Australian Economy remains far from Philip Lowe's 'Nirvana': CommSec's Craig James

EXPERT OBSERVER

In trend terms, the Internet Vacancy Index decreased by 0.1 per cent in August. The index is 6 per cent lower than a year ago, but it is 9.4 per cent above the level recorded five years ago.

As widely expected, the RBNZ has left the official cash rate unchanged at a record low of 1.00 per cent at its meeting today

Governor Lowe delivered a speech titled “Economic Update.”

The internet job vacancies data is a leading indicator of the job market and therefore important for consumer-focussed stocks and companies. Speeches from the Reserve Bank Governor can provide guidance on interest rate settings. Changes in New Zealand monetary policy settings can affect rates in Australia as well as the sharemarket and currency.

What does it all mean?

The Reserve Bank Governor wouldn’t be drawn on the timing of the next rate cut. The rate cut may well be delivered on Tuesday. But if the Bank believes that the economy is indeed turning higher (it has reached a ‘gentle turning point’), the Bank may end up deciding that rate stability is the best source of action in the current environment.

The Governor adopted his usual ‘glass half-full’ approach rather than ‘glass half-empty’. In fact Philip Lowe believes we have a tendency to focus on what could go wrong rather than focus on the ‘tremendous opportunities’. The main concern is that consumers are not spending like they have in the past. And the other area of worry is the fact that investors are choosing to sit on the sidelines. There are plenty of savings but investors are not tapping those funds and investing.

No surprises from Reserve Bank New Zealand. The easing bias still exists. But clearly the ‘jumbo’ or ‘super-sized’ rate cut in August provided the Bank with more time before deciding the next move. Commonwealth Bank Group economists expect the next rate cut in November.

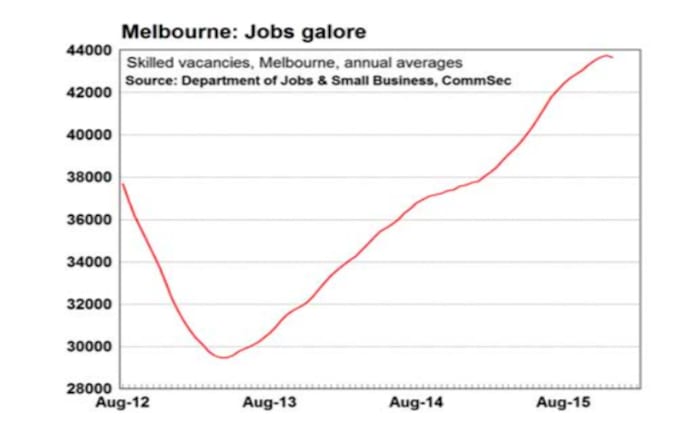

It’s steady as you go on job vacancies. There was little change in vacancies in the past month but the loss of momentum in Sydney and Melbourne gives the Reserve Bank additional scope to cut rates next week. Construction job vacancies continue to ease, reflecting slower home construction. But significant job vacancies continue to exist in Health, Education and personal/community services.

What do the figures show?

Click here to enlarge:

Skilled Job Vacancies

The Department of Employment Internet Vacancy Index fell by 0.1 per cent in August. The index is 6 per cent lower than a year ago although it is up 9.4 per cent above the level recorded five years ago.

In August 2019: “Job advertisements decreased in four of the eight occupational groups, and remained steady in two. Job advertisements increased for Labourers as well as Community and Personal Service Workers (both up 0.4 per cent).”

Over the year to August 2019: “Job advertisements fell in six of the eight occupational groups, with the strongest falls recorded for Machinery Operators and Drivers (down by 16 per cent), Sales Workers (down by 12 per cent) and Technicians and Trades Workers (down by 10.7 per cent). Increases were recorded for Community and Personal Service Workers (up by 5.2 per cent) and Professionals (up by 0.3 per cent).

Over the year to August 2019, 12 of the 48 detailed occupational groups recorded increases in job advertisements. “The largest increases were recorded for a range of education and health related occupations such as Education Professionals (up by 1270 job advertisements), followed by Health Diagnostic and Therapy Professionals (570), Medical Practitioners and Nurses (500) and Carers and Aides (480).”

“The largest decrease was recorded for General-Inquiry Clerks, Call Centre Workers, and Receptionists (down by 1220 job advertisements), followed by Sales Assistants and Salespersons (1060), Corporate Managers (1010), Construction, Production and Distribution Managers (860) and Engineering, ICT and Science Technicians (840).”

