RBA to cut in 2016: ANZ Research

GUEST OBSERVER

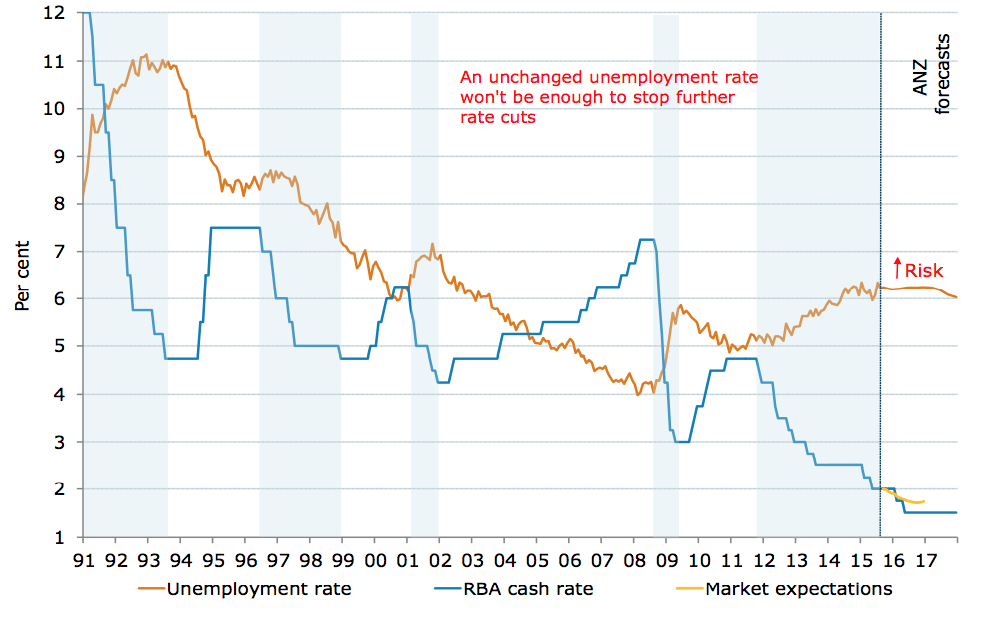

We now expect the RBA to cut the cash rate by a further 50bps next year, taking the cash rate to 1.50%. Pinpointing the timing of the cuts is tricky, but we are pencilling in 25bp cuts in February and May at this stage.

Since the Bank cut the cash rate by 50bps earlier this year, we have consistently characterised the risks as being towards further monetary policy easing at some stage. We are now making that our central case.

The change of view has largely been driven by two factors and our judgement that growth will not be sufficient over 2016 and 2017 to eat into spare capacity in the economy. Hence, extra policy support will be needed.

