RBA keeps rates on hold at October meeting

The RBA have resisted a cut to the official cash rate at their October meeting today, with the budget announcement tonight expected to have kept the RBA waiting.

They noted in their meeting statement that they are still considering how additional monetary policy can support jobs.

CoreLogic's head of residential research Tim Lawless says the focus will now be on whether the stimulus measurers announced in the budget tonight are enough to offset the tapering of JobKeeper and the effect of higher mortgage arrears as home loan repayment deferrals become less prevalent.

"Such a low setting for interest rates, along with policies aimed at ensuring liquidity across financial markets, has been a key factor in supporting housing market activity and insulating home values", Lawless said.

"With the cash rate and mortgage rates set to remain low or reduce even further, prospective home buyers are likely to feel more confident in making high commitment purchasing decisions, such as property.

"Government incentives, such as the first home loan deposit guarantee, the first home buyers grant and the HomeBuilder grant, along with state based incentives such as stamp duty discounts, have supported greater levels of participation from first home buyers, while existing mortgage holders have been shopping around for the best mortgage rates fuelling a surge in refinancing

Mortgage Choice chief executive Susan Mitchell said it was unlikely to board would cut today despite hinting at a cut.

“Board members will wait to digest the Federal Budget announcement before making their next move," Mitchell said.

CreditorWatch economist Harley Dale says the RBA will likely reduce the cash rate in due course.

“Tonight, it is the turn of the Federal Government to set out a clear agenda for recovery in what is the most important fiscal update in close to a century.”

Graham Cooke, insights manager at Finder, said that a standalone cut of 15 basis points is unlikely to have much of an impact on Australia’s economy.

“The cash rate has fallen by 125 basis points over the last year and a half– 15 more is unlikely to make much of a difference beyond making the RBA feel like they are at least doing something.

“The decision to hold the rate for now also suggests that the RBA wants to assess the budget in detail before making a decision about further moves,” he said.

A good time to buy?

Two thirds of experts in the Finder survey say now is a good time to buy property.

Some 86 per cent of respondents said the housing market is showing more resilience than anticipated, with one of Commonwealth Bank's worst case scenario's tipping more than 30 per cent falls.

Rebecca Cassells of Bankwest Curtin Economics Centre said that government stimulus measures during the pandemic have largely propped up the property market.

“The current resilience of the housing market is related to the stimulus that both federal and state governments are directing to the sector and not necessarily driven by current economic conditions,” Cassells said.

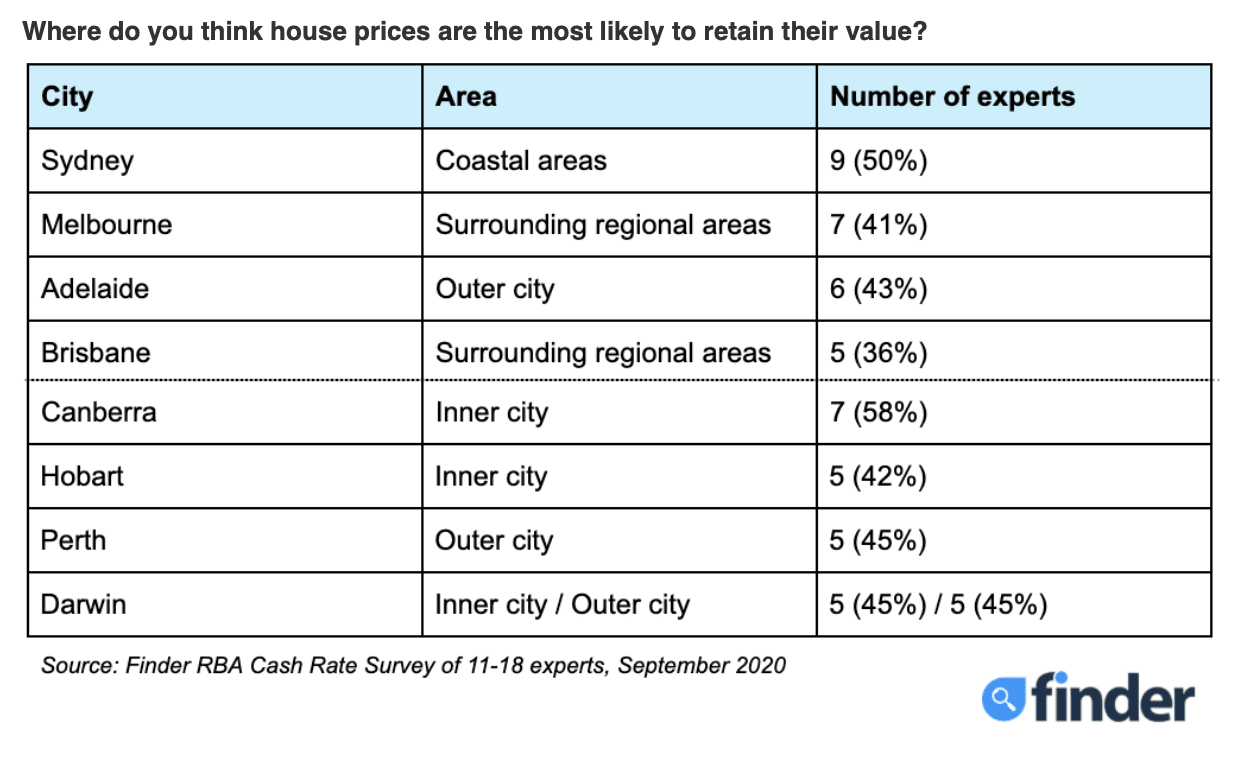

When asked about the areas where house prices are most likely to retain their value, those who weighed in cited the coastal surrounds of Sydney (50%, 9/18), followed by Greater Melbourne (41%, 7/17).