RBA chilling out for Christmas: HSBC's Paul Bloxham

GUEST OBSERVER

The RBA is clearly set to remain on hold next week. This was made clear in a recent speech by Governor Stevens, when, rather unusually, he gave fairly clear guidance on the near-term outlook for rates.

When asked about whether he was ‘still content with a 2.00% cash rate’ or whether the central bank was ‘going to surprise us all again next February’, he said that, “February is three months away, we’ve got Christmas, we should just chill out… come back… and see what the data says.”

December is seemingly not even in consideration.

So if December is out: what about February?

One thing is clear: the RBA does not want to cut further. Otherwise, it would have done so already. Inflation is low and the central bank is forecasting it to stay low over coming quarters. At the same time, the RBA is forecasting growth to remain below trend until late 2016 and the unemployment rate to stay high over the next two years. The RBA is clearly patient and has set a high bar for delivering any further stimulus.

Between now and February there is also a large number of significant local and global events. Local Q3 GDP data arrive next week and are expected to be on the stronger side. Local jobs numbers come after that and will be worth watching, given the surprisingly strong October result. The Fed’s meeting in mid-December will be important, particularly its implications for the AUD: if the Fed hikes, but delivers a dovish message, the AUD may not fall as many are hoping. At the same time, commodity prices have fallen in recent weeks, as the Chinese slowdown has continued. Finally, the next local CPI print, due on 27 January 2016, will be critical.

We remain optimistic about local growth, but pessimistic about the global inflation outlook. Given low inflation, our central case has the RBA delivering another cut early next year, but there is significant uncertainty, given the large collection of events between now and then, and the RBA’s considerable reluctance about considering the prospect of further cuts.

Growth is lifting, as the rebalancing act continues

Timely indicators of economic conditions continue to suggest that Australia’s growth is lifting.

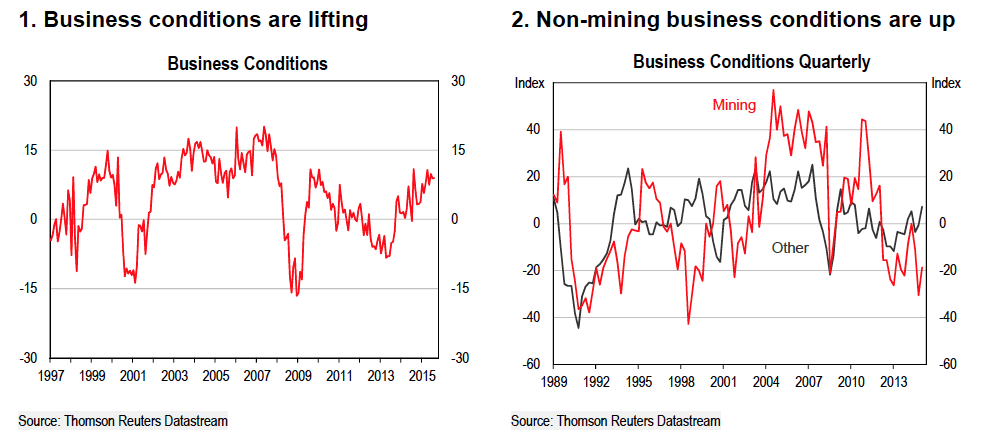

The NAB business survey, which the RBA has put significant focus on recently in its commentary, shows that business conditions are at around five-year highs (Chart 1). The NAB survey has also shown a further pick-up in capacity utilisation, although business confidence ticked down recently and remains below average. The improvement in business conditions has been led by the services sectors, as growth rebalances away from mining (Chart 2).

