial cash flow.

The old adage is true. When it comes to property, it really is first and foremost about "location, location, location".

Over recent cycles, house prices have also outperformed apartment prices in most capital cities, although with initial rental yields often 1 per cent or more lower on average for inner suburban houses generally the growth needs to be stronger to compensate for the weak initial cash flow.

The old adage is true. When it comes to property, it really is first and foremost about "location, location, location".

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.