RBA adopts stronger easing bias as higher AUD complicates economic adjustment

GUEST OBSERVER

Today’s RBA Minutes are similar in most respects to the Statement following the April meeting. But the wording around the considerations for monetary policy implies to us that the easing bias is stronger.

Mainly because the higher Australian dollar (AUD) will “complicate” the economy’s adjustment to different growth drivers.

It may be that the RBA has decided that the fundamental drivers of the AUD, like global bulk commodity prices, are now more likely to be higher over the rest of the 2016.

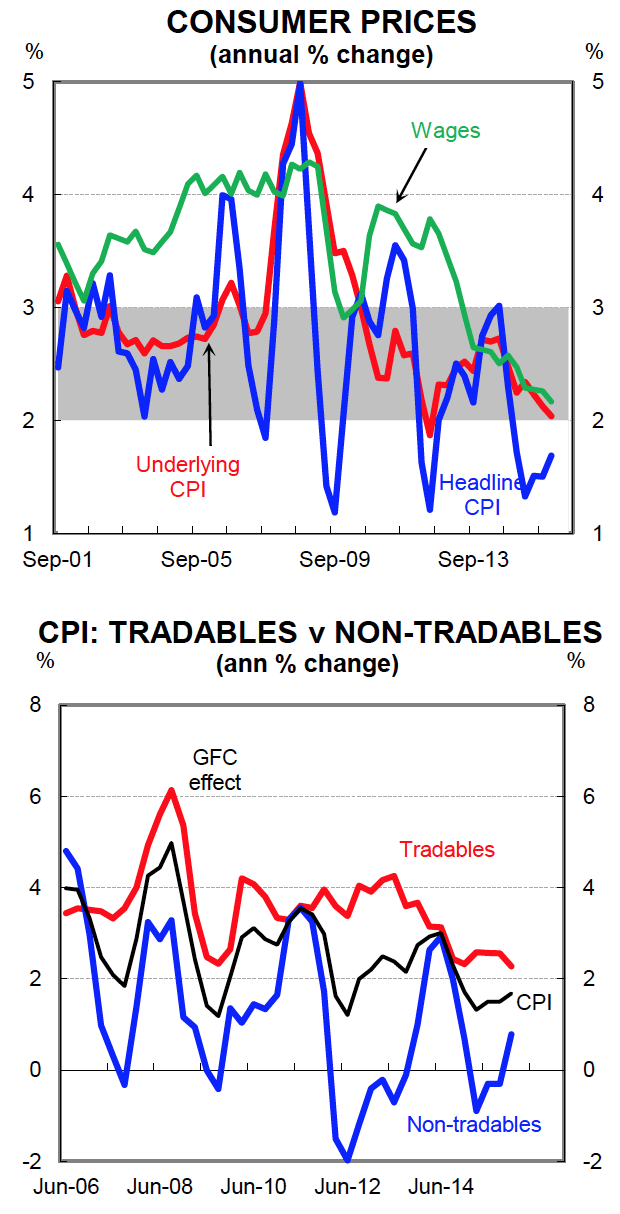

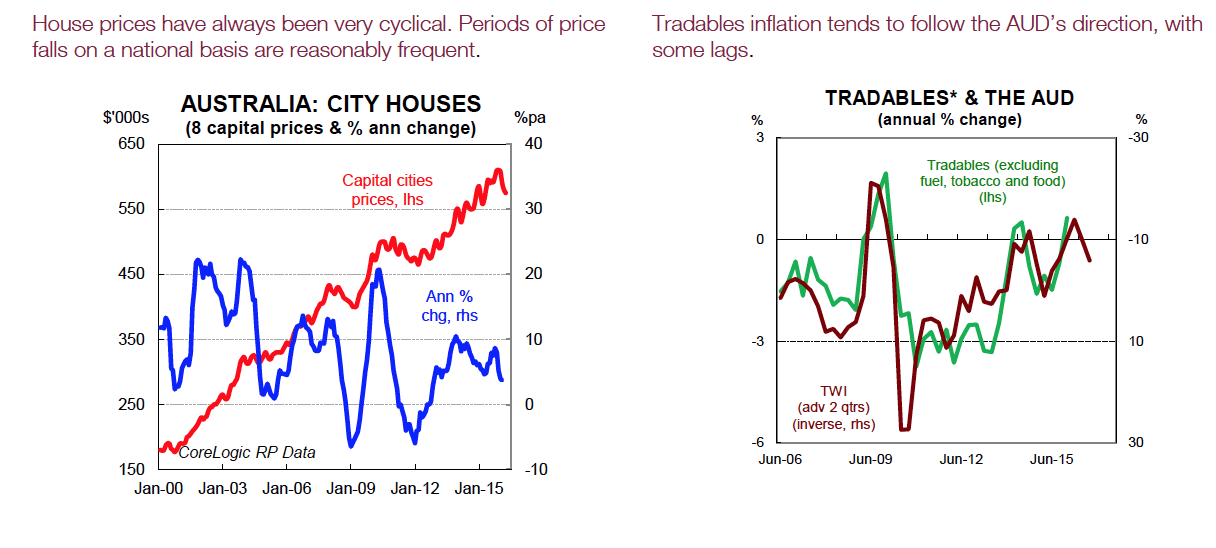

The minutes have a comment that the terms of trade is set to rise modestly because of the pick-up in bulk commodity prices. It means the risks on the AUD may be rebalancing to the upside, and away from the more comfortable (for the economy) levels under USD0.75. A higher AUD complicates lots of things, especially the inflation outlook. Lower inflation outcomes could justify lower cash rate settings than current. Especially if some more downside growth risks, like significant global financial market volatility, become reality.