Job vacancies increased in four states and two territories in August: NSW (down 0.7 per cent), Victoria (down 0.2 per cent); Queensland (up 0.2 per cent); South Australia (up 0.6 per cent); Western Australia (up 0.7 per cent); Tasmania (up 1.1 per cent); Northern Territory (up 0.6 per cent); and ACT (up 0.9 per cent).

Over the year to August 2019, job vacancies rose in three states and one territory: NSW (down 12.1 per cent), Victoria (down 7.4 per cent); Queensland (down 2.5 per cent); South Australia (up 3.0 per cent); Western Australia (up 1.6 per cent); Tasmania (up 11.3 per cent); Northern Territory (down 4.3 per cent); and ACT (up 11.9 per cent).

Over the year to August 2019, in three month moving average terms, job advertisements decreased in 19 of 37 regions. “The strongest decreases in job advertisements were recorded in Sydney (down by 15.4 per cent), followed by Gosford & Central Coast NSW (down 11.2 per cent), NSW North Coast (down 10.9 per cent), Melbourne (down 9.4 per cent) and Gold Coast (down 8.3 per cent).”

“The strongest increases were recorded in Port Augusta & Eyre Peninsula, SA (up 32.5 per cent), Yorke Peninsula & Clare Valley, SA (up 30.2 per cent), Fleurieu Peninsula & Murray Mallee, SA (up 18.9 per cent), Hobart & Southeast Tasmania (up 15.6 per cent) and South West WA (up 15.3 per cent).”

Reserve Bank Governor Speech

The speech can be found here: https://www.rba.gov.au/speeches/2019/sp-gov-2019-09-24.html

Interest rates: “Further monetary easing may well be required. While we are at a gentle turning point and expect growth to pick up, the strength and durability of this pick-up remains to be seen.”

Interest rates: “At our Board meeting next week, we will again take stock of the evidence. It is nevertheless likely that an extended period of low interest rates will be required in Australia to make progress in reducing unemployment and achieving more assured progress towards the inflation target. The Board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, make further progress towards full employment, and achieve the inflation target over time.”

In the Question & Answer segment, the Governor said that ‘nirvana’ would be inflation near 2.5 per cent, wage growth near 3.5 per cent, the job market at ‘full employment’ (near 4.5 per cent) and the economy displaying ‘decent’ productivity growth.

Reserve Bank of New Zealand interest rate decision

Click here to enlarge:

Click here to enlarge:

RBNZ has held the official cash rate at a record low of 1.00 per cent at its meeting today, as widely anticipated by economists.

The Monetary Policy Committee “agreed that new information since the August Monetary Policy Statement did not warrant a significant change to the monetary policy outlook.”

On jobs and inflation: “Keeping the OCR at low levels is needed to ensure inflation increases to the mid-point of the target range, and employment remains around its maximum sustainable level.”

On the outlook for monetary policy: “There remains scope for more fiscal and monetary stimulus, if necessary, to support the economy and maintain our inflation and employment objectives.”

Commonwealth Bank Group economists expect another 25 basis point rate cut in November.

What is the importance of the economic data?

The Department of Employment releases a monthly Internet Vacancy Index. The index is based on a count of online job advertisements newly lodged on three main job boards (SEEK, CareerOne and Australian JobSearch) during the month. The index is the only publicly available source of detailed data for online vacancies, including around 350 occupations (at all skill levels), as well as for all states/territories and 37 regions.

Reserve Bank Governor speeches give a guide to policymaker thinking on interest rate settings.

What are the implications for interest rates and investors?

Financial markets believe that rates will be cut next Tuesday. But whether its Tuesday or a month or two later, the Reserve Bank Governor believes that is reasonable to assume that further rate cuts lie ahead given that inflation is below the 2-3 per cent target band.

Lower interest rates will keep the Aussie dollar near US67-68 cents. And that lower Aussie dollar is good news for Australian businesses, especially exporters. Lower interest rates will also provide support for consumer-focussed stocks on the sharemarket.

The lack of momentum on job vacancies points to slower employment ahead and thus giving the Reserve Bank further reason to be cutting interest rates.

Click here to enlarge:

Click here to enlarge:

Ryan Felsman is a senior economist at CommSec

Craig James is the chief economist at CommSec.