Sydney property investors the key to the three big issues for the RBA: Paul Bloxham

Paul Bloxham, the chief economist, Australia and New Zealand at the HSBC Bank Australia Limited, sees three key issues for the RBA.

- Low rates are supporting a house price and construction boom, but could also risk inflating a housing bubble

- The prudential regulator has already been working to tighten lending standards and the RBA has been ‘jawboning’ to temper conditions in the housing market

- Tighter lending standards or so-called ‘macro-prudential’ tools could see the RBA willing to leave rates low for longer

Bloxham argues that after a long period in which Australia was building mines and too few houses, there was now a strong pipeline of housing construction. But he suggests these forces are "slowly" permeating the rest of the economy, with broader business conditions lifting modestly.

"Overall demand has been sufficient to keep inflation at around its target (the CPI print showed underlying inflation at 2.6% year on year in Q3) and to see the unemployment rate showing signs of stabilising.

"As yet, though, demand has not been strong enough to lift inflation or to drive the unemployment rate lower, which would be needed to see the RBA start to lift rates back towards neutral.

"But low interest rates also carry some costs.

"The longer interest rates stay at very low levels, the greater the chance that some asset prices could become misaligned with fundamentals.

"This is clearest in the housing market.

"Although national housing price growth of 10% a year should not be unexpected for now, persistent double-digit growth would be a worry and 15% annual price growth in Sydney is already concerning."

Source: HSBC Global Research

He says the so-called ‘macro-prudential’ tools, to try to further manage the housing boom, would be incremental, rather than revolutionary, and more akin to adjustments to current prudential tools than a ‘macro-prudential’ overhaul.

Trends in the Sydney property market were particularly concerning, according to Bloxham noting housing prices continuing to rise at around 15% over the past year.

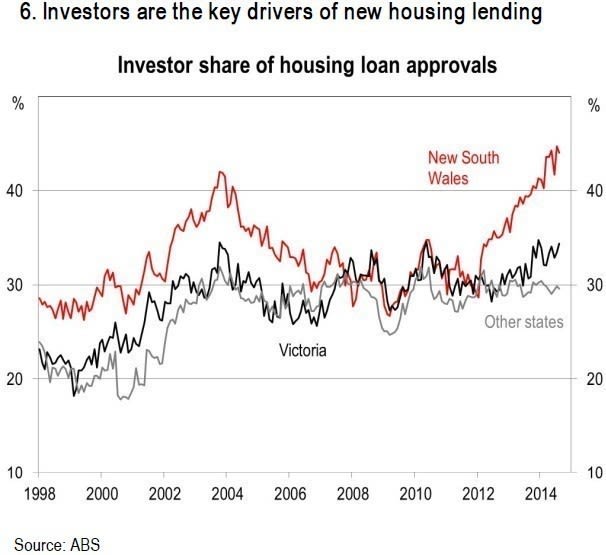

"A key part of the concern is that the pick-up in housing prices is being increasingly driven by investors.

"Investors account for an increasing share of housing loan approvals and are particularly prominent in the Sydney market, where the investor share of loans is at a new record high of 44%.

"Although the RBA does not seem concerned about the riskiness of investor borrowing per se, they are concerned that the rise in investor interest is a signal that a speculative element has started to drive the housing market.

"The RBA still sees the risks to financial stability from current trends as low, given that investors tend to be higher-income households with larger mortgage deposits.

"But increased investor involvement could lead to a larger rise in housing prices, which could see a bigger fall some time down the track, exacerbating the economic cycle."