Rise in unit approvals drives rebound: Cameron Kusher

The Australian Bureau of Statistics (ABS) released building approvals data for July 2015 earlier this week. According to the data there were 19,298 dwelling approvals over the month which represents an increase of 4.2% over the month and a year-on-year rise of 13.4%. Monthly dwelling approvals reached a record high of 20,260 approvals in March 2015 and the July 2015 result represents the fifth largest monthly number of dwelling approvals on record.

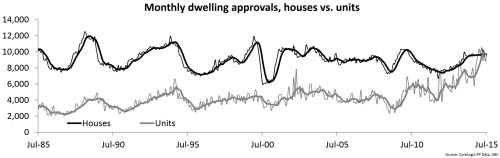

Over the month there were more unit approvals than house approvals. In fact it was only the seventh time on record that there were more units approved over the month than houses, five of which have happened in 2015. Although unit approvals outnumbered house approvals over the month it is important to note that they tend to be much more volatile than house approvals and are ultimately less likely to be built than houses (approximately 85% of all unit approvals proceed through to a completion historically). Although this is the case, particularly for larger unit development, the economic benefit is extended over a longer period because they take much longer to complete.

In July 2015 there were 9,479 houses and 9,819 unit approvals over the month. House approvals fell by -2.6% in July and were -2.1% lower year-on-year. Meanwhile, unit approvals increased by 11.7% in July (following a fall of -13.3% in June) and were 33.8% higher year-on-year. On an annual basis there has been a record high 224,121 approvals to July 2015. To put the recent ramp-up in approvals into perspective, three years ago there were just 148,449 approvals over the year.

As the number of approvals has increased, the greatest rise has occurred across the multi-unit segment. Over the past 12 months a record high 48.3% of all approvals were for units. If you look just at the capital city markets 55.7% of all dwelling approvals were for units.

The rise in unit approvals is reflective of changing lifestyle patterns with more and more people preferring to live closer to the city centre and along transport spines where most of these units are located. It also shows that developers are enjoying a level of confidence by seeking approvals for a record high number of units.

Another factor contributing to the rise in higher density dwelling approvals is changes in town planning policies where governments are aiming to maximise existing transport infrastructure by allowing higher densities along existing and planned transport corridors and mixed use precincts.

If we look at the types of units that are being approved it is interesting to note the sharp rise in high-rise approvals, that is units in a block of four or more storeys. Over the past 12 months, a record high 63.4% of all unit approvals were within high-rise projects while a record low 26.2% of approvals were terrace and townhouses and a record low 4.9% of approvals were for units in a one or two storey block. Again, these figures just go to show the heightened level of developer confidence particularly when you consider the relative level of risk associated with high rise development.

The number of dwelling approvals remains high albeit it is slightly lower than recent record highs. Strength in the approvals figures are becoming increasingly reliant on the multi-unit sector which tend to be much more volatile than house approvals. With many banks, credit unions and building societies tightening their lending criteria it will be interesting to see over the coming months if this flows into approvals and causes developer confidence to wane.

No matter what happens with approvals over the coming months and years there is a strong pipeline of new construction, much of which is high-rise and will extend out over a number of years. Furthermore, with population growth slowing we should see a better relationship between housing supply and housing demand. This is already being seen by the fact that capital city rental rates are increasing at an historic low rate currently.

Cameron Kusher is research analyst for CoreLogic RP Data. You can contact him here.