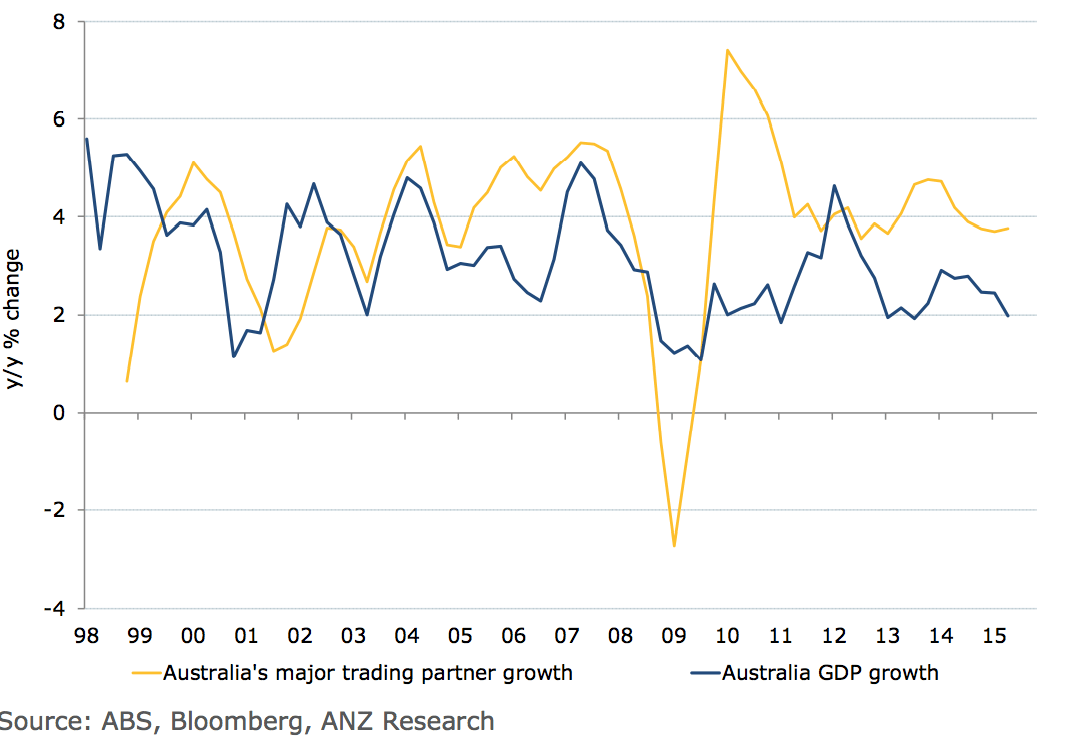

First, we recently downgraded our global growth forecasts to ‘more of the same’ from previously expecting a modest pick-up. The downgrade reflects a softer profile for EM growth. Gaining traction in global growth has remained difficult despite very accommodative monetary policy globally. The fact that ‘everyone’ has wanted a lower currency is telling in our view. Risks to growth in Australia’s major trading partners in Asia, and Australia’s terms of trade, are skewed to the downside, with China in particular facing several significant challenges.

Secondly, while current momentum in Australia’s non-mining economy is sufficient to keep the RBA ‘content’ this year, we see waning support to non-mining growth from housing market activity and the sharply lower AUD next year. Governor Stevens has previously noted that growth in the non-mining economy needs to be above average for a couple of years to eat into spare capacity – at best it is currently around average with little prospect of improving much in our view. At the same time, mining investment has much further to fall.

With this backdrop, it is difficult to see how inroads can be made into an elevated unemployment rate. Even an expected unchanged jobless rate for two years – as currently forecast by the RBA – would ultimately be very uncomfortable for a central bank, especially if asset prices are flat and domestic interest rates are above global levels. The economic backdrop we have outlined above points to greater risk that unemployment worsens rather than improves over the next 12-24 months. Governor Stevens’ ‘path of least regret’ suggests he will need to cut rates again.

Where could we be wrong? (i) A large China stimulus, but this would represent just a delay and could eventually make things worse if it furthers inflates imbalances in their economy. (ii) Momentum in the non-mining economy persists for longer than we expect. We actually expect most domestic activity indicators to remain relatively solid over the next few months; it’s next year where we see things softening.

FIGURE 1. MORE CUTS NEEDED TO EAT INTO UNEMPLOYMENT

GLOBAL GROWTH TRACTION REMAINS HARD WON

For some time we have been expecting global growth to improve. While we remain constructive on the outlook for the US and Europe, we recently revised down the outlook for world GDP growth (see ANZ Live) and view the risks as being tilted to the downside. Emerging market (EM) economies are now half of global economic activity and the lion’s share of economic growth. It is these economies that are slowing. Our still constructive, even optimistic, view of global growth has it steady at around 3.5% for the next two to three years.

The risks to this view are to the downside and ultimately centre on EM and China where: growth is slowing in a structural sense; there has been a very significant increase in leverage since the GFC and the spectre of rising bad debts lingers, both limiting the prospect of upside surprises to growth; a changing composition of growth – ie less steel intensive – which is less growth-friendly for Australia in the near term; and policymakers face the challenge of keeping reform ticking over given that growth is slowing.