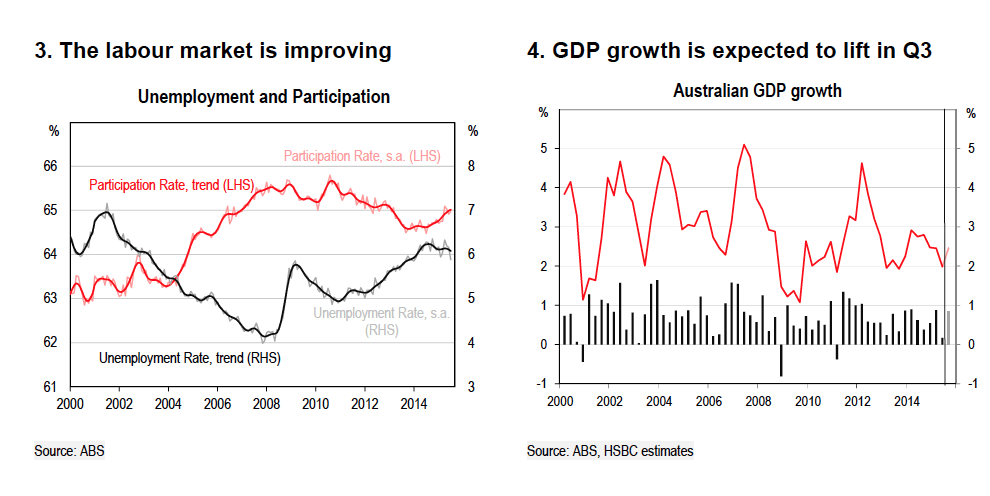

Jobs growth is also being driven by services sector employment. The recent lift in jobs growth has seen the unemployment rate tick down to 5.9%, which is its lowest level since April 2014

(Chart 3). Although the official labour market numbers have been subject to significant measurement issues recently, the collection of labour market indicators suggests gradual improvement in labour market conditions. Job advertisements, job vacancies, internet vacancies and the business surveys have also shown a gradual trend improvement in recent months.

Q3 GDP, which is due to be published next week (2 December), is expected to show a solid lift in the quarter, following the weak print in Q2 (Chart 4). A key support for growth is expected to come from net exports, with preliminary numbers showing a strong rise in exports and falling imports. Resources exports are ramping up as new capacity comes on line and coal exports rebound after weather-related disruptions in Q2. Domestic demand is expected to be modest with solid growth in household consumption and housing construction more than offsetting the effect of a sharp fall in mining investment.

Inflation is low and expected to stay there for some time

Although growth is picking up, inflation is low. This partly reflects that growth has been below trend for the past three years and the unemployment rate remains at a level that is well above full employment (around 5-5.25%). This has dampened wages growth and kept domestic price pressures at bay.

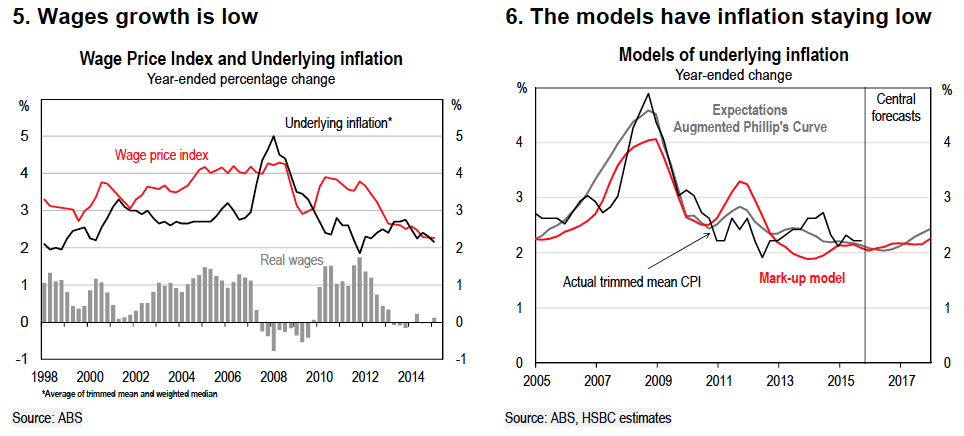

This month brought the wage price index, which showed that wages growth remains at its slowest pace in at least 18 years (Chart 5). The wage price index showed growth of 2.3% y-o-y in Q3, unchanged from Q2. However, growth in the private sector wage price index fell to a new record low of 2.1% y-o-y. Real wages have been broadly flat for the past two years.

Low wages growth is contributing to low inflation, with the underlying measures of inflation having surprised on the downside in Q3. Underlying inflation was running at 2.2% y-o-y in the Q3, which is near the bottom edge of the RBA’s 2-3% target band. Our own modelling, which is based on the RBA’s own work-horse models and using similar assumptions to the central bank, show that underlying inflation is expected to skirt the bottom edge of the target band over coming quarters (Chart 6).

