RBA's contentment with neutral stance maintained: CommSec's Craig James

GUEST OBSERVER

The cash rate has been left at a record low of 2% for a fifth month (six months of rates at 2%). The Reserve Bank has left the accompanying statement the same – almost word-for-word.

The Aussie dollar rose by a third of a cent as investors gave up on hopes for a rate cut in the future. What does it all mean?

In outlining where the Reserve Bank stands on interest rate settings, the Governor recently told the House of Representatives Economics Committee, "I think we are pretty content where we are right now.” And little more needs to be said.

The key question now, is what will be the next move on rates? It is clear to us that the economy is picking up momentum but there are still challenges ahead, so interest rates should remain on hold. But there is certainly no case for rate cuts.

Consider:

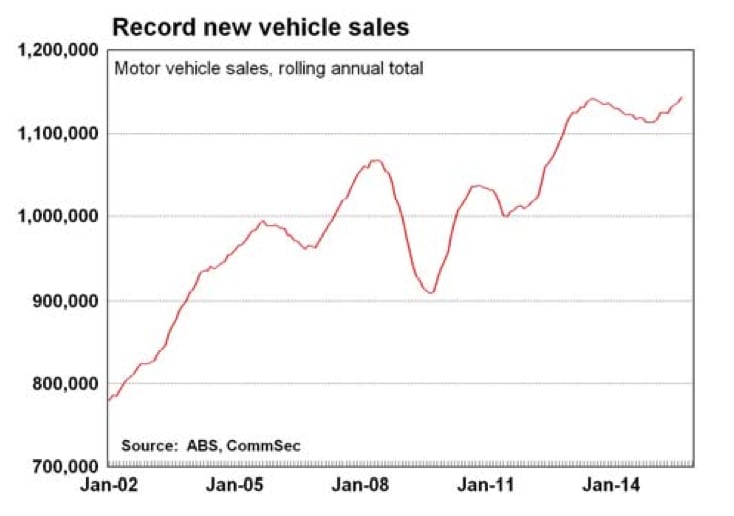

Car sales are at record highs

Building approvals are at record highs

Job ads have lifted for 14 of the last 16 months

Employment has posted the biggest 6-month gain in 41⁄2 years

Manufacturing & services sectors are expanding

The Aussie dollar has fallen around US17 cents over the past year

The only real changes to the text of the statement. In September: “Equity markets have been considerably more volatile of late, associated with developments in China, though other financial markets have been relatively stable”. In October: “Equity market volatility has continued, but the functioning of financial markets generally has not, to date, been impaired.”

Also, in September: “The Bank is working with other regulators to assess and contain risks that may arise from the housing market.” In October: “Regulatory measures are helping to contain risks that may arise from the housing market.”

The only other change: the Reserve Bank noted “Dwelling prices continue to rise strongly in Sydney and Melbourne...” In September it only referred to prices in Sydney.

Bottom line is that there has been no change to the neutral policy stance – a stance that suggests that the next move in rates could be either up or down.

Craig James is the chief economist at CommSec.