Reserve Bank Board reluctant to cut rates: CommSec's Craig James

GUEST OBSERVER

If Reserve Bank Board members had to be “persuaded” to cut rates, it is clear that there was a variety of views.

It also seems clear that there was some reluctance to cut rates. And that is understandable. Ordinarily you cut rates if the economy is weakening and needs and extra kick along. But that is certainly not the case. The issue is solely inflation, more specifically, the outlook for inflation.

Inflation is tipped to remain low and that means that the economy could grow a little faster. Board members also had to be comfortable (“persuaded?) that a rate cut

wouldn’t cause the housing market to become over-inflated.

It is important to remember that there is no formal vote at Reserve Bank Board meetings. Decisions are arrived at by consensus (a “collegiate approach”). Reserve Bank Board members are no doubt a touch sceptical that rate cuts still work to lift growth and inflation at low nominal levels.

Some economists and strategists have pushed for another rate cut in June. This is now far from likely. The “rate cut school” are failing to properly understand the position of Reserve Bank Board members. The Reserve Bank Board will wait for the next inflation data at the end of July. There is no rush. And Board members may have to again be convinced that a rate cut is a useful thing to do.

Another rate cut may occur in August but it all depends on inflation. If the economy continues to out-perform and the housing market remains bubbly then the Board will remain firmly on the sidelines. A key question is whether a rate cut would actually do anything – it could up being counter-productive – causing people to fret that the economy is in some form of trouble.

What do the figures show?

Reserve Bank Board minutes

The key quotes from the Board minutes:

Summary: “Members discussed the merits of adjusting policy at this meeting or awaiting further information before acting. On balance, members were persuaded that prospects for sustainable growth in the economy, with inflation returning to target over time, would be improved by easing monetary policy at this meeting.”

Summary: “In coming to their policy decision, members noted that developments over recent months had not led to a material change in the outlook for economic activity or the unemployment rate, but the outlook for inflation had been revised lower. At the same time, they took careful note of developments in the housing

market, which indicated that supervisory measures were strengthening lending standards and that the potential risks of lowering interest rates therefore were less than they had been a year earlier.”

Australian dollar: “The exchange rate depreciation since early 2013 was assisting with growth and the economic adjustment process, although an appreciating exchange rate could complicate this.”

Inflation: “…the CPI data had indicated that weakness in domestic cost pressures had been broadly based. Non-tradables inflation had declined further in March to around its lowest year-ended rate since the late 1990s, reflecting low growth in labour costs and a range of other factors, including heightened retail competition, a moderation in conditions in housing rental and construction markets, and declines in the cost of business inputs such as fuel and utilities.”

Wages: “…information from the Bank's business liaison suggested that firms generally had been unwilling to make offers of wage growth below 2 per cent. But if inflation was to be persistently lower than previously forecast, it was possible that, in time, this could be reflected in lower wage growth.

Consumer spending: “Information from the Bank's liaison with retailers suggested some moderation in trading conditions in 2016, although conditions had remained generally positive.”

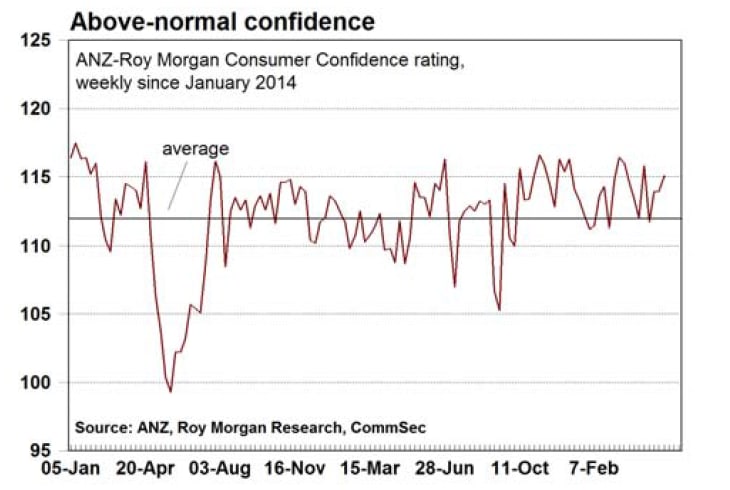

Consumer confidence

The ANZ/Roy Morgan consumer confidence rating rose by 1.1 per cent to 115.1 in the week to May 15.