Considerable reluctance to cut

With growth running below its trend pace, the unemployment rate still well above its full employment level and underlying inflation at the lower edge of the target band, the RBA has scope to cut interest rates further, if it deems that this is needed. As Governor Stevens pointed out in a recent key speech, the RBA is “more than content to lower [the cash rate] if that actually helps”. At the same time, given the recent lift in business conditions and improving labour market, the RBA appears to have considerable reluctance to cut further. Part of this reflects that monetary policy is clearly doing what it is supposed to do and the RBA clearly sees the costs of a further cut outweighing the benefits at this stage.

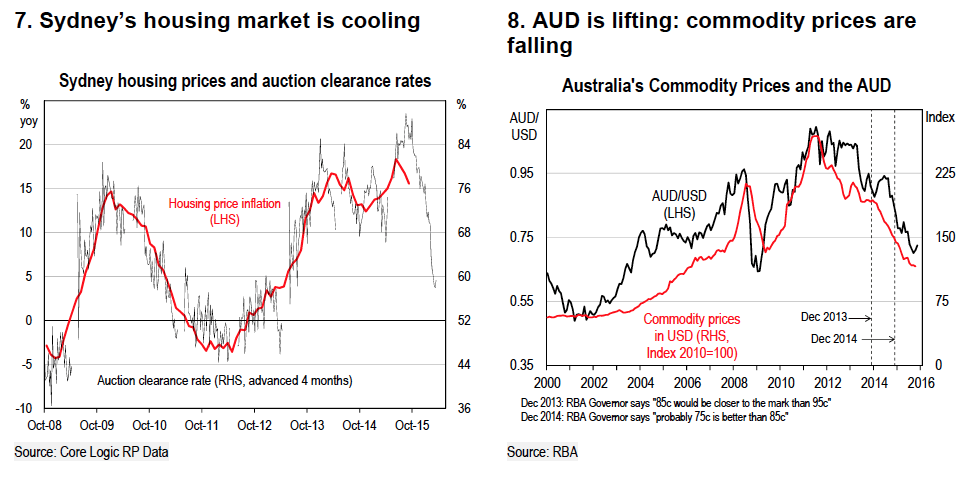

One of these costs is financial stability. The central bank’s recent financial stability review suggested that the RBA remains concerned about potentially over-inflating the Sydney and

Melbourne housing markets, which have both seen significant housing price growth in recent years. The RBA has also recently expressed concerns about potential over-building in the housing and commercial property markets in some cities. Notably, there are signs that the housing market is cooling, particularly in Sydney, which may reduce the RBA’s concerns about financial stability issues over time (Chart 7).

The RBA’s reluctance to cut further may also reflect timing and uncertainty. The RBA’s recent official statement emphasised a large number of risks at the current juncture.

One risk is what path the Fed might take in coming months and what that could mean for the AUD. The chances of Fed ‘lift-off’ this year have risen in recent weeks, particularly following the strong payrolls numbers for October. Although this could put some downward pressure on the AUD, much depends on the Fed’s subsequent path for rates. If the AUD falls noticeably from here, this could help to lift inflation faster, which could help the RBA hit its target. However, if the Fed’s commentary is more dovish the AUD could rise, putting further downward pressure on already low Australian inflation.

Another risk is what the slowdown in China will mean for commodity prices. The iron ore price has recently fallen to a 10-year low of around USD45 per tonne. The RBA has been content with the level of the AUD recently, partly because it had fallen in line with commodity prices and partly because there are clear signs that the lower AUD is lifting growth (Chart 8). If commodity prices were to fall further and the AUD rose, this could squeeze local income and become a concern for the RBA.

Importantly, we also get a swathe of local data for Australia before February. Next week we get Q3 GDP, which we expect to show solid growth (0.8% q-o-q and 2.5% y-o-y). The following week we get official labour market numbers for November, which will be of particular interest, given the strong result in October. Another critical piece of information ahead of the February RBA meeting will be Q4 CPI print, which is due on 27 January 2016. A low CPI print could encourage the RBA to cut further, although the central bank’s own forecasts already anticipate underlying inflation of 2.0% y-o-y, so it would take a weak result to surprise the RBA to the downside.

PAUL BLOXHAM IS CHIEF ECONOMIST (AUSTRALIA AND NEW ZEALAND) FOR HSBC.