Tricky, but expect RBA rate cut next week: HSBC's Paul Bloxham

GUEST OBSERVER

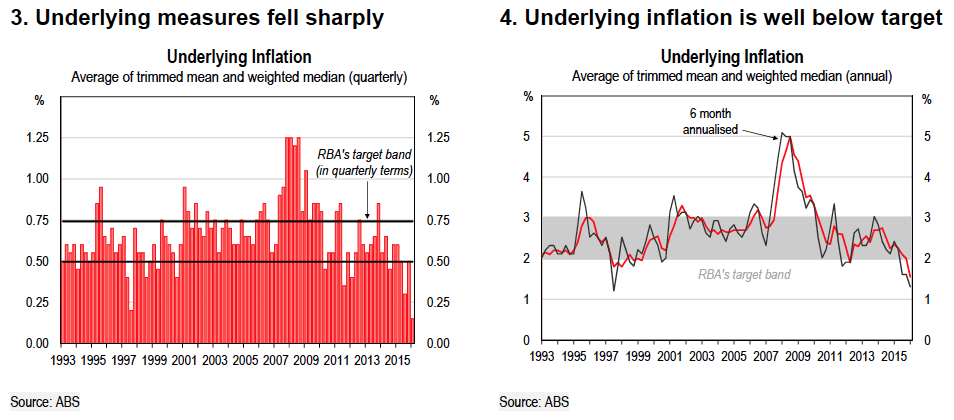

Australian CPI numbers surprised significantly to the downside. The RBA’s preferred measures of underlying inflation both fell well short of market expectation and are tracking well below the RBA’s last set of forecasts.

These core measures of inflation have also declined to be convincingly below the bottom edge of the RBA’s 2-3 percent target band. The average of these underlying measures was 1.55% y-o-y.

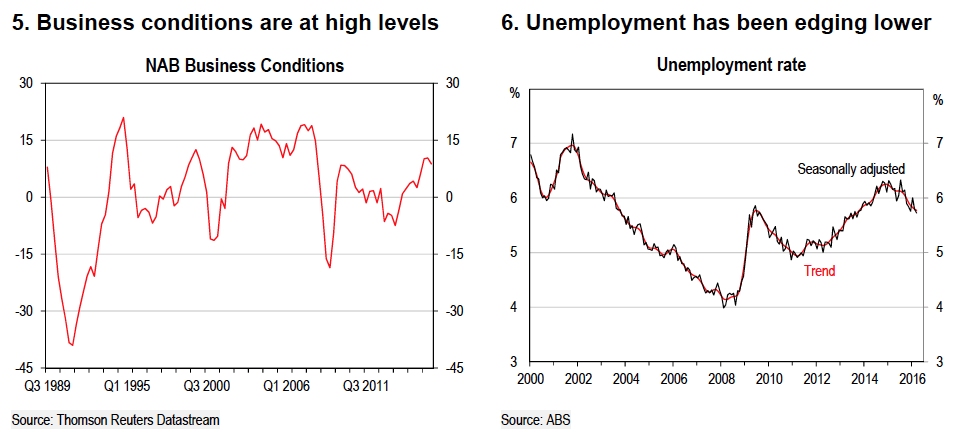

This puts the RBA in a tricky spot. Most of the demand indicators have held up recently, with the unemployment rate falling and business conditions improving.

Normally a lift in the activity generates a solid rate of inflation. However, although growth has been solid, it has not been strong enough to keep inflation on target.

Low inflation partly reflects that the end of the mining investment boom has brought an extended period of below-trend growth, which has weighed on wages and price pressures in the economy. Global inflation has also been very low. More recently, low global inflation and rates have seen the AUD climb, which is set to weigh further on the outlook for inflation and could also weigh on growth.

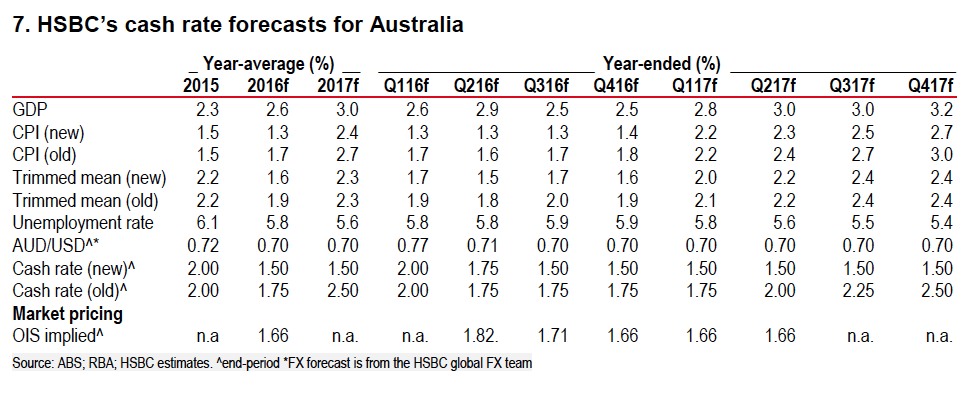

All of this adds up to suggesting that the RBA will need to cut its cash rate further. It now also seems likely that a 25bp cut may not be enough.

