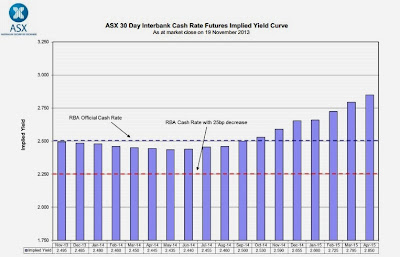

It's going to be a low interest rates 2014, but will the RBA cut rates further?

While fixed interest rates seem to have at last passed their nadir, the market still can't quite seem to get its head around the next movement in interest rates being up.

The implied yield curve at close of business this Tuesday was pretty much there, yet still suggested that on balance the cash rate may well be staying somewhere close to exactly where it is throughout the next calendar year.

Source: ASX

whether or not the next move does prove to be an upwards adjustment, we are perhaps unlikely to see the first hike until the uptrend in unemployment is broken, however long that takes. Having spent too much of the last decade preparing ABS figures, one thing that I can warn you to expect from employment data is volatility, but we are hoping to see improving jobs data in 2014.

More cuts?

Views differ a little on the outlook for interest rates. NAB believes that there will be a cut in the official cash rate (OCR) to 2.25% in the middle of next year, while Westpac believes that the OCR will be cut twice in 2014 to just 2.00%.

What gives? The short answer is that falling mining investment is likely to represent a headwind for economic growth, and thus the Reserve Bank (RBA) may need to cut rates in order to stimulate. The expected level of total capital expenditure according to the ABS is now beginning to slide and is forecast to fall further as we head in 2014/15 after a booming decade.

Source: ABS

The RBA forecasts below-trend economic growth next year before stimulatory interest rates beginning to push GDP upwards into 2015.

Delayed effect

Interest rates tend to have a delayed impact on spending patterns. There are the first signs that the mortgage affordability dividend delivered by interest rate cuts totalling a non-trivial 225bps over the past two years are resulting in increasing consumer spending.

The major concern for many is that low interest rates will also result in resurgent housing markets. Interestingly, in 2011 there were a spate of blunt news articles stating in no uncertain terms that dwelling prices would not be turned upwards by lower borrowing rates.

The effects of an altered monetary policy stance are not evident overnight. Interest rates take time to impact levels of business and construction activity (anyone who is in inner Sydney, must surely by now be aware of the increased levels of construction activity), and they take time to impact housing market sentiment too. Some easing cycles, of course, will have more impact than others.

By the time 2013 is out dwelling prices across Australia may have appreciated by ~10% for the calendar year, with the usual varying fortunes between cities and states. Here is how the RBA is seeing dwelling prices across Australia in its latest chart pack, the data of which runs to 31 October.

The evidence suggests that the housing market in Sydney is in the middle of a strong upswing, after a sloppy few years post-2003. Other markets such as Brisbane and Adelaide (and possibly Hobart) are only just beginning to respond in any meaningful manner to low interest rates by moving upwards.

For months now there has been a lot of sifting through the RBA tea-leaves in order to find supposed references - coded or otherwise - to a housing market intervention. I'm not seeing it, but if you have your proverbial magnifying glass to hand, you can do your own sleuth work, for here is what the latest RBA minutes of monetary policy had to say on the matter:"Members noted that conditions in the housing market continued to strengthen. Nationally, dwelling prices were above their late 2010 peak, with prices over the three months to October increasing significantly in Sydney.

Housing turnover and loan approvals had picked up noticeably. Improved conditions in the established housing market were providing an impetus to dwelling investment, with residential building approvals increasing over the year.

Approvals increased notably in September, driven by a pick-up in high-density approvals, which tend to be quite volatile from one month to the next. In discussion, members observed that developments in the established housing market and the increase in new dwelling activity seen to date were among the expected effects of the low level of interest rates."

Macroprudential measures?

The RBA has duly noted the price action in Sydney but the use of turns of phrase such as "expected effects" doesn't suggest a particularly excited board to me, rather a watchful one. Note that were macroprudential measures to be introduced in Australia, they would spawned via the Australian Prudential Regulation Authority - more commonly known as APRA - rather than the Reserve Bank.

APRA is the agency which retains the power to act to change the behaviour and balance sheets of entities in order to achieve macroprudential outcomes. APRA will have noted that more than 38% of housing loan approvals in the June 2013 quarter were for interest only products. This suggests a high level of speculative investor activity and will be one point of concern.

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' was released on 1 September 2013.