What’s up in funding markets? ANZ's Martin Whetton and Katie Hill

GUEST OBSERVER

Funding markets have shown some stress in recent weeks as investors and borrowers prepare for imminent structural reforms and amid cyclical issues around banks.

We look at the recent moves in single currency and cross-currency basis markets, USD Libor and credit spreads.

With less than two weeks until US money market funds are required to comply with new liquidity and asset rules, we opine on the outlook for funding markets.

Funding markets have seen significant shifts in recent weeks as markets prepare for the upcoming new money market rules in the US. The rules, outlined in US money market reform 2a-7 primer, will come into force on 14 October.

In addition to money market reform, a confluence of factors has increased the cost of funding, namely quarter and year-end as well as concerns around European banks. There has been in recent weeks the usual pickup in funding stresses associated with quarter end – normally because of the need for 3 month funding which rolls over the ‘turn’ of the calendar year (or financial year end for US banks).

With banks now less willing to have significant balance sheet items over their year-end, the cost of USD funds will remain elevated. This quarter end has seen an escalation of this normal arrangement due to the money market reform being implemented at the same time.

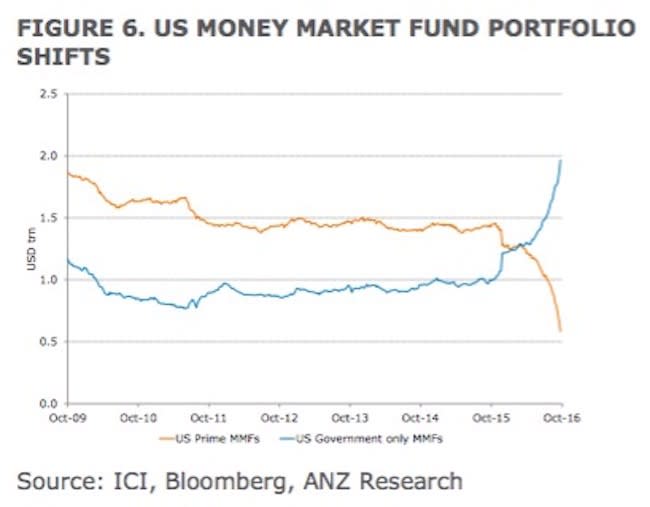

Furthermore, as investments shift out of ‘prime’ funds (those who hold credit) to government only funds, the ability of both banks and corporate borrowers who access short-term funding has been diminished. This has forced borrowers out the term curve – or in the case of sectors of the bank market – to simply ‘pay up’ for alternate sources of funding.

The demand for USD has shown up in the sharp moves in 3 month cross-currency basis swaps (Figure 1) which have lifted the cost of funding sharply in the last week. The JPY basis has been driven by the structural need for Japanese banks to find a new funding source given their large reliance on US MMFs. This issue has not been fully addressed despite an increase in USD funds available from the BoJ. That said, it has led to a wider ‘Japan premium’ (which is the cost of USD 3 month Libor for Japanese banks relative to other members of the Libor panel).

THE BASIS FOR OTHER MOVES

In comparison, the move higher in USD FRA/OIS and Libor/OIS, as well as a gradual but significant rise in 3 and 6 month USD Libor since mid-year, has been gentler. The move in EUR cross-currency basis (see Figure) 1 has come at a time when European banks have been under the spotlight. This unwanted introduction of a systemic threat has augmented the current demand for USD funding.

The basis has moved to the most negative level (highest cost for USD funds) since the European sovereign crisis period in 2012. Both prior to this period and since, central banks have introduced a number of measures to allow for USD liquidity in times of stress.

After a reasonably steady period, the basis has dropped from -25bp to -59bp since mid- September. The spread remains a long way from its historic lows of -210bp in 2008-09 and the -160bp level seen in 2011.

The demand for USD via the ECB's 1 week funding mechanism has also seen a sharp rise. Last week’s auctions for 1 week USD funding saw just under USD6.4bn awarded to twelve banks. This was the largest amount requested since 2014.

In the FRA markets, the modest move wider for EUR FRA/OIS has not been matched by the sharper USD move. This suggests that concerns over European banks have not yet shown up in funding for EUR. In fact, the 3 month Euribor/OIS spread is little moved and is at multi-year lows. We believe any stresses are likely to show up in the USD funding markets – rather than in EUR.

A RISING TIDE

The single currency basis market, at least for USD, has steepened sharply in the last year and has risen significantly higher than the levels seen during the 2012 European crisis. Similarly the USD 3s/1s basis curve has steepened to the highest level since 2009. 3s/1s sits at 25bp, around 3bp higher than what it reached in the European crisis. In the last few weeks, domestic USD basis has stabilised at these elevated levels.

Looking at the forward curves for single currency basis, it would appear that the peak for the 1 year basis has been set and will begin to match the forwards. The risk to this view would be a sustained period of higher USD funding costs and increased market expectations for Fed hikes.

In time, such an outcome should narrow the 1 year 6s/3s and 5 year 6s/3s basis, driven by a rise in the latter.

OUTLOOK FOR FUNDING POST US MONEY MARKET REFORM

US money market funds now have less than ten days to comply with the new rules governing their operations. As Figure 6 shows, total holdings in prime funds are around USD600bn. While we expect some balance to be retained in the funds that choose to hold credit assets, there is likely to be further reduction in the coming days. This should, all things being equal, push USD Libor and USD Libor/OIS higher and wider.

It is worth noting that while the larger shifts in Libor have reflected a replacement premium for USD bank funding, corporate borrowers are also affected as they will need to source alternate means of funding. These may come via bank revolver credit facilities or through the term market as borrowers.

After the full implementation on 14 October, we expect markets to stabilise and for the Libor rate to reflect more cyclical news around the banking sector as well as the eventual addition of a premium or reflect market-based expectations of a Fed rate hike in December.

We also expect to see an increase in the issuance of term debt for banks as the ability to use short-term funding comes to an end. This more expensive method of borrowing also comes at a time when other regulatory requirements will be placed on the market.

WHAT TO WATCH

The key variables to watch will be the use of FX USD swap lines at the various central banks (primarily the BoJ and ECB). Domestic USD basis (6s/3s and 3s/1s) and 3 month JPY and EUR cross-currency basis are also important to gauge the demand for USD from non-US counterparties hedging loans, assets, and borrowings.

Bank credit spreads are an important gauge of the market’s perception of asset quality. While these have widened recently, they do not reflect significant concern. The CDS market, once a popular product in financial markets, has become an illiquid and poorly- traded instrument.

Lastly – and perhaps obviously – as the money market reforms are finalised, the USD Libor rate and spread to OIS are expected to rise a little further before stabilising and they represent a more realistic price for USD funding.

Martin Whetton is senior rates strategist, ANZ. Katie Hill is strategist, ANZ. Both can be contacted here.