Thinking of a fixed home loan? Check out the top 5

With the RBA cutting its cash rate to a historical low of 1.75 percent, fixed rate home loans look more attractive than ever, although the a majority of lenders are yet to say if they will pass on the rate cut to borrowers.

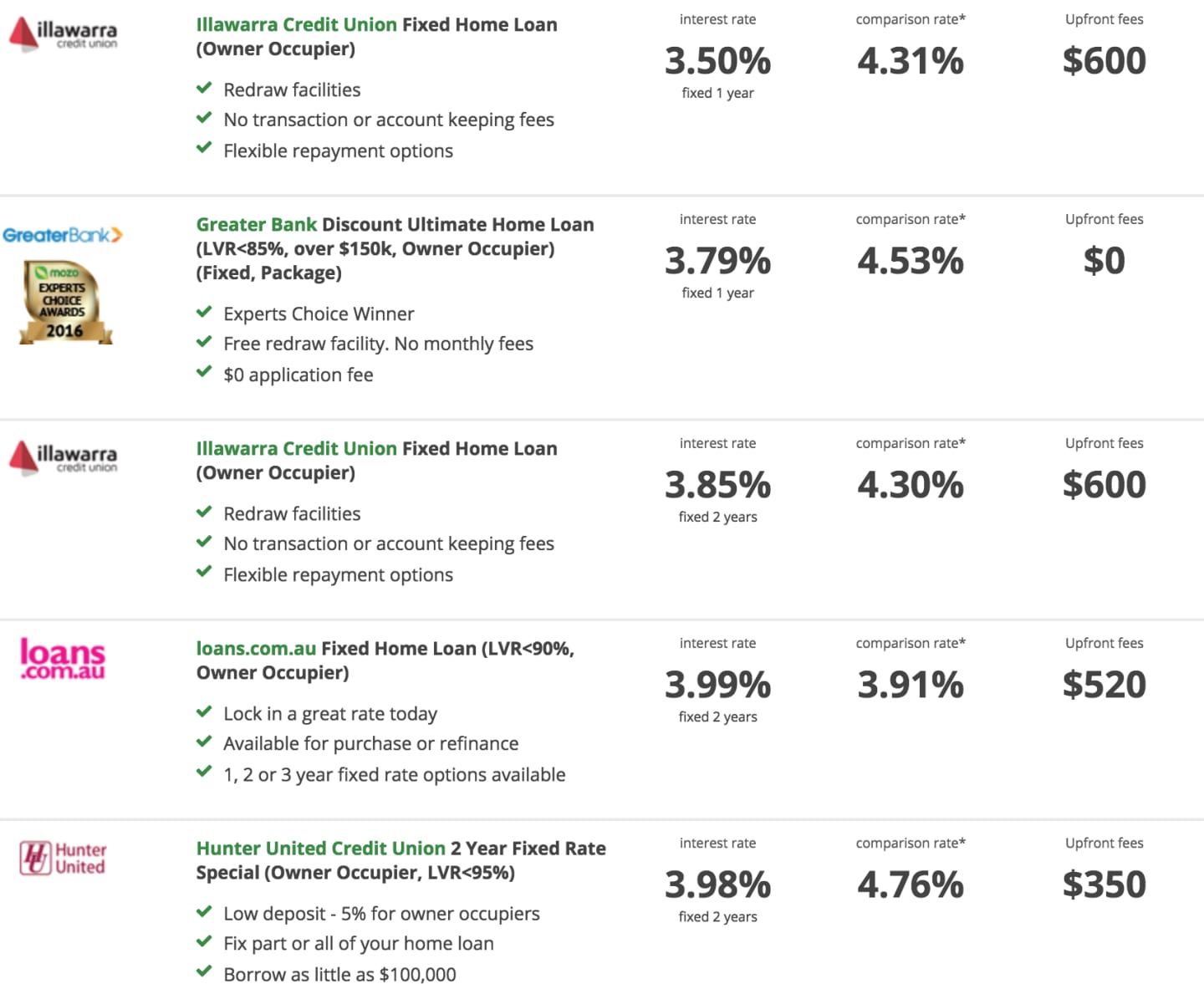

Property Observer went looking for the cheapest fixed home loans and came up a its five lowest from mozo.com.au, listed as lowest rate first:

At the top was Illawarra Credit Union with an interest rate of 3.5% for the first year of mortgage, followed by Greater Bank at 3.79 percent, again Illawarra Credit Union with 3.85 percent (for two years), loans.com.au at 3.99 percent and last Hunter United Credit Union at 3.98 percent. Each had an upfront fee ranging from $350 to $600 except Greater Bank, which did not have any for its fixed one-year product.

None of the Big Four banks are offering loan rates lower than any of these.

However, on the popular three-year period for fixed home loans, NAB figured at no. 3 with 4.24 percent, behind loans.com.au and UBank UHomeLoan, according to www.finder.com.au for a sample loan amount of $150,000 for a period of 30 years.