FIGURE 2. DOWNSIDE RISKS TO AUSTRALIA’S MAJOR TRADING PARTNER GROWTH

NON-MINING ACTIVITY WILL WANE

Despite sharp falls in mining investment and the drag on national income from lower commodity prices, overall growth in Australia has been sufficient to keep the unemployment rate broadly unchanged over the past year or so. Heading into 2016, however, we see two key supports to growth so far – housing activity and the lower AUD – waning.

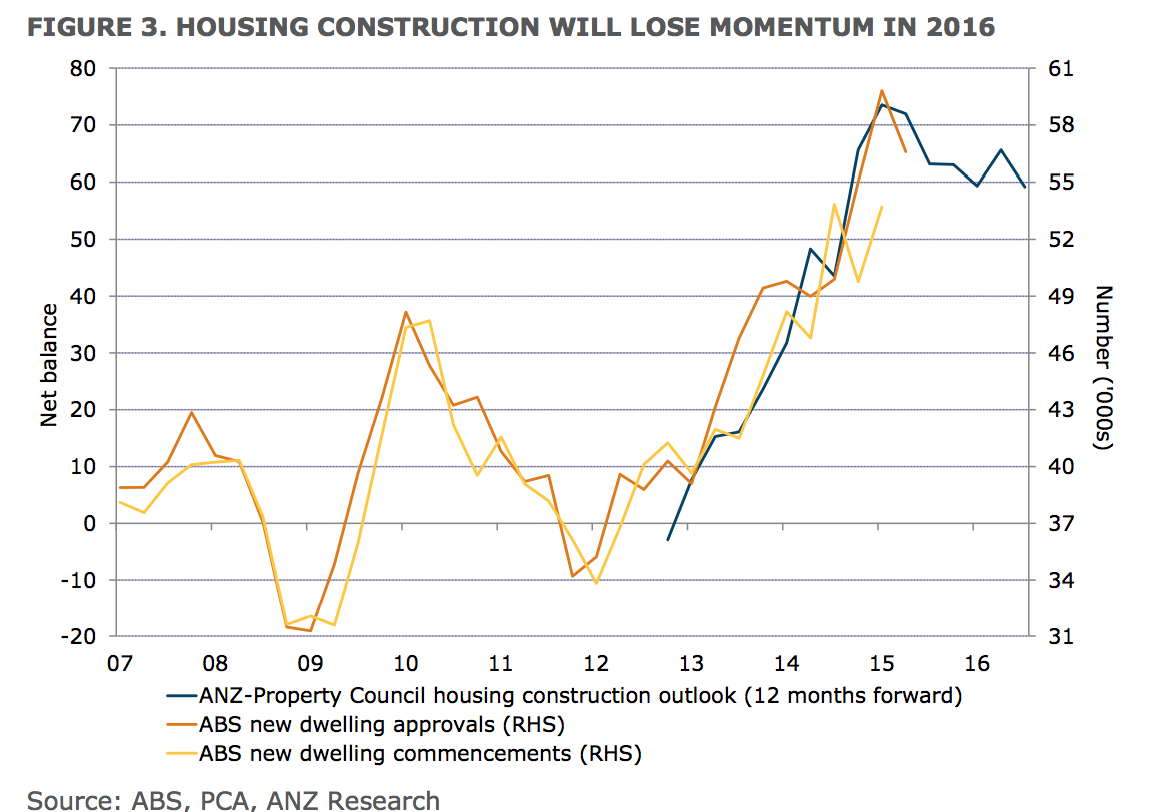

HOUSING

Robust housing market activity, largely in Sydney and Melbourne, has supported growth via strong housing construction and positive effects on consumer spending (directly on household goods and indirectly through ‘wealth effects’). While further growth in housing construction is anticipated over the next 6-9 months, there are clear signs that new housing construction will then peak (Figure 3). While we expect dwelling construction to remain at a high level, particularly in Sydney, the impetus to growth will wane.