Confidence is up 0.4 percent over the year and above the average of 112.1 since 2014. Two of the five components of the index rose in the latest week:

The estimate of family finances compared with a year ago was down from +5 to +4;

The estimate of family finances over the next year was down from +26 to +25;

Economic conditions over the next 12 months was up from -3 to +3;

Economic conditions over the next 5 years was up from +7 to +10;

The measure of whether it was a good time to buy a major household item was down from +34 points to +33 points.

New car sales:

According to the Australian Bureau of Statistics (ABS) new vehicle sales fell by 2.5 per cent in April after rising by 2.2 per cent in seasonally adjusted terms in March. Passenger car sales fell by 1.2 per cent, while sales of sports utility vehicles fell by 2.6 per cent and sales of “other” vehicles (includes utilities, panel vans, cab chassis, goods carrying vans, rigid trucks, prime movers, non-freight carrying trucks, and buses) fell by 4.8 per cent.

New vehicles sales were up by 2.4 percent over the year. Passenger car sales in April were up by 0.6 percent over the year while SUVs sales were up by 1.6 percent and “other vehicles” were up by 7.8 percent.

Sales across the country in April: NSW (-1.5 per cent); Victoria (+0.1 per cent); Queensland (-7.7 per cent); South Australia (-4.5 per cent); Western Australia (-1.3 per cent); Tasmania (+0.9 per cent); Northern Territory (-6.7 per cent); ACT (-1.8 per cent).

In rolling annual terms, a record 1,169,057 new vehicles were sold over the year to April. Sales of SUVs (423,744) hit record highs in annual terms, while annual sales of “other” vehicles stood at a 32-month high of 238,309.

Sales of passenger vehicles lifted from a near 19-year low of 505,348 to 507,004 in the year to April.

SUVs accounted for a record 45.53 per cent of combined passenger car and SUV sales in the year to April.

What is the importance of the economic data?

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

The Australian Bureau of Statistics provides seasonally adjusted and trend estimates of industry data. The Federal Chamber of Automotive Industries releases estimates of car sales on the third business day of the month. The figures highlight the strength of consumer spending as well as conditions facing auto & components

companies.

The Reserve Bank releases minutes of its monthly Board meeting a fortnight after the event. The minutes give a guide to Reserve Bank thinking on interest rate settings. What are the implications for interest rates and investors?

Future rate cuts are wholly dependent on inflation. If the next inflation figures are even slightly above RBA and market forecasts, then the Reserve Bank Board members will stay on the interest rate sidelines.

Australia is probably the only country in the world where rate cuts aren’t prompted by weakness in the economy.

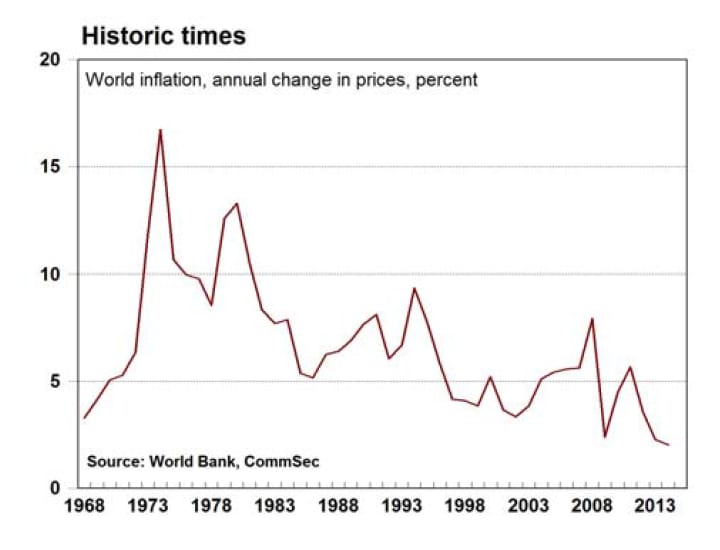

Twice the Reserve Bank mentioned “heightened retail competition”. Global tech-led disruption is driving down costs, prices, wages and, in turn, interest rates.

Consumer confidence is remarkably positive despite the election now being in full swing and despite a weaker Aussie dollar.

Craig James is the chief economist at CommSec.