The RBA also faces a tricky timing issue. The government is due to hand down the federal budget on 3 May, which is the same day as the RBA meets next week and a federal election looks likely on 2 July. The RBA typically looks to stay out of the political process, so cutting rates around these events is less than ideal.

Weighing all of this up, there is no denying that inflation is too low, which means that the cash rate almost certainly needs to be cut. The usual rule of thumb is the sooner the better. We retain our view that the RBA is likely to cut by 25bp in Q2. We now expect that a cut in May is likely, despite the budget. We now also expect a follow-up 25bp cut in Q3 and for the cash rate to remain at 1.50% over the forecast horizon.

Q1 CPI was very weak

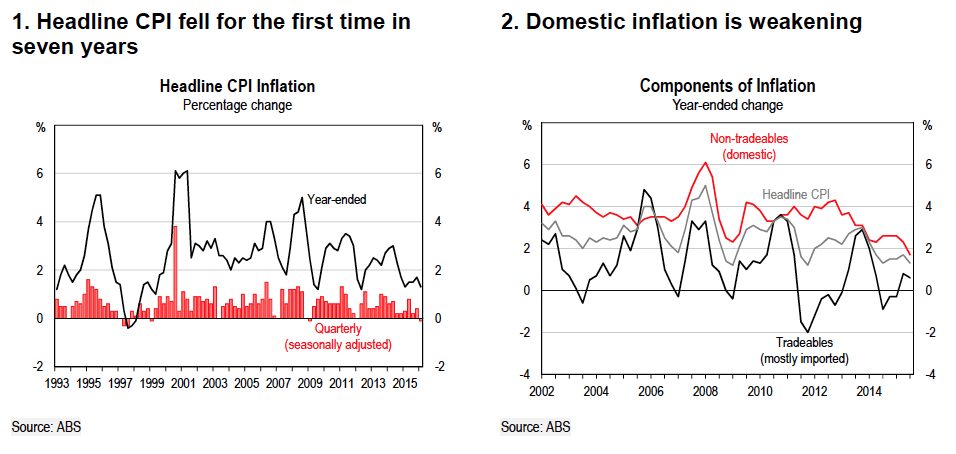

Today’s CPI numbers showed that inflation was weak across the board. The headline CPI print showed a fall of -0.2% q-o-q, which was the first decline in seven years (Chart 1). The y-o-y rate of headline CPI inflation has now been below the RBA’s 2-3% target band for six quarters, which is the longest period of below-target headline inflation since 1999. The fall in the headline CPI rate reflected weakness in imported prices, but also, and more worryingly, a fall in domestic inflationary pressures (Chart 2).

Of course, the RBA focuses on its preferred underlying measures of inflation – the trimmed mean and weighted median – which strip out the volatile items. Here the news is even less promising. The average of the two preferred underlying measures fell to its lowest rate in the history of Australia’s inflation-targeting regime (since mid-1993) (Chart 3). The average of the two underlying measures was running at 0.15% q-o-q in Q1. In y-o-y terms, underlying inflation is well below the RBA’s 2-3% target band and also at its lowest level on record (Chart 4).

The challenge is that this has occurred at the same time that domestic demand indicators have been lifting. Surveyed business conditions also remained at high levels in Q1 and the unemployment rate has continued to edge lower. As we have pointed out recently though, the improvement in the labour market has not yet been enough to lift wages growth (see Downunder Digest: Looking for signs of rising wages, 15 April 2016). At the same time, the rising AUD is likely to weigh on growth and inflation (see Downunder Digest: Services exports and the AUD, 30 March 2016).

The timing is tricky, given the budget and election

With the Prime Minister, Malcolm Turnbull, having pulled the budget forward by a week to 3 May in order to facilitate calling an early election on 2 July, the budget is now due to be handed down on the same day as the RBA board meeting. This is less than ideal for the RBA, if it is looking to cut rates on that day. Typically, the RBA would like to stay apolitical and the Governor, Glenn Stevens, has also spoken on a number of occasions about monetary policy reaching its limits and other arms of policy (fiscal policy) needing to be more supportive of growth. Ideally, we would be hoping this allows the government to announce its policies without a cash rate cut also being part of the message. The RBA may also be reluctant to cut in the lead-up to an election (likely on 2 July) as it typically seeks to remain apolitical.

However, if the RBA deems that rates will need to be lowered at some point, the typical rule of thumb is: the sooner the better. Governor Stevens also has a track record of setting policy independent of the political cycle, having lifted the cash rate only a few weeks before the 2007 election. With this in mind, if the RBA does consider that the CPI print warrants it cutting further, as we think is likely, getting it done in May seems a little easier than waiting until June, given that it can more easily point to the lower-than-expected CPI as the trigger.

PAUL BLOXHAM IS CHIEF ECONOMIST (AUSTRALIA AND NEW ZEALAND) FOR HSBC.