RBA expected to hold rates: HSBC's Paul Bloxham

Latest figures from HSBC's global research team expect the Reserve Bank to keep rates on hold next week in order to further stabilise growth and keep a lid on asset prices.

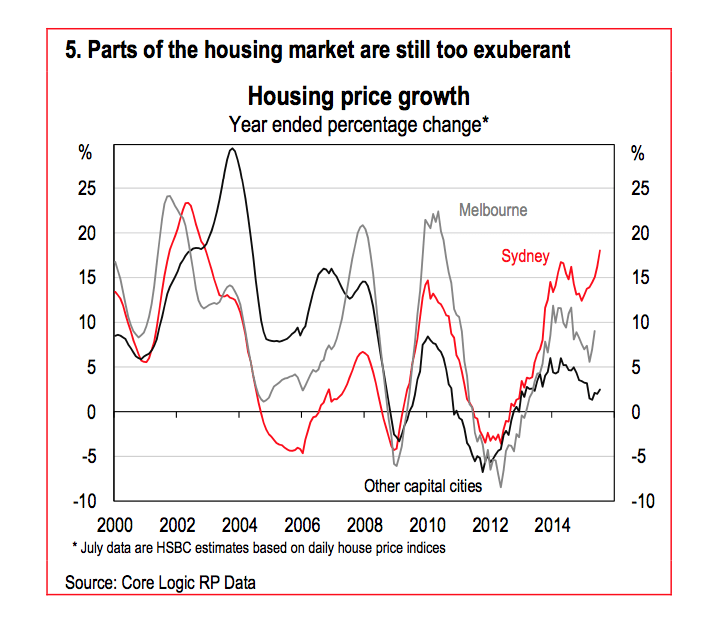

Recent moves by APRA to slow investor lending will begin to take effect in the next few months, according to Paul Bloxham, chief economist of HSBC, with concerns the benefits of cutting rates further could be outweighed by the costs.

"The prudential regulator is now requiring banks to hold more capital and, to this end, has announced that mortgage risk weightings will be increased for the major banks from approximately 16% currently to at least 25% by 1 July 2016," Mr Bloxham said.

"The banks are responding to the APRA’s increased scrutiny by toughening up requirements for investor mortgages. Actions taken so far have included lifting interest rates on investor loans, imposing limits onmaximum loan-to-value and increasing servicing requirements."

"We expect the cash rate to be held steady at 2.00% next week and for the RBA to repeat its emphasis on the need for the AUD to fall to assist the ongoing rebalancing of growth."