Record annual trade deficit, exports to the US lifts: CommSec's Savanth Sebastian

GUEST OBSERVER

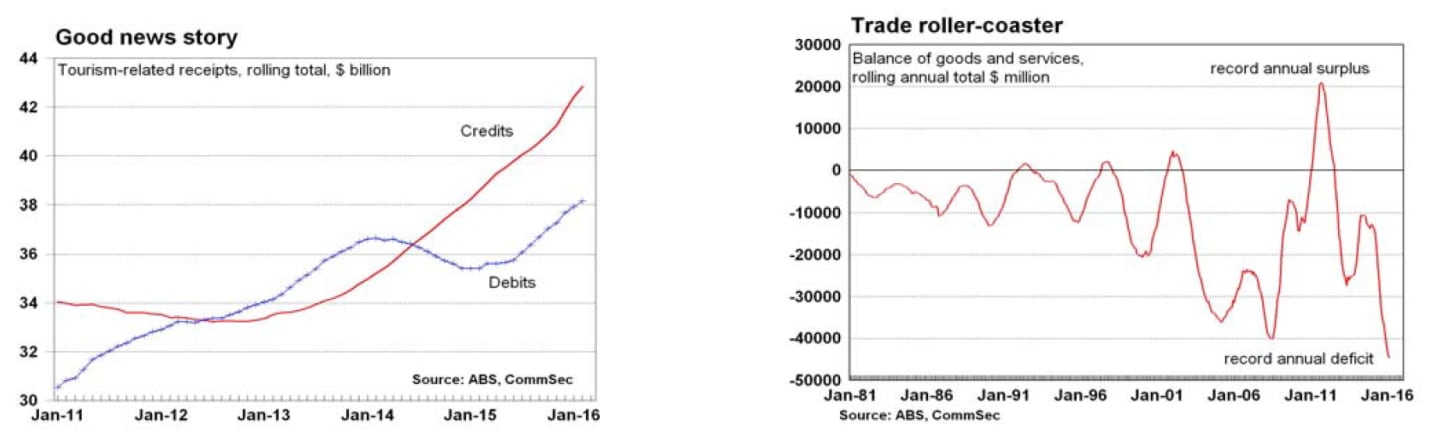

Australia’s trade deficit widened from $3.16 billion in January to $3.41 billion in February. It was the 23rd consecutive monthly deficit. The rolling 12-month deficit stood at a record high $44.53 billion in the year to February.

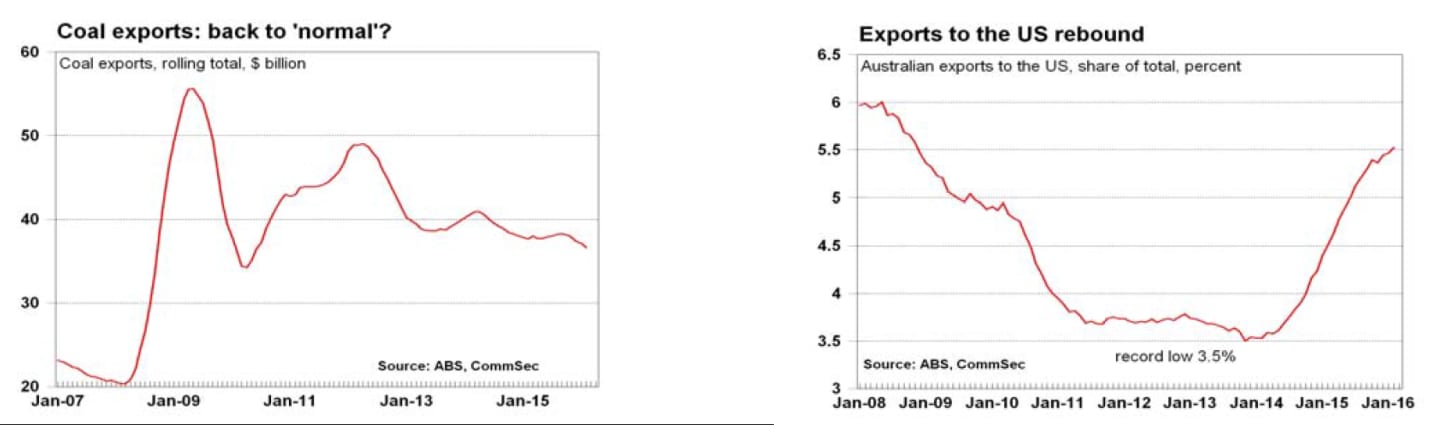

Exports to US: In the year to January, Australia exported $13.57 billion of goods to the US – just shy of the record high $13.69 billion in the year to October 2015. But the share of annual exports going to the US lifted from 5.44 per cent to a fresh 7-year high of 5.53 per cent.