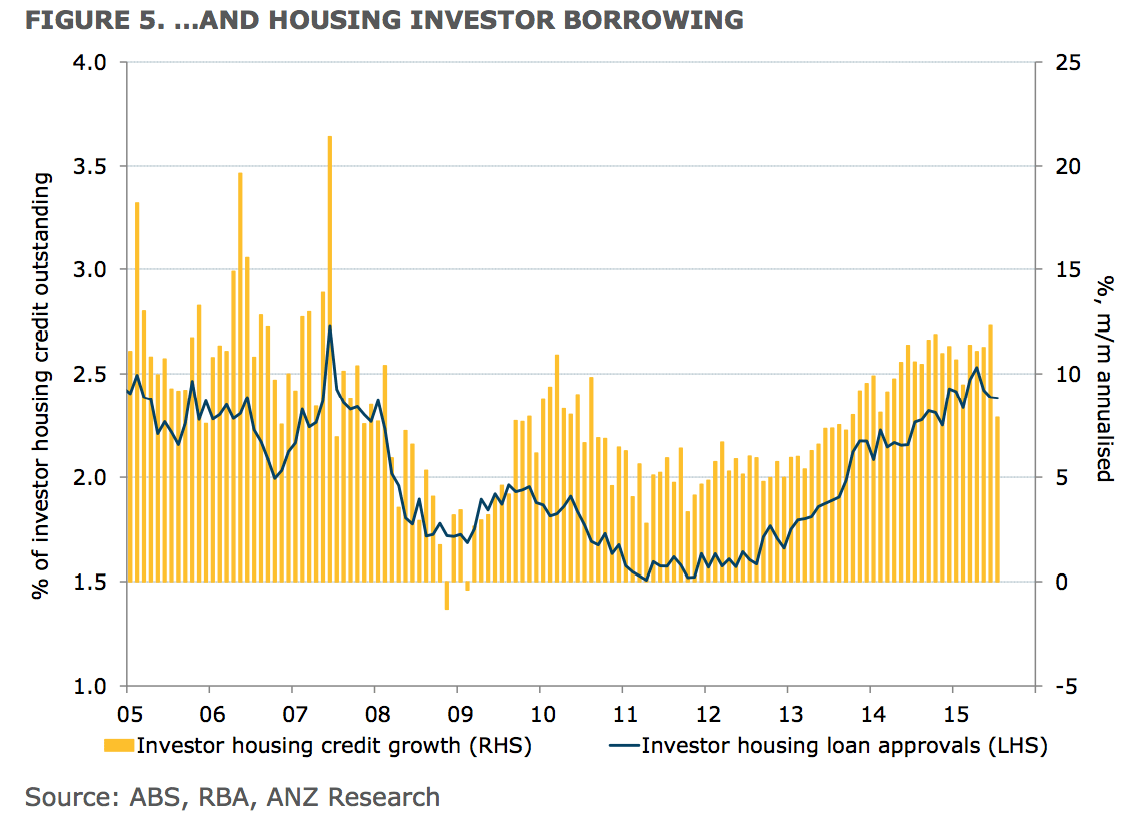

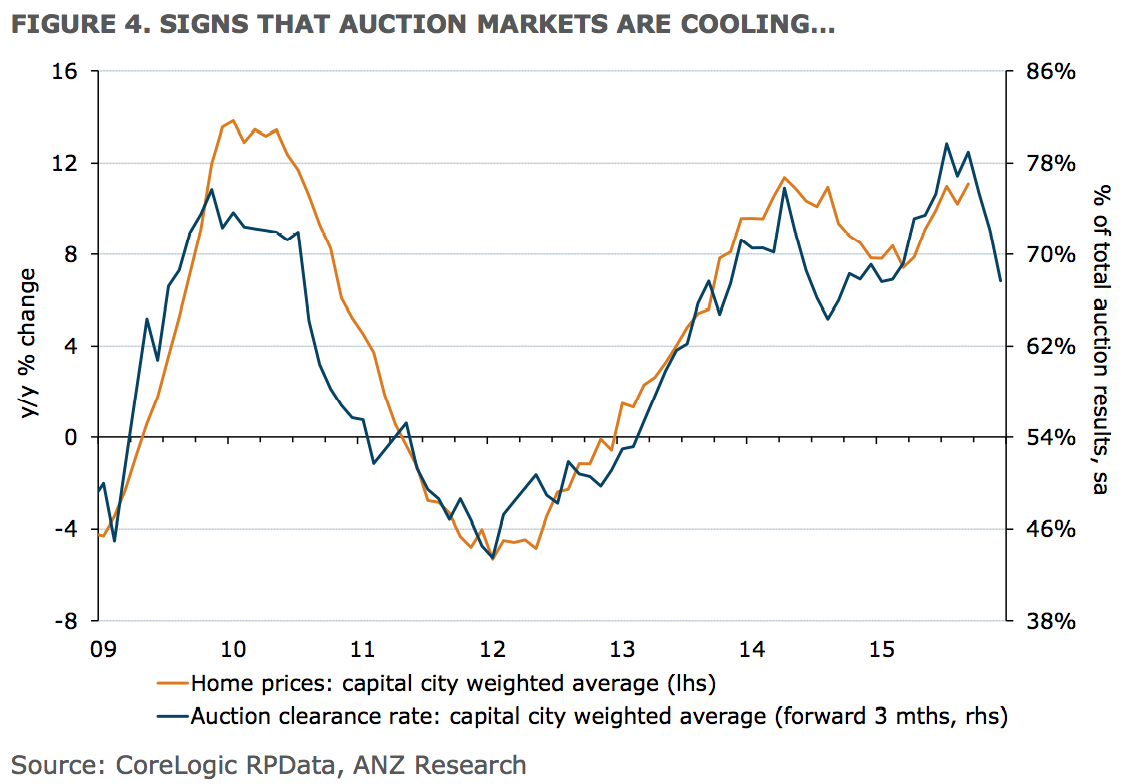

At the same time, cooler housing markets in Sydney and Melbourne, particularly investor activity, would remove a clear hurdle for the Bank to cut rates further. Sentiment in auction markets in the major cities has clearly shifted and already suggests that house price momentum is slowing (Figure 4). Signs are also emerging that borrowing by housing investors has started to moderate in-line with regulators’ plans (Figure 5). We expect investor activity to moderate further.

Combined with the threat of further regulatory action by APRA if needed, our view is that the Bank will become reasonably comfortable that further rate cuts will not pose significant macro or financial stability risks down the track.

