Is Melbourne's property market finally running out of steam? Pete Wargent

Superficially, at least, more strong auction clearance rates last weekend.

Sydney's epic run continues with another clearance rate of 82.5%, but in truth, this was only from a small pool of auctions on Labour Day weekend.

That said, some auction results showed signs of a very hot market with reserve prices getting smashed.

Meanwhile in Melbourne, the REIV reported a preliminary auction clearance rate of 71% from 712 auctions.

Solid enough on the face of it.

However, with 80 "no results" reported in Melbourne, it's possible that this result gets revised down below the 70% barrier which is often regarded as the notional barrier for a 'strong' market.

RP Data also recorded a result of 71% from a larger pool of auctions.

A few observations:

1). It is far too early for anyone to tell whether market prices are actually softening - the diabolical track record of so many market forecasters bears ample testimony to that (I'm talking here about dwelling prices rather than the level of housing activity).

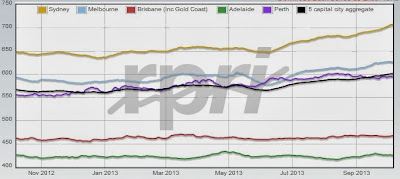

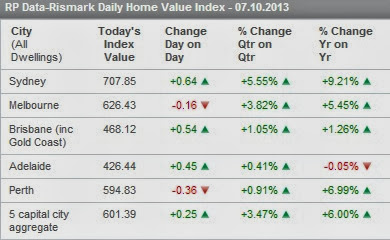

For what it's worth, RP Data shows the following in its daily home value index (see light blue line for Melbourne), which is a rip-roaring Sydney market and far more subdued activity elsewhere:

Source: RP Data

2). It would be no surprise if Melbourne finally did slow up after a confounding run since 2007;

3). In a market driven largely by speculation, news stories reporting a slowing market could at last kill momentum;

4). Melbourne's 'fundamentals' - such as reported vacancy rates - have been less strong than elsewhere, although there has been notably strong speculative activity to date in well-located established housing stock; and

5). Although it is common to refer to stronger dwelling prices as improvement is ultimately bad news for the Australian economy if dwelling prices outstrip household incomes for too long.

The RBA will be heartened that dwelling prices have firmed and shown a little growth to encourage development and construction, as well as a level of consumer confidence.

What we don't need is a return to very fast dwelling price growth while improvement in the rest of the economy lags.

Construction and manufacturing indices have shown heartening news for our economy of late, while retail sales may be in the process of recording a post-election bounce.

Sydney's property market appears to be the problem child. After underperforming since early 2004, the Sydney market is now very active and - with a new influx of Asian buyers - looks set to continue rising for some time to come.

Pete Wargent is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His new book 'Four Green Houses and a Red Hotel' was released on 1 September 2013.