Home loan customers can save $82,000 by switching from a big four bank

People power is the only way to send the big banks a message, says RateCity spokesperson Sally Tindall.

New research has revealed the average home loan customer could save $82,000 by switching from a big four bank, to a low rate online lender.

The comparison site RateCity is urging home loan customers unhappy with the behaviour of our major banks to shop around.

New calculations show a family with a $350,000 loan looking for a fully-featured mortgage, could save up to $82,118 over the life of their loan, by going with the lowest comparable online lender, instead of a major bank.

RateCity spokesperson Sally Tindall said the only way to give the majors a wake-up call is to vote with your feet.

“The big four banks have an incredible 75 per cent share of the home loan market.

"If you’re fed up with what’s coming out of the Royal Commission, now could be the time to switch.

“Online lenders are increasingly putting fully-featured loan products on the table – at significantly lower rates,” she said.

For example, the big four advertise fully-featured loans for about 4.5 percent, along with a hefty package fee of $395 a year, while some of the smaller lenders are offering fully-flexible loans for as little as 3.49 per cent, complete with a 100 per cent offset account and no ongoing fees.

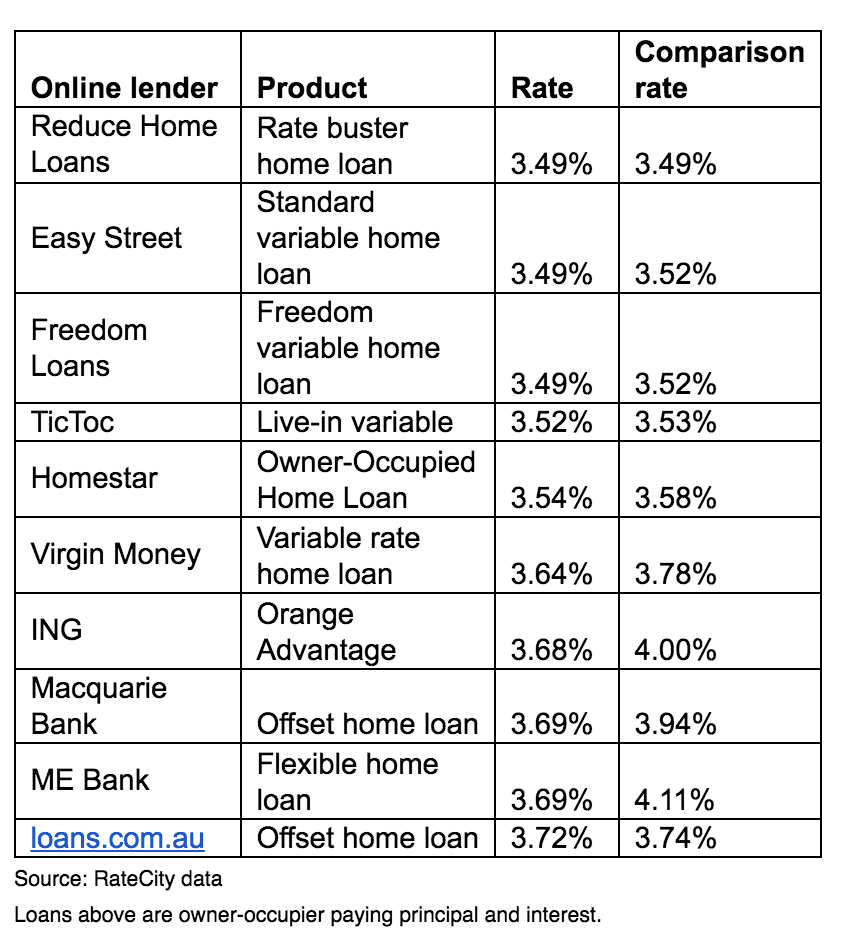

Low rate online lenders with offset accounts

Roughly 30% of lenders in the RateCity database are online.

Australia’s fifth largest home loan lender is online only (ING).

While nine of the 10 lowest rate lenders in the RateCity database are online lenders.

To find the best home loan for you it is recommended that you use a comparison site such as RateCity.com.au to research online lenders which including ratings for each product, find out what services each provider offers to field customer enquiries, test out their call centre and online chat service as well as reading online reviews, in particular social media feedback and it is of vital importance that they have a comprehensive website, check carefully for hidden fee's or charges as these are big red flags.

Mozo suggest some 7 in 10 home borrowers who have haggled their lender for a better home loan interest rate have received one.

According to research from Mozo.com.au, the comparison site consumers are far more comfortable haggling at the shops on a new fridge or television rather than their home loan, despite seven times the potential savings from home loan haggling, Mozo research has found.

Mozo research indicates there is little reward for being a loyal mortgage customer unless you are actively pushing for a better deal on a regular basis.

With 44% of mortgage holders currently on a home loan rate above 4.00%, there is plenty of room to haggle. More than half of the lenders in the Mozo database are now offering a rate under 3.70%.