Melbourne gets added to the strong as October RBA issues a carbon copy of last month’s statement: Gareth Aird

GUEST OBSERVER

Today’s decision to leave the cash rate unchanged came as no surprise to either economists or market participants. As such, the focus was on the Governor’s accompanying Statement which turned out to be basically a carbon copy of last month’s wtatement.

With concerns around the outlook in China weighing on global markets we thought that the Statement might contain something new on China, but the Governor simply repeated last month’s comment that there has been, “some further softening in conditions in China and east Asia of late”.

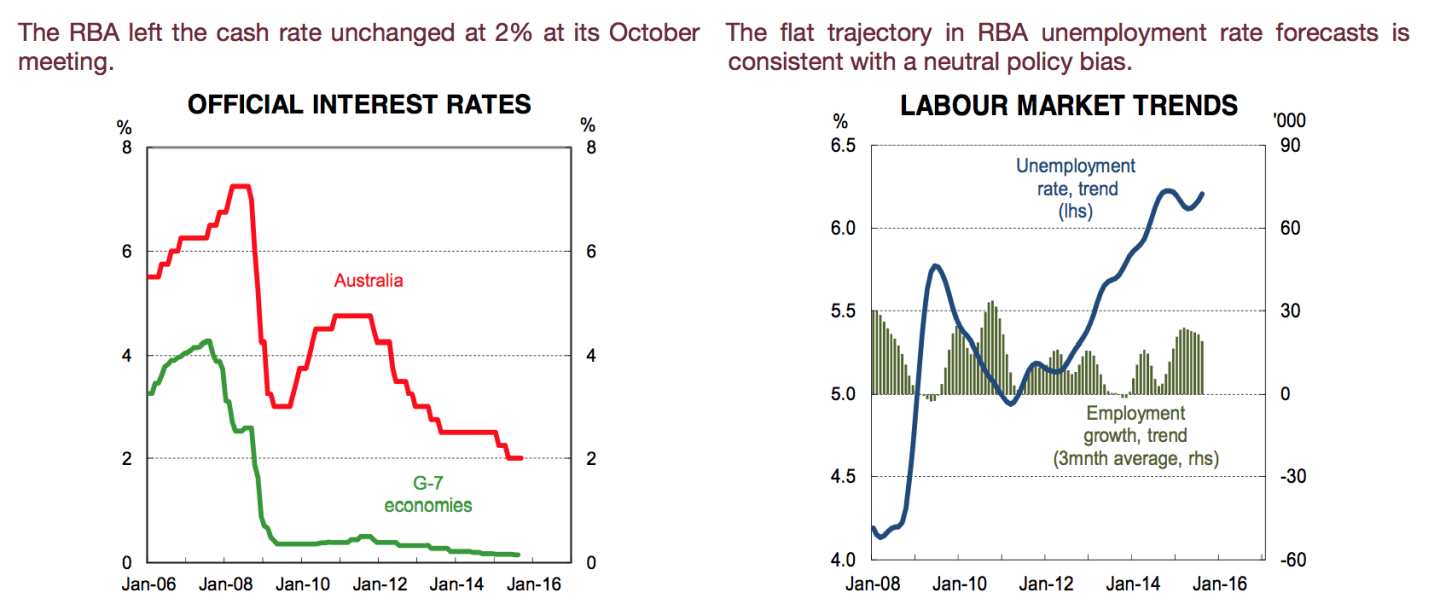

The Governor’s comments on the Australian labour market are unchanged which means that their forecasts for a flat unemployment rate over the next year remain intact.

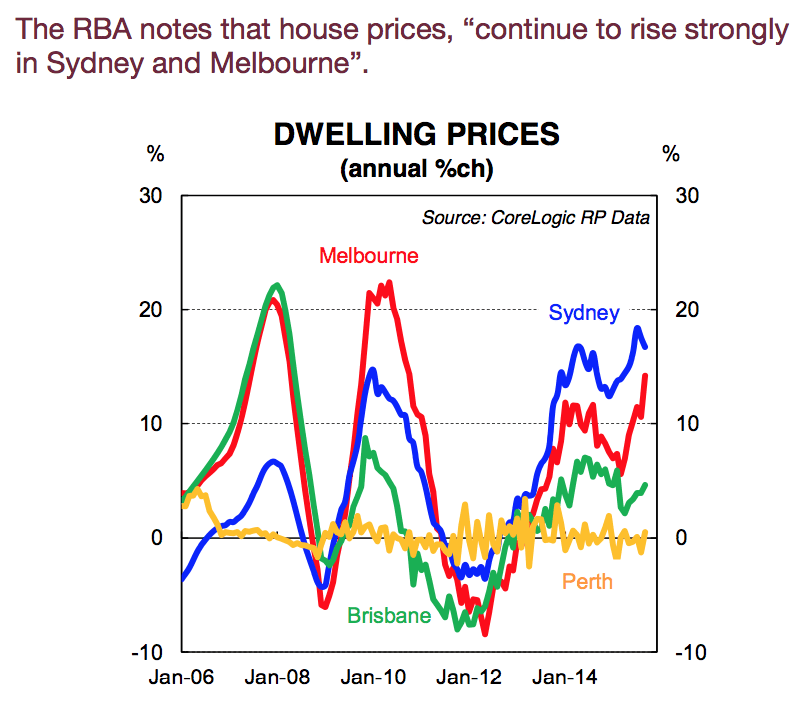

There were only two material changes from last month’s statement. The Governor notes that dwelling prices “continue to rise strongly in Sydney and Melbourne” (last month only Sydney was cited). And Steven’s stated that “the available information suggest that moderate expansion in the economy continues” (last month he stated that “most of the available information.....”)

The Governor again refrained from making any comments around the AUD needing to move lower. In our view, the AUD is currently trading in the RBA’s ‘comfort zone’. It’s has fallen enough to help the Australian economy rebalance without posing a risk to the near term inflation outlook. We see the AUD falling further over the next few months.

The outlook

Markets are assigning a 50% probability that the RBA eases policy again in 2015 (a 29% chance of a November rate cut is priced). In our view, the case to leave rates unchanged is stronger than the case for a near term rate cut so we have the RBA on hold at 2.0%. The forward looking indicators of the labour market are consistent with a flat unemployment while the lower AUD is helping the economy to rebalance. The RBA would need to downgrade their growth forecasts in the November Statement on Monetary Policy to justify a rate cut and in our view that looks unlikely.

The focus for RBA enthusiasts turns to a run of speeches by RBA officials (Assistant Gov. Debelle [7 Oct.], Head of Economic Research Simon [8 October] and Deputy Gov. Lowe [13 Oct]. On the data front, QIII inflation data towards the end of the month and the jobs report next week are the most important pieces of economic information ahead of the November meeting. A decent employment report next week would probably see market pricing for a November rate cut recede. But a poor print and a low CPI outcome would mean that the November meeting would be seen as ‘live’.

Gareth Aird is economist at Commonwealth Bank and can be contacted here.