No surprises from the Reserve Bank: CommSec's Craig James

The cash rate has been left at a record low of 2% for a seventh month (eight months of rates at 2%).

The Reserve Bank Board has noted the moderation in home prices in Melbourne and Sydney.

What does it all mean?

In November, the Reserve Bank re-instituted the ‘easing bias’. That is, the RBA intimated that if rates were to move in coming months it would be down, not up. The ‘easing bias’ hasn’t changed. But this is more of an insurance policy. The economy is actually performing well and momentum appears to be lifting. Of course, if the economy started to lose steam, then the RBA could cut rates again – for the key reason that inflation is actually a bit lower than the RBA had earlier expected.

The next meeting of the Reserve Bank Board is not until February 2 2016.

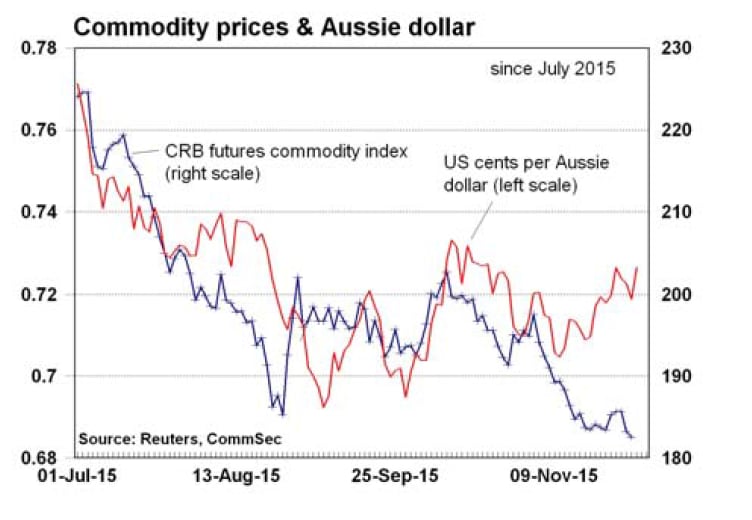

On the Australian dollar, the Reserve Bank continued with the same language: “The Australian dollar is adjusting to the significant declines in key commodity prices.” Seemingly, the RBA is “happy” with the current level of the currency. However some could contend that the Aussie is a little firm compared with commodity prices like gold, oil, coal and iron ore.

On the housing market, the RBA noted: “The pace of growth in dwelling prices has moderated in Melbourne and Sydney over recent months and has remained mostly subdued in other cities.” Back in October, the RBA said: “Dwelling prices continue to rise strongly in Sydney and Melbourne, though trends have been more varied in a number of other cities.” The Reserve Bank would be happy that supply and demand in the housing market has become more balanced in Australia’s biggest cities.

The good news is that Aussie consumers and businesses have almost two months of grace before being badgered again by interest rate speculation.

Perspectives on interest rates

The previous rate cut was in May 2015 (25 basis points), taking the cash rate to a record low of 2%.

There have been 10 rate cuts since November 2011.

The Reserve Bank had previously lifted rates seven times from October 2009 to November 2010 – a total of 1.75 percentage points, from 3% to 4.75%.

What are the implications of today’s decision?

CommSec doesn’t expect any change in the cash rate for the foreseeable future. Inflation is under control but the major uncertainty relates to the “pass-through” of the lower exchange rate in lifting prices of imported goods. So far, retailers have been reluctant to pass on higher prices to consumers. The economy is well supported by record building approvals which are serving to lift many boats across the country.

With interest rates poised to stay low or potentially move even lower, investors will need to remain pro-active in embracing the best deals on online bank accounts. Borrowers also need to be on guard as fixed-term rates could edge higher in coming months as the US Federal Reserve seeks to ‘normalise’ interest rates.

Craig James is the chief economist at CommSec.