Inflation to decide on rate cut: CommSec's Savanth Sebastian

GUEST OBSERVER

The Reserve Bank Board minutes make it clear that policymakers are waiting on more timely economic data to gauge how the economy is tracking.

However the minutes have also set the scene for next week’s inflation data and the subsequent August 2 Board meeting – highlighting potential triggers for an interest rate cut.

What makes the prospect of another rate cut a possibility in coming months is not just the modest slowdown in the economy over the past six months, but also the discussion on the Australian dollar. Board members noted that “at the time of the present meeting, the Australian dollar (in trade-weighted terms) was around the levels assumed in the forecasts at the time of the May Statement on Monetary Policy.”

Interestingly since that meeting the Australian dollar is around US1 cent higher. There was still the usual jawboning on the need for a lower Aussie dollar, with Board members noting that “an appreciation in the exchange rate could complicate the necessary economic adjustments”

A super-low inflation result would pave the way for the Reserve Bank to cut rates again. However the RBA would need to feel confident that a rate cut would have the desired impact in driving the Aussie dollar lower. Most central banks that have eased monetary policy in the past have seen their currencies continue to strengthen. However it is easier to justify another rate cut in light of slower employment growth and softer retail activity over the first half of 2016 – although it could be election related.

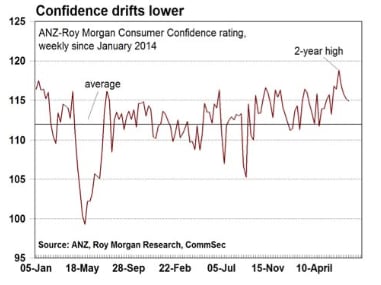

Consumer confidence has drifted low for the past four weeks, but it is nothing to be worried about. Rather a post- election hangover. In fact Aussie households have a lot of reasons to be more chipper about life. Not only are interest rates at generational lows, but petrol prices are falling, and job security is strong – all important in improving household budgets. In addition the Federal election is out of the way and share markets are now holding near 11 month highs – all ingredients that should hopefully result in consumers spending a little bit more freely in coming months.

What do the figures show?

The key quotes from the Board minute: Economic growth: “Overall, the available data for the June quarter were consistent with a moderation in GDP growth following the stronger-than-expected outcome in the March quarter, mainly because there appeared to have been a smaller contribution to growth from net exports in the June quarter”.

Australian dollar: “Low interest rates were continuing to support household spending and the lower exchange rate since 2013 had continued to assist the traded sector of the economy. Members noted that an appreciating exchange rate could complicate the necessary economic adjustments”.

Inflation: “Inflation was still expected to remain quite low for some time given very subdued growth in labour costs and very low cost pressures elsewhere in the world.”

Consumer spending: “The value of retail sales had increased only slightly in April and May but liaison indicated that growth in retail sales had picked up in June, partly because cold weather had boosted clothing and apparel sales. However, liaison had also pointed to ongoing pressure to discount prices in response to increased competition in some retail markets.”

Summary: “Taking account of the available information, the Board judged that holding monetary policy steady would be the most prudent course of action at this meeting. The Board noted that further information on inflationary pressures, the labour market and housing market activity would be available over the following month and that the staff would provide an update of their forecasts ahead of the August Statement on Monetary Policy. This information would allow the Board to refine its assessment of the outlook for growth and inflation and to make any adjustment to the stance of policy that may be appropriate.” Consumer confidence

The ANZ/Roy Morgan consumer confidence rating fell by 0.3 percent to 114.9 in the week to July 17. Confidence is up 2.8 percent over the year and well above the average of 112.1 since 2014. Three of the five components of the index fell in the latest week:

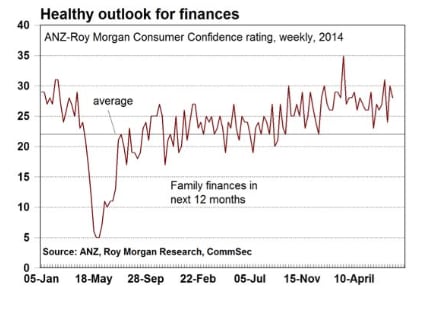

The estimate of family finances compared with a year ago was unchanged at +7;

The estimate of family finances over the next year was down from +30 to +28;

Economic conditions over the next 12 months was up from -4 to -1;

Economic conditions over the next 5 years was down from +9 to +7;

The measure of whether it was a good time to buy a major household item was down from +34 points to +33 points. What is the importance of the economic data?

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

The Reserve Bank releases minutes of its monthly Board meeting a fortnight after the event. The minutes give a guide to Reserve Bank thinking on interest rate settings. What are the implications for interest rates and investors?

Overall it is clear that the low inflation environment provides the central bank with scope to cut rates further if deemed necessary. The next round of inflation data is released next week and essentially means that the mostly likely scenario for another rate cut would be at the August Board meeting.

Click to enlarge

Savanth Sebastian is an economist for CommSec