Click to enlarge

THE CURRENCY

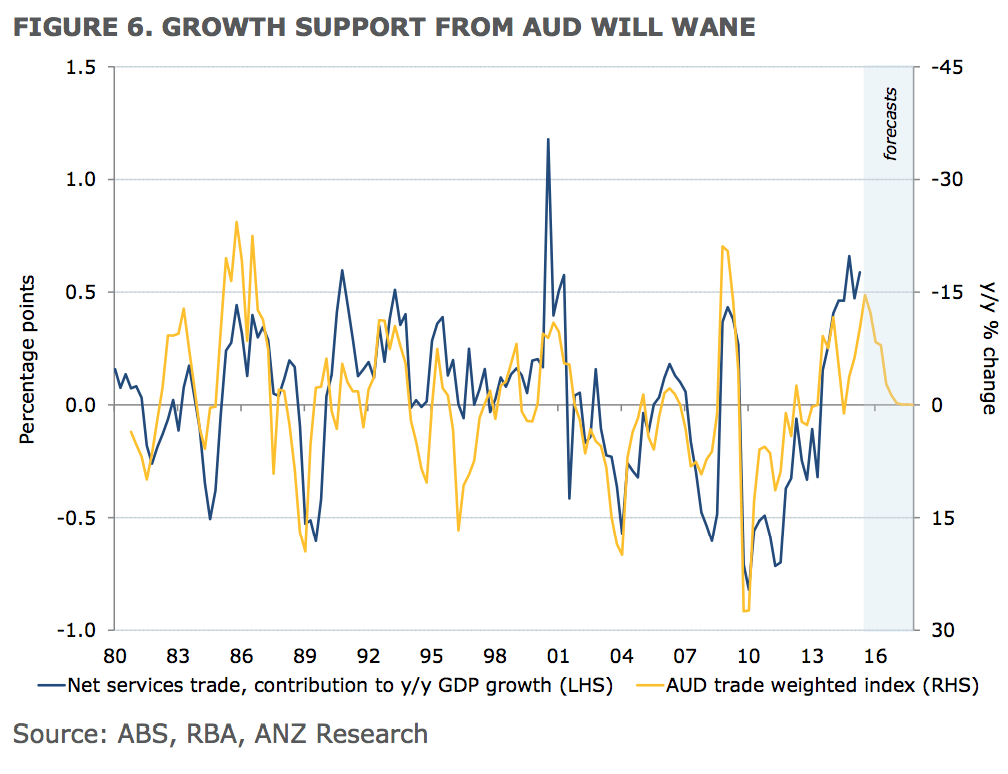

The belated depreciation of the AUD has clearly supported many parts of the economy. Most evidently, the contribution from net services trade has shifted from the largest ever subtraction from GDP growth to the biggest ever contribution to growth (Figure 6). Along with strong support from housing/property markets, the non-mining services part of the economy has strengthened noticeably. Over 90% of jobs growth over the past year came from just three services industries: professional services, health, and hospitality.

The key here is that even with further expected falls in the AUD, the impetus to overall growth from the currency is expected to diminish (Figure 6 highlights this).

