Home loan values see biggest jump in 18 years: CommSec

EXPERT OBSERVER

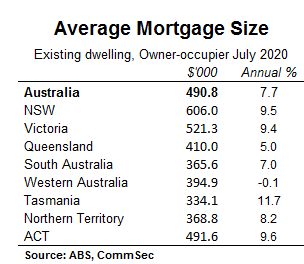

The value of home loans rose by 8.9 per cent in July after a 6.4 per cent rise in June (consensus: up 2 per cent). It was the biggest back-to-back increase in home loans in 18 years of records. First home buyer numbers are at a 10½-year high.

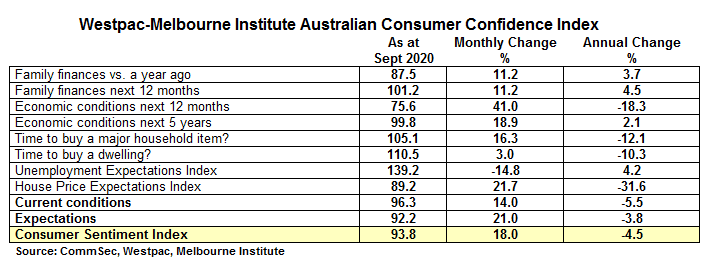

The Westpac-Melbourne Institute Index of Consumer Sentiment rose 18 per cent in September, lifting from 79.5 to 93.8. A reading below 100 points denotes pessimism.

Consumers believe that the wisest place for extra savings is in the bank (32.7 per cent of respondents). But 8 per cent say that they don’t know the wisest place for savings – the second highest level on record.

Chinese consumer prices rose 0.4 per cent as expected in August to be up 2.4 per cent on the year. Producer prices fell 2 per cent over the year as expected

The lending figures have implications for builders, housing-reliant businesses, finance providers, retailers, and companies dependent on consumer and business spending. The consumer confidence figures have implications for retailers, and other consumer-focussed businesses.

What does it all mean?

- Today’s economic data can be filed in the ‘encouraging’ category. Consumers are more chipper, home loan data is healthy and average home loans are still bigger than a year ago. There are more first home buyers taking out loans than at any point over the past decade. Also expectations of future house prices lifted almost 22 per cent last month.

- We have said this many times – this is not your traditional recession. Spending is rising at double digit annual rates and people are still confident enough to be buying and building more homes.

- The Reserve Bank strategy is working. Super-low interest rates and an expectation that they are not going to rise for three years are encouraging people to buy and build homes.

- If you had a saving windfall, what would you say is the wisest place to put it? In the latest survey, 8 per cent say they don’t know – the second highest reading on record (25 years).

What do the figures show?

Lending - July

- The value of home loans rose by 8.9 per cent in July (consensus: up 2 per cent) with owner-occupier loans up by 10.7 per cent and investor loans up by 3.5 per cent. The accompanying table has the details of lending per category.

- The value of loans to first home buyers in July rose by 10.6 per cent and was 26.6 per cent higher for the year.

- The number of owner occupier first home buyer loan commitments rose by 14.4 per cent in seasonally adjusted terms.

- By value, first home buyer loan commitments accounted for 38.7 per cent of all owner-occupier home loans in July (excluding refinancing) – a 10½-year high.

- Personal finance fixed term loan commitments rose by 6.9 per cent in July after rising 5.2 per cent in June. Commitments were down 3.9 per cent on a year ago. Car loans fell by 0.9 per cent after rising 61.2 per cent in the two prior months.

- Personal lending from revolving sources (including credit cards) fell by 11.1 per cent in July after falling 13.5 per cent in June. Loans were down by 40 per cent over the year.

- New finance leases fell by 14.1 per cent in July after dropping 6.1 per cent in June. Finance leases were down 3.3 per cent on the year.

- The value of new loan commitments to businesses for construction fell by 25.1 per cent in July after rising by 57.3 per cent in June. Loans were down 16.6 per cent on the year.

- Loans for the purchase of property by business fell by 14.2 per cent in July after falling 15.3 per cent in June to be down by 25.4 per cent over the year.

Consumer confidence – September

- The Westpac-Melbourne Institute Index of Consumer Sentiment rose by 18 per cent from 79.5 to 93.8 points in September. A reading below 100 points denotes pessimism.

- The current conditions index rose by 14 per cent. And the expectations index rose by 21 per cent.

- All five major components of the index rose in September.

- The survey was based on responses from 1,200 people and conducted in the week from August 31 to September 6, 2020.

- Wisest place for savings: Overall 32.7 per cent of respondents believe the wisest place to put new savings is in the bank – down from a 5½-year high of 34.8 in June. Only 9.2 per cent of consumers nominated shares – down from a 6½-year high of 11.4 per cent in June. And 9.9 per cent believe the wisest place for savings is real estate, up from 9.0 per cent in the June quarter.

- Also in the latest quarterly survey, 8 per cent say that they don’t know the wisest place for savings – the second highest level on record. Consumers are less keen on paying down debt – the reading of 17.1 per cent was a 5-year low. Only 3.4 per cent thought ‘spend it’ was the best use for new savings – down to a near 7-year low. Those electing ‘superannuation’ as the wisest place for savings lifted from 4.5 per cent to 6.9 per cent

- “Lending Indicators” is released monthly by the Bureau of Statistics and contains figures on new housing, personal, commercial and lease finance commitments. The importance of the data lies in what it reveals about the appropriateness of interest rate settings, confidence and spending levels in the economy.

- Westpac and the Melbourne Institute release the Index of Consumer Sentiment each month. The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes. Confident consumers may be more inclined to spend, especially on major items.

- These are strange times. And the fog doesn’t look like lifting any time soon. Mask-wearing Aussies are buying homes and indulging in retail purchases against the biggest downturn in the economy since World War II.

- It just shows that the stimulating policies of the Federal Government and Reserve Bank are working perfectly.

- Interest rates are set to remain low for three years – the Reserve Bank Governor’s own words. Aussie consumers are responding by buying and building homes. We just need businesses to recognize the different times and take back workers from their hibernation and take on new staff.

- The housing market outlook is improving. There was a 3 per cent lift last month on the question of whether it was a good time to buy a home. And there was a 21.7 per cent lift in house price expectations.

- All in a recession.

What is the importance of the economic data?

“Lending Indicators” is released monthly by the Bureau of Statistics and contains figures on new housing, personal, commercial and lease finance commitments. The importance of the data lies in what it reveals about the appropriateness of interest rate settings, confidence and spending levels in the economy.

Westpac and the Melbourne Institute release the Index of Consumer Sentiment each month. The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes. Confident consumers may be more inclined to spend, especially on major items.

What are the implications for investors?

These are strange times. And the fog doesn’t look like lifting any time soon. Mask-wearing Aussies are buying homes and indulging in retail purchases against the biggest downturn in the economy since World War II.

It just shows that the stimulating policies of the Federal Government and Reserve Bank are working perfectly.

Interest rates are set to remain low for three years – the Reserve Bank Governor’s own words. Aussie consumers are responding by buying and building homes. We just need businesses to recognize the different times and take back workers from their hibernation and take on new staff.

The housing market outlook is improving. There was a 3 per cent lift last month on the question of whether it was a good time to buy a home. And there was a 21.7 per cent lift in house price expectations.

All in a recession.

CRAIG JAMES is the Chief Economist at CommSec