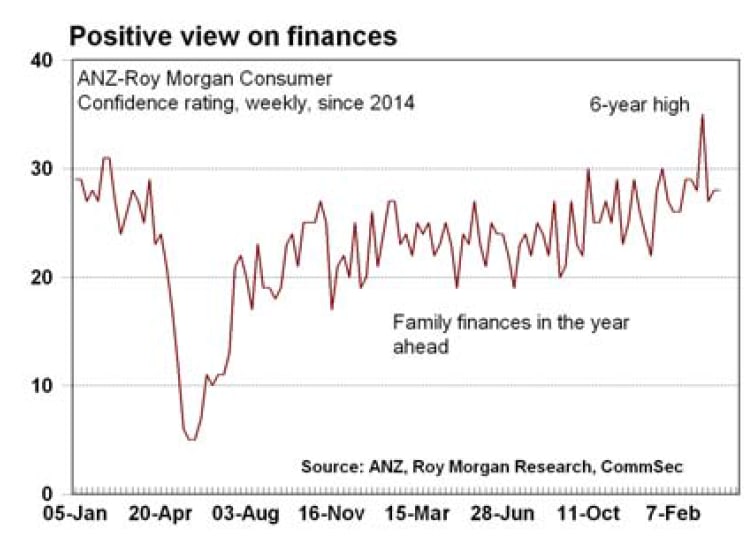

Consumer confidence: The weekly ANZ/Roy Morgan consumer confidence rating fell by 1.1 points (1 per cent) to 113.4 in the week to April 4. Confidence is still 3.4 per cent higher over the year and above the average index value of 112 since 2014.

New vehicle sales: There were 104,512 in March, down 0.5 per cent over the year. SUVs accounted for a record 36.2 per cent of all vehicle sales in the 12 months to March.

The trade data has the potential to affect the Aussie dollar so may be important for exporters. The data on car sales provide insights into consumer and business spending Stocks affected include Super Retail Group, AP Eagers, Automotive Holdings, ARB Corporation and Schaffer Corp. The consumer confidence figures have implications for finance providers, retailers, and companies dependent on consumer and business spending.

What does it all mean?

The latest trade data was decidedly weak. Not only have the trade accounts been in deficit for almost two consecutive years, but the 12-month rolling annual deficit came in at $44.5 billion – the largest deficit in monthly records going back 45 years. However the trade data doesn’t have the impact on the currency that it once did. Given that the currency fell less than a fifth of a cent it is pretty clear that there appears little concern by foreign investors about the red ink. Over the medium term it is likely that trade deficits will remain the norm.

Interestingly consumption good imports rose by over 3 per cent and are up almost 10 per cent on a year ago. At face value this may be an early sign that consumer activity is lifting, and as a result more goods are being imported.

It’s clear that a lower currency will be required to continue to support the rebalancing across the economy - particularly in light of providing a further boost to Australia’s rural and services exports. The other interesting shift is the strength in exports to the US. In the past year Australia exported $13.57 billion of goods to the US – just shy of the record high of $13.69 billion in the year to October 2015. In addition the share of annual exports to the US is now at a 7-year high. While China will continue to remain our dominant trading partner the lift in activity with other nations like the US and India will help to alleviate some of the weakness.

The car industry has certainly been a key beneficiary of improved household budgets and low interest rates. Over the year to March, a total of 1,163,143 new vehicles were sold - just shy of the record 1,163,684 sold in the year to February. And March vehicle sales were affected by the early timing of Easter.

Of note, sports utility vehicles (or four-wheel drive vehicles) remain the ‘new black’. While sales of ‘ordinary’ passenger cars fell by over 9 per cent in March compared with a year ago, SUVs lifted by 8.3 per cent over the year. In fact 421,625 SUVs were sold over the past year – a record high. One in three new vehicles sold in Australia is a SUV. And almost 46 per cent of combined SUV and passenger cars sold are SUVs.

What do the figures show?

