Slowly but surely low interest rates are starting to work

Since 2011, we've heard a lot of opinions which suggest that "low interest rates don't work any more" and such like. However, slowly but surely low interest rates are indeed starting to work as these three charts from RP Data show.

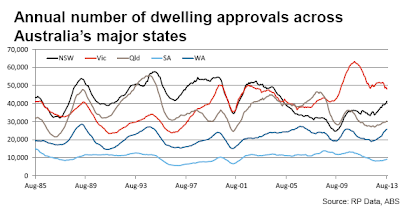

It's certainly been a slow burn but gradually dwellings are being approved and constructed, with total approvals now moving 1.9% above the 20 year average according to RP Data.

Low interest rates necessarily take time to work, and this is particularly the case when it comes to dwelling construction as new projects can take many years to make it through the approval and financing stages.

Source: RP Data

I've said to a few people of late that if anyone truly and honestly believes that dwelling construction is not happening in Sydney then they should pop around to my place for a cuppa on a Saturday morning and listen to the awesome racket going on outside.

A huge amount of building is underway around inner Sydney with many thousands of new apartments due to come online over the next five years, particularly around the CBD and the inner south (where an apartment boom sees some 25,000 units planned for the next five years).

I can see the upturn with my own eyes, but you can also see it in the NSW line on the chart below with the number of dwelling approvals increasing dramatically over the past four years.

Source: RP Data

Only Victoria has a chart which is moving in a downwards direction, but this is to be expected after a huge spike in approvals after the financial crisis 'emergency low' interest rates which led to something of an oversupply of certain types of stock on the market in that state.

The monthly figures are volatile but year on year the trend is clearly up, particularly in NSW (+22.6%), Queenesland (+12.2%) and Western Australia (+31.8%). In Victoria, approvals slipped by 3% while South Australia saw a moderate upturn (+9.6%).

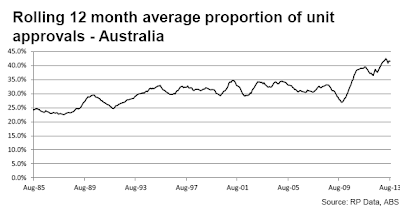

Note that the new building in Australia will be heavily focussed upon units and medium-density dwellings as opposed to detached houses, with 41.6% of approvals for that type of property (2012: 33.2%).

This trend is to be expected with our denser cities today and demographic shift towards living close to the CBD in medium-density dwellings.

Household sizes are also smaller today than in decades past, and while there will remain a high demand for well-located detached housing, the higher cost of city land will ensure that most new builds in the future will be unit stock.

Source: RP Data

The Reserve Bank of Australia (RBA) will be happy with the unfolding trends as mining construction capital expenditure looks set to drop off through 2014 and beyond.

The RBA hopes that the inevitable fall in mining capex will be offset by an increase in dwelling construction. The charts above show that we are slowly but surely moving in the right direction.

Clearly the Sydney housing markets have been firing for some time with price growth close to 13% in 2013 alone.

But now there are some signs of life in Brisbane too, which has been expected given the reports from those 'on the ground' in Queensland. Dwelling prices in Brisbane are reported as being up by 1.84% quarter on quarter.

Not sure what happened in Melbourne yesterday - prices recorded as being up by more than $2,000 in 24 hours...?!

RP Data has Perth seeming to have slowed a little after a strong uplift in prices.

The slowest growth of the major capital cities has been in Adelaide where prices are up by 1.55% year on year, which is a slower rate of growth than the national inflation rate.

Source: RP Data

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' is out now.