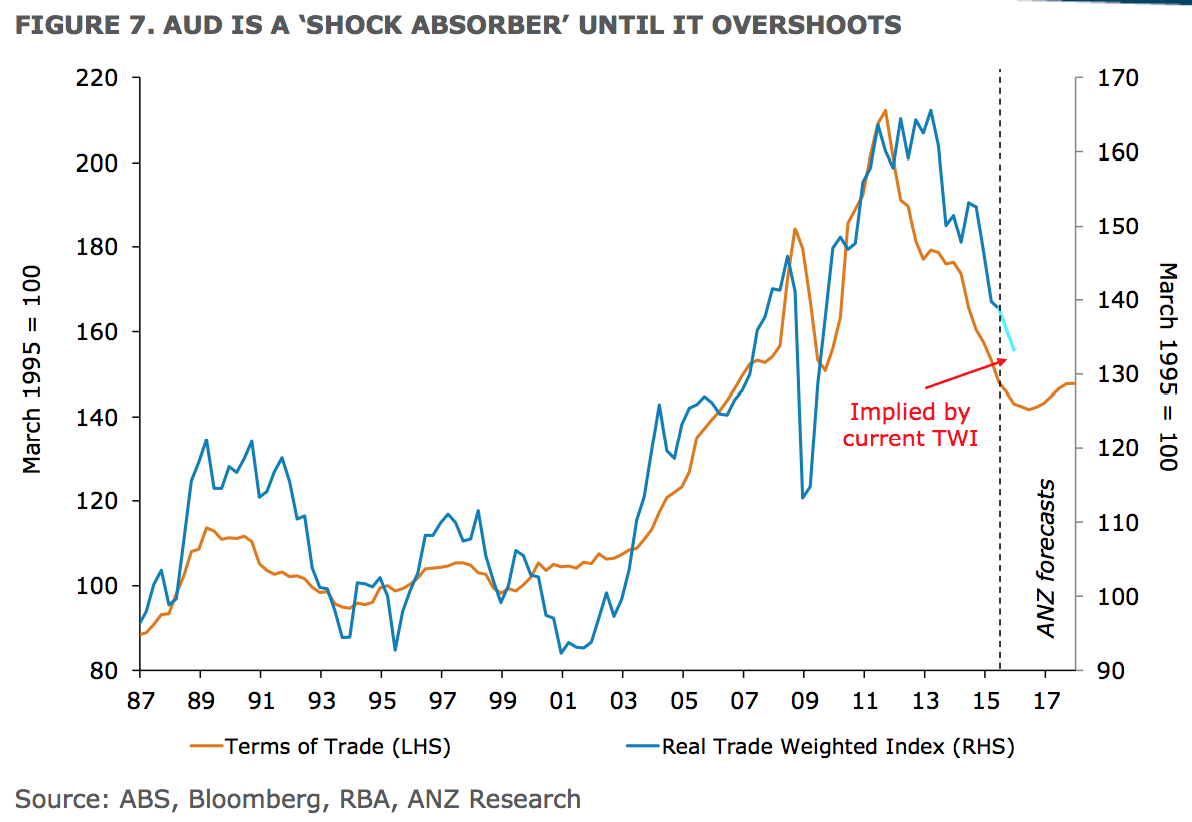

While the AUD continues to play its ‘shock absorber’ role (Figure 7), overall GDP growth remains soft at around 2% whichever way one cuts the data. Even if this understates true growth in the economy, it’s clear that growth is not above average which is where it needs to be to eat into economic spare capacity and send the unemployment rate lower.

INFLATION NO OBSTACLE TO MONETARY EASING

With growth set to be below trend and spare capacity in the labour market, inflation is likely to remain benign over the next year or so. We expect the inflation ‘pulse’ to remain towards the bottom of the RBA’s 2-3% target range for the medium term. The risks to this forecast, as guided by global factors, are to the downside.

Global disinflationary pressures are also likely to weigh on inflation. Many studies have shown that global factors are increasingly important, if not dominant, in most countries’ inflation outcomes. Spare capacity in the global manufacturing sector, lacklustre wages growth in developed economies, and persistent weakness in commodity prices are all consistent with a subdued global inflation outlook.

FISCAL POLICY REMAINS CONSTRAINED

The other main macro policy lever – fiscal policy – remains relatively constrained despite signs of modestly less restraint recently. Government spending is 20% of GDP.

The prospect of looser fiscal policy to assist growth is negligible, with the new Commonwealth Treasurer Scott Morrison stating this week that expenditure at over 26% of GDP is “not something that we believe is sustainable”. His comments suggest the current trajectory for a tightening in fiscal policy through smaller underlying cash deficits each year for the next three remains firmly in place. Equally, state governments have given no indication that they intend to stray from their policies of keeping a tight rein on expenditure.