International trade:

Australia’s trade deficit widened from $3.16 billion in January to $3.41 billion in February. It was the 23rd consecutive monthly deficit. The rolling 12-month deficit stood at a record high $44.53 billion in the year to February.

In February, exports of goods and services fell by 1.2 per cent (goods down by 1.3 per cent) while imports of goods and services fell by 0.2 per cent (goods up by 0.2 per cent). Exports are down 8.5 per cent on a year ago, while imports are down by 2.0 per cent.

Rural exports fell by 5.5 per cent after sliding by 1.8 per cent in January. Non-rural exports rose by 1.6 per cent (but gold fell 20.4 per cent) after rising by 2.2 per cent in January.

Within imports, consumer imports rose by 3.4 per cent with capital goods imports up by 0.4 per cent while intermediate goods imports fell by 3.1 per cent.

Consumption goods imports are up 9.5 per cent on a year ago while capital goods imports are down by 9 percent and intermediate goods imports are down by 12.2 per cent.

Australia's annual exports to China stood at a 31-month low of $79.0 billion in the year to February. Annual exports were down 8.4 per cent on a year ago. Exports to China accounted for 32.2 per cent of Australia's total exports.

Australia's annual imports from China rose from $61.88 billion to a record high of $62.01 billion in the year to February, up 14.8 per cent on a year ago. Imports from China accounted for 23.2 per cent of Australia's total imports in February.

Australia's rolling annual trade surplus with China hit a 5-year low of $17.01 billion in February, well down from the record high of $51.16 billion set in April 2014.

Australia annual exports to the US lifted from $13.54 billion to $13.57 billion in the year to February and just down from a record high of $13.69 billion in the year to October 2015. But the share of annual exports going to the US lifted from 5.44 per cent to a fresh 7-year high of 5.53 per cent.

Australia’s annual exports to India eased further from the two-year high of $10.45 billion set in the year to April 5 2016.

Consumer confidence

The weekly ANZ/Roy Morgan consumer confidence rating fell by 1.1 points (1 per cent) to 113.4 in the week to April 4. Confidence is still 3.4 per cent higher over the year and above the average index value of 112 since 2014.

Two of the five components of the index fell in the latest week:

The estimate of family finances compared with a year ago was up from +6 to +9;

The estimate of family finances over the next year was unchanged at +28;

Economic conditions over the next 12 months was down from -3 to -4;

Economic conditions over the next 5 years was down from +12 to +3;

The measure of whether it was a good time to buy a major household item was up from +30 points to +31 points.

New vehicle sales

According to the Federal Chamber of Automotive Industries (FCAI), Australian new motor vehicle sales totalled 104,512 in March, down 0.5 per cent over the year. In the year to March, 1,163,142 new vehicles were sold, just shy of the record 1,163,684 sold in the year to February.

Passenger vehicles in March were down 9.4 per cent on a year earlier while sales of sports utility vehicles (SUVs) were up by 8.3 per cent and other vehicles were up by 4.9 per cent.

In the year to March, SUVs represented 45.5 per cent of combined passenger car and SUV sales. SUVs accounted for a record 36.2 per cent of all vehicle sales in the 12 months to March.

What is the importance of the economic data?

The monthly International Trade in Goods and Services release from the Bureau of Statistics provides estimates on exports and imports of physical goods (such as coal, beef and computers) and services (such as travel receipts). The balance of goods and services (BOGS) is a narrower description of Australia’s external position than the current account estimates. The import data is a useful gauge of consumer and business spending while exports reflect global demand as well as domestic influences such as drought.

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

The Federal Chamber of Automotive Industries releases estimates of car sales on the third business day of the month. The figures highlight the strength of consumer spending as well as conditions facing auto & components companies.

What are the implications for interest rates and investors?

China dominates Australia’s trade relationships but the lift in trade with the US and India is encouraging.

At present there is no rush to move rates in any direction. And while the Reserve Bank policymakers may fret about the stronger Aussie dollar, CommSec believes interest rates will remain unchanged over 2016. Any need to cut rates would be as a result of a downturn in the global economy rather than due to domestic factors.

The Reserve Bank knows that the Aussie dollar is a two-edged sword. Consumers love a stronger currency as it means cheaper overseas travel and imported goods. But a stronger Aussie makes it more difficult for businesses, especially exporters and those in regional and rural regions.

Savanth Sebastian is an economist for CommSec