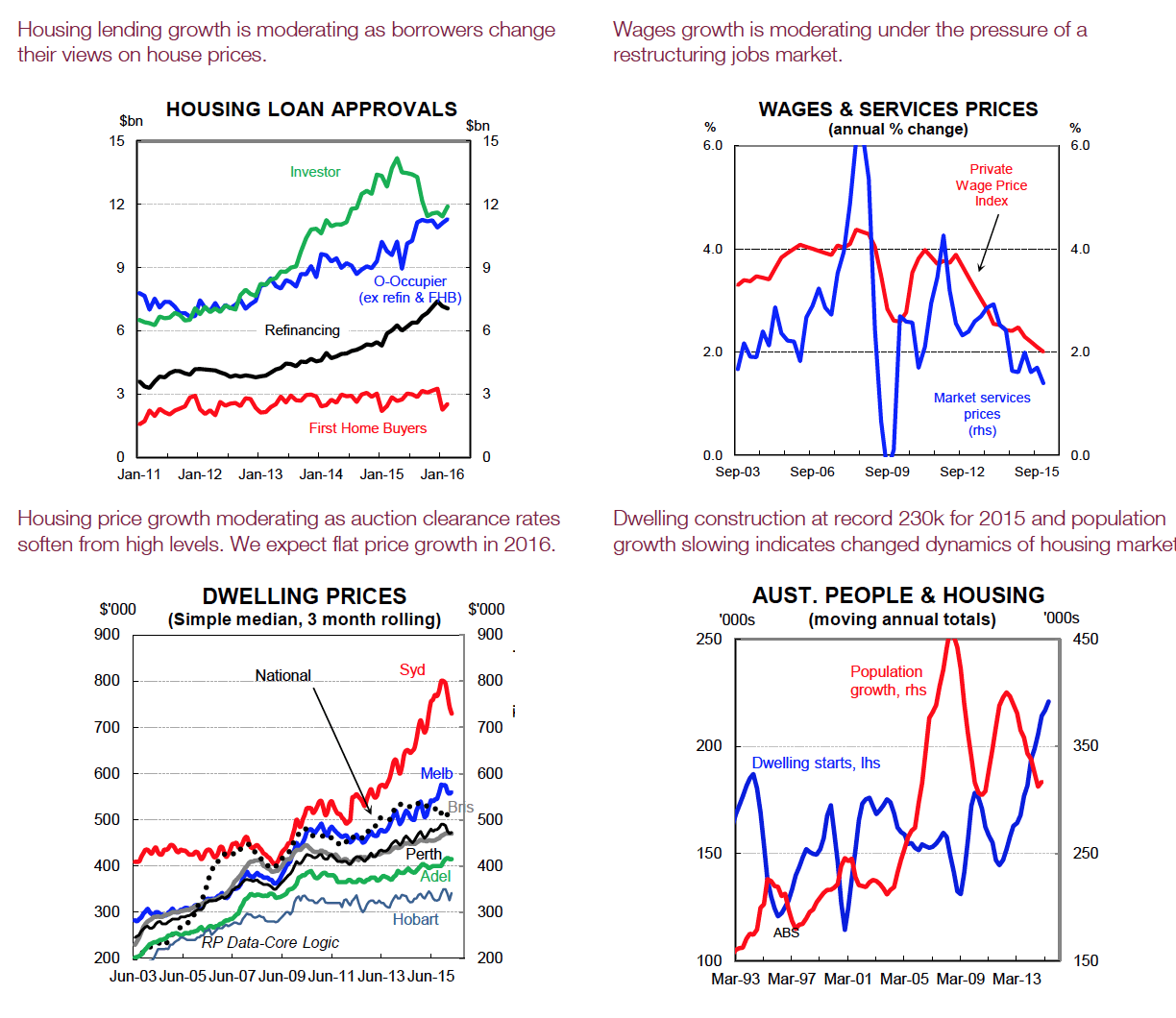

The minutes indicate a number of positive developments in the domestic economy. Established house price growth has continued to ease, reducing the risks around the property sector. The strong lift in supply of new apartments has also resulted in an easing of their prices. But demand conditions across the country vary considerably. Surveys of national business conditions have been more favourable recently, with signs of a pick-up in non-mining profits. But non-mining investment intentions remain broadly unchanged even though business credit growth has lifted over the past six months.

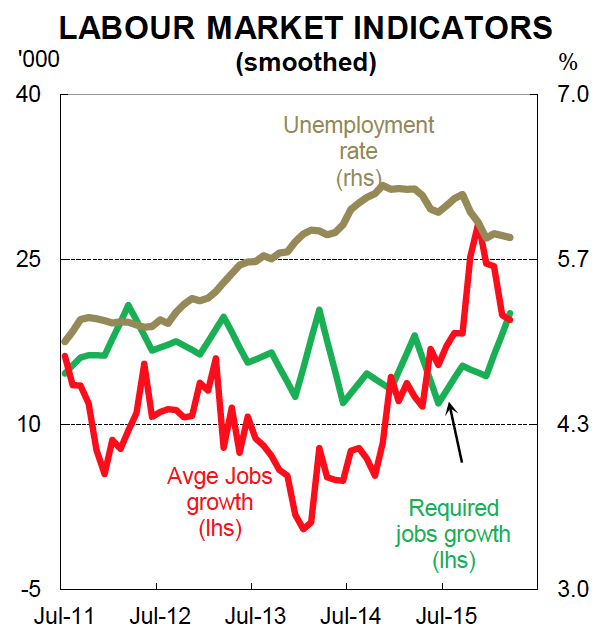

Employment growth in the non-mining sectors has been strong. While the recent jobs data was weak, the RBA said it needed to be compared to the unusual strength of activity through late 2015. The unemployment rate looks to have peaked in mid-2015 and leading indicators of the jobs market are mixed. Wages growth remains subdued despite firm jobs growth. Unit labour costs growth has been negligible for the past four years.

There was no RBA commentary on the AUD that indicated that it was out of line with fundamentals. The minutes list the reasons for the AUD moving higher since late 2015. Namely, higher bulk commodity prices and above-trend GDP growth for 2015 of 3% and easy US monetary policy.

We expect the RBA to keep the cash rate at 2 percent over coming months. The domestic economy is rebalancing towards different growth drivers and employment growth is firm. The major issue is the trend to lower inflation outcomes. The higher AUD complicates the picture. So a very low underlying inflation result, say near 0.3%q/q and 1.7%pa, next Wednesday could support a rate cut.

Michael Workman is senior economist, Commonwealth Bank.