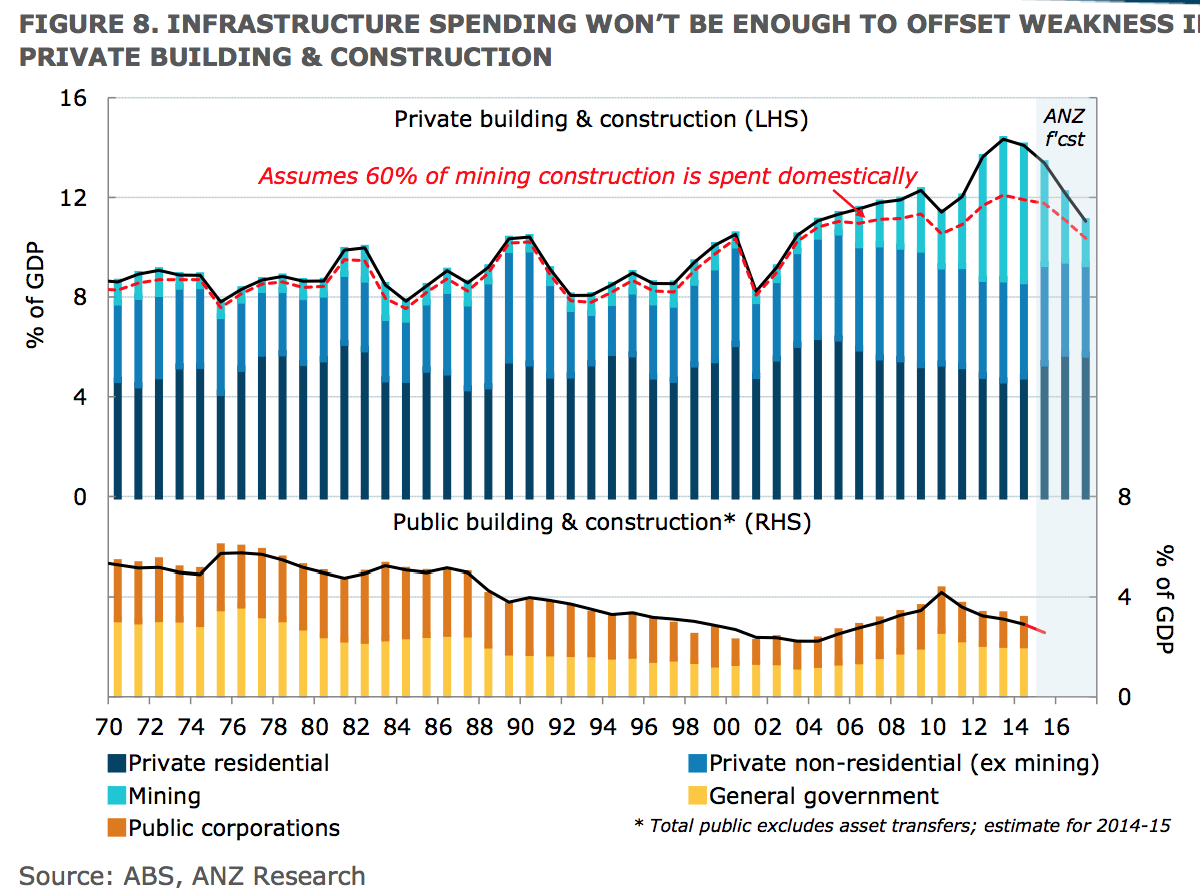

But what about the pick-up in infrastructure spending? Centred on Sydney, this will provide some modest additional support to overall growth in the coming years. Our view has been, and remains, that this support is relatively modest in the face of ongoing weakness in non-residential building and ongoing large falls in mining and related investment.

CONFIDENCE BOOST FROM NEW LEADERSHIP NOT ENOUGH

While it is encouraging to see a strong lift in consumer confidence following the change in Australia’s political leadership, it may not be enough to move the dial on the economy in the next 12-18 months. Even if the jump in consumer confidence, and what we expect to see as a jump in business confidence, is sustained over the next six months, that needs to be translated into investment spend and employment growth. We doubt it will, or at least not enough to offset the effects of a softening in property markets and weaker EM growth.

The government needs to focus on two key planks to economic policy, both medium to long term in nature. First, they need to get the government’s finances in order. This is well advanced, but more work needs to be done. As noted above, this will be a headwind to the economy, rather than a support. Second, they need to present a vision for Australia’s economy and communicate and legislate the adjustments to how our economy operates to get there. This takes time and may even come at the cost of growth in the short term.

As we move into 2016, sub-par economic growth in the context of weaker property markets will leave the job of supporting activity, once again, to the RBA. In our view, a modest downward adjustment to the cash rate will ensure stable unemployment and support economic activity over the medium term.

Warren Hogan is chief economist and Justin Fabo is senior economist, ANZ Research.