Building approvals improve, house price growth eases: ANZ Research

GUEST OBSERVER

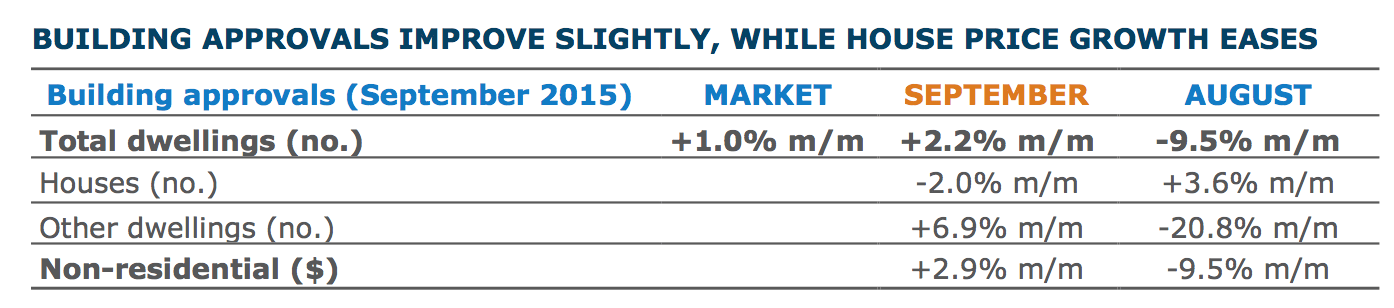

Building approvals rose slightly in September, but did not offset last month’s fall.

We continue to believe that the housing market is at or near a peak, and further growth from housing construction is looking increasingly unlikely.

Housing building approvals rose marginally in September, not offsetting the previous month’s decline, which was revised even further downward. Detached housing approvals fell slightly, meaning that activity has been unchanged for near two years. But the key swing variable, the higher-density segment, posted growth of 6.9% m/m (Figure 1).

This monthly growth in the higher-density segment was mixed across the states. Queensland rebounded sharply to a near-record level, while Victoria posted mild growth. On the other hand, New South Wales approvals fell heavily, and are now 60% lower than the peak of just two months ago, highlighting the volatility inherent in the data. Nonetheless, the national level of approvals continued to trend lower, consistent with our belief that although demand for new housing will remain solid, it will not return to the peak levels of earlier this year. This means that although construction activity will remain elevated, further growth, and further contribution to national output, will be increasingly hard to come by.

Meanwhile, the outlook remains weak in the non-residential segment. Approvals rose slightly in September, but remain low, hindered by ongoing softness in the office segment particularly. Accommodation-related approvals continue to trend higher, and now sit at record levels, likely supported by the lower AUD’s positive impact on the tourism sector (Figure 2).

Other data today showed house price growth weakening in Sydney, up just 0.3% in October (in seasonally adjusted terms). In turn, annual price growth eased back to 16%, from a peak of 20% in July. This marked slowdown is in line with falling auction clearance rates (Figure 3), reflecting lower housing market sentiment, especially amongst investors. Melbourne price growth remained more robust, outpacing Sydney for the past four months in seasonally adjusted terms. However, price growth is easing in Melbourne too, and has slowed over each of the past three months.

This waning enthusiasm for housing is at least partially driven by tighter regulation aimed at removing some of the heat from the housing market. APRA’s macro prudential measures (which have resulted in tighter borrowing conditions and higher interest rates) have resulted in a sharp slowdown in investor borrowing, as seen in last Friday’s credit data. This is expected to result in house price growth easing further over coming months, with Sydney and Melbourne growth rates to converge with other capital cities.

Cherelle Murphy is co-head of Australian economics, ANZ and Daniel Gradwell is economist. They can be contacted here.

Jonathan Chancellor

Jonathan Chancellor is one of Australia's most respected property journalists, having been at the top of the game since the early 1980s. Jonathan co-founded the property industry website Property Observer and has written for national and international publications.