Reserve Bank mulls the next move: CommSec's Craig James

GUEST OBSERVER

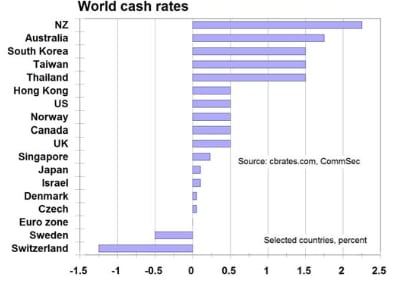

The Reserve Bank has left the cash rate at a record low of 1.75 percent. The Reserve Bank has maintained a “neutral stance” – indicating that policymakers will assess more information before deciding the next move on rates.

What does it all mean?

Did the Reserve Bank get it wrong when it cut rates last month to fresh record lows? Certainly all of the subsequent economic data have been strong including economic growth, which is now running at the fastest annual rate in 31⁄2 years.

The short answer is no. The Reserve Bank was already expecting Australian economic growth to be running at a 3 per cent annual rate over the next year. The Reserve Bank is always forward-looking – and despite expectations of solid 3 per cent growth, it cut rates. Simply, the Reserve Bank feels that the economy can run at a 3 per cent plus rate and not generate higher inflation.

Certainly the environment has changed – with companies challenged by “disruption” at every turn, causing managers to focus on increasing productivity and efficiency and reducing costs rather than lifting prices. The Reserve Bank now assumes that underlying inflation will hold in a 1.5-2.5 percent range. That is, a mid-point of 2 percent is expected – the bottom of the Reserve Bank’s 2-3 percent target band.

Since the rate cut in May, the Aussie dollar has fallen from US77 cents to around US73-74 cents. And the currency is weaker despite higher commodity prices. The RBA notes “Low interest rates have been supporting domestic demand and the lower exchange rate overall is helping the traded sector.”

The accompanying statement was quite short. But there are interesting observations on housing. The RBA notes a lift in home prices. But it warns “considerable supply of apartments is scheduled to come on stream over the next couple of years, particularly in the eastern capital cities.”

Perspectives on interest rates

The Reserve Bank left the cash rate at a record low of 1.75 percent. The previous rate cut was in May 2016 (25 basis points), taking the cash rate to a record low of 1.75 percent.

There have been 11 rate cuts since November 2011.

The Reserve Bank had previously lifted rates seven times from October 2009 to November 2010 – a total of 1.75 percentage points, from 3.00 percent to 4.75 percent.

What are the implications of today’s decision?

We expect the Reserve Bank to stay on the interest rate sidelines until August. At the August meeting the Reserve Bank will have digested the latest inflation data (released end July) as well as the Brexit decision in the UK and the June and July rate decisions in the US.

On balance rates still have scope to fall. It all depends on the Reserve Bank’s assessment on how fast the economy can grow without generating inflation above the upper end of the 2-3 percent target band.

This is a brave new world where old assumptions are being challenged. Investors need to do this also. In the past investors could work on the assumption of total sharemarket returns lifting on average by 9-11 per cent. With nominal economic growth closer to 4-5 percent, expected sharemarket returns also need to be adjusted down to a similar range.

Returns on residential real estate have averaged 13 per cent over the past two years. But over 2011 and 2012 returns averaged 2 per cent. With housing supply set to rise, even views on high-flying real estate will need to be adjusted downwards.

Craig James is the chief economist at CommSec.