Three experts tip interest rates to fall further: Finder RBA survey

While all 37 leading economists and experts surveyed by Finder ahead of today's Reserve Bank meeting expect the cash rate to stay on hold this afternoon, three experts are tipping another cut to occur next year.

Last month, the Finder Reserve Bank Survey saw Australian Property Monitors’ Andrew Wilson tip a rate cut for the future, and he is now joined by two other experts.

Market Economics’ Stephen Koukoulas, joining the panel for the first time, and David Scutt from Scutt Partners also expect a drop next year. This would bring the cash rate from the current low of 2.50% to a new record low.

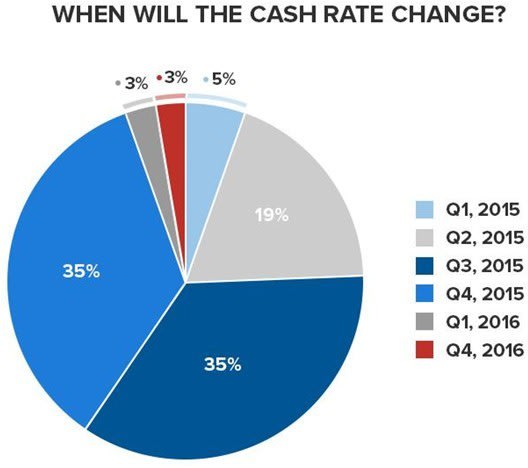

However, they are vastly outnumbered by those tipping the next move to be up – 92% of the panel. In total, 94% of the panel expect the cash rate to move in 2015, while 6% expect the next move to in 2016.

Source: Finder Reserve Bank Survey

Michelle Hutchison, Money Expert at finder.com.au, said that it was interesting to see some experts tip a cut.

“It was also interesting to find some experts in the survey discussing the reality of a rate cut next year, with factors that could occur such as a falling housing market and slower growth in China and other foreign economies,” she said.

“There is a definite shift in the direction that the cash rate could take, with last month’s survey results showing all 33 experts were forecasting the cash rate to rise next year, including one expert (Andrew Wilson, Domain Group) predicting a rate cut before an upward cycle begins,” said Hutchison.

“But now there are three experts on the panel who are betting on a rate cut and others citing a possibility of a drop.”

In terms of today’s meeting, Wilson notes that there will be no impact from any change until next year.

“House price growth will track around inflation depending on local demand and supply drivers,” he said.

Koukoulas noted that the RBA has been slow to acknowledge the subdued nature of the economy, with an “unhealthy obsession” with Sydney house prices.

Meanwhile, Scutt said that the Australian Dollar remains overvalued, labour market conditions are still soft and commodity export prices have declined with the economy expected to grow below trend until 2016.

“They should be easing now but won't, at least in December. With house price appreciation slowing and targeted macroprudential tools still a strong possibility, if current domestic and international economic conditions remain subdued, the RBA will have little to prevent them easing early in the New Year.”