RBA on hold in June and a higher bar for an August cut: ANZ's Felicity Emmett

GUEST OBSERVERS

The RBA left the cash rate unchanged at 1.75 percent and provided no explicit forward guidance. The Bank seems confident that the transition to non-mining activity is continuing but remains worried about low inflation.

The lack of forward guidance means that an August rate cut is a much closer call than we had previously thought. That said, we continue to think that the extent of the downgrade to the RBA’s inflation forecasts and ongoing weak price pressures suggest that on balance the Bank will cut rates again in August, although it is now more data dependent.

DETAILS

The lack of a clear easing bias was the big surprise in today’s statement. The large downgrade to inflation in the May Statement on Monetary Policy suggested to us that more than 25bp of easing was required to keep real interest rates low, where the RBA’s forecasts also hinged on a further easing. Moreover, the Bank rarely cuts rates only once.

Last week’s strong Q1 GDP results were clearly encouraging for the Bank. RBA Governor Glenn Stevens noted that “despite a very large decline in business investment...other areas of domestic demand, as well as exports, have been expanding at a pace at or above trend”. The Bank also seems more positive about the labour market, noting the indicators are “consistent with continued expansion of employment in the near term”.

We expect, though, that the weak inflation outlook will continue to dominate the policy outlook. The Bank reiterated its concerns over inflation, noting that “inflation has been quite low...[and] this is expected to remain the case for some time”. The large downgrade to the RBA’s forecast inflation profile, where the average inflation forecast remains at or below the lower bound of the 2-3 percent target band for the entire forecast period, strongly suggests to us that the Bank will need to ease further. The recent uptick in the exchange rate and a possible delay to Fed tightening only puts further pressure on the cash rate.

Interestingly, the RBA seems relatively unperturbed by the recent pick-up in housing. The RBA acknowledged the recent rise in house prices, but noted that “lenders are also taking a more cautious attitude to lending in certain segments” and that “considerable supply of apartments is scheduled to come on stream”.

MARKET IMPLICATIONS

While the RBA continued to reference any currency appreciation as a factor that can complicate the economic adjustment, these words will be superseded by the lack of an explicit bias in the final paragraph of the statement. With this guidance lacking, and weeks before we get any further read on either inflation or wages, the AUD will likely perform better on crosses, most notably AUD/NZD. Further depreciation against the USD will now become contingent on more USD strength.

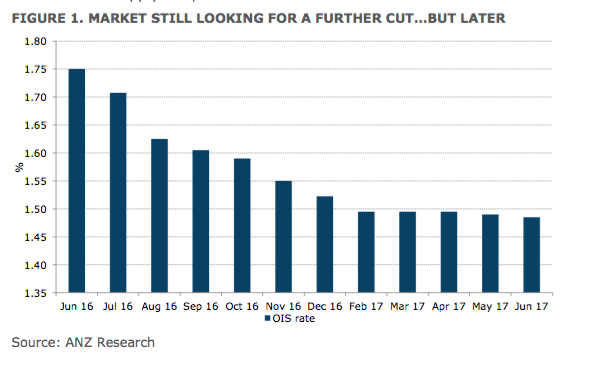

Rates markets have reacted to the RBA’s statement with higher yields across the term rates structure. RBA meeting date OIS pricing has shifted between 4-5 basis points higher, with the first full cut priced for June 2017. Further out the curve, the 3 year rate has risen by 8 basis points. We expect that significant sell-offs will find a base, particularly given a bounce in the AUD may be seen as a reason for easing.

OUTLOOK

The lack of an explicit easing bias makes an August rate cut a much closer call than we had previously thought. That said, we continue to expect a further cut given the size of the downgrade to the Bank’s inflation forecasts and the fact that the mid- point inflation forecast remains at or below the lower bound of the 2-3% target band for the entire forecast period.

Felicity Emmett is head of Australian Economics, ANZ, Daniel Been is senior FX strategist and Martin Whetton is senior rates strategist. They can be contacted here.