Savings rates cut by NAB along with six other providers

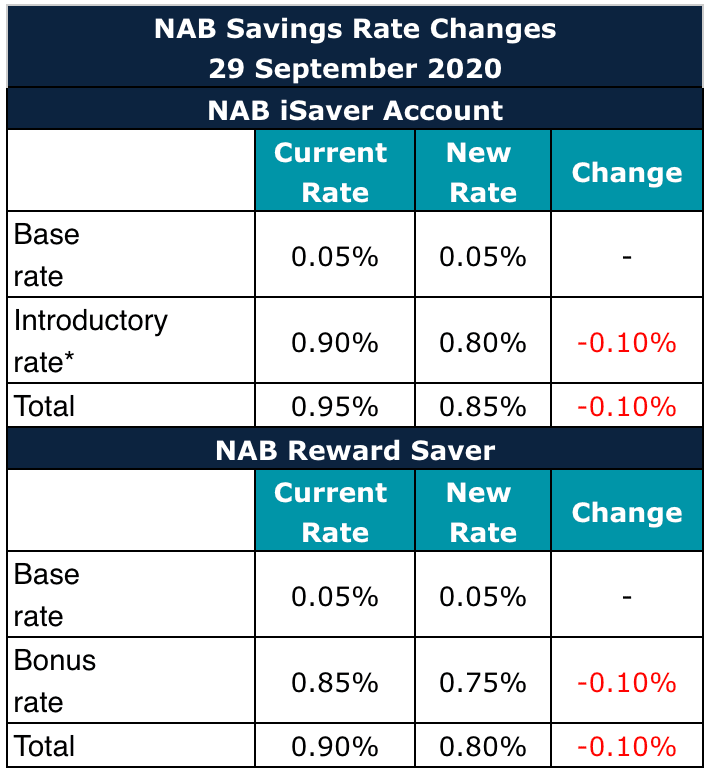

National Australia Bank has made cuts of -0.10 per cent to savings rates on Tuesday, becoming the seventh provider to cut savings rates over the last week.

Other providers who cut their savings rates include BOQ and ING, Canstar data reveals.

The bank also cut a number of term deposit rates by between -0.05 per cent and -0.15 per cent.

Canstar’s group executive Steve Mickenbecker noted that prices are down when it comes to saving rates.

“With the Reserve Bank supplementing bank fund raising with 0.25 per cent loans, banks are under less pressure to raise funds from savers”, he said.

“We have seen savings interest rates continue to slide through the pandemic.”

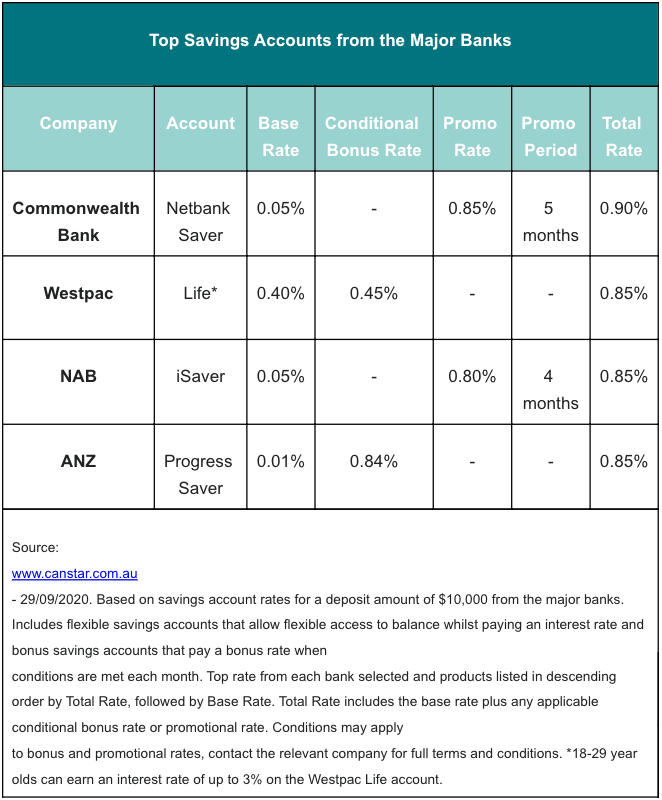

Canstar notes that savers have to actively manage their money or make do with modest remuneration.

“Savers have to micromanage their money by qualifying for bonus rates or switching savings accounts every few months to earn introductory rates, or settle for rates around 0.05 per cent.” Mickenbecker said.

He noted that these rates are likely an unanticipated consequence of the measure to fund businesses through the crisis.

The top saving rates from the major banks still sits with Westpac Life account.

Young adults, aged between 18 and 29, can earn an interest rate of up to 3 per cent.