Reserve Bank tips moderate growth, lower inflation: Craig James

GUEST OBSERVER

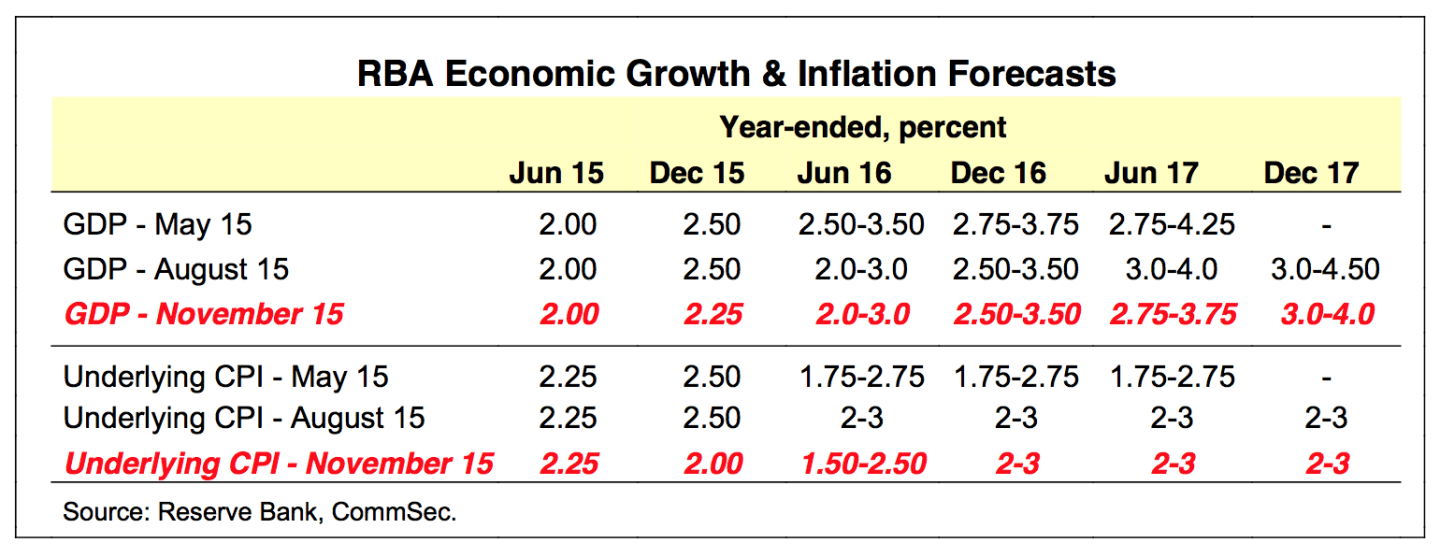

The Reserve Bank has not materially changed economic growth forecasts but trimmed short- term inflation forecasts.

Economic growth is seen at 2.0-3.0% in June 2016, unchanged from the previous forecast. But underlying inflation is now seen between 1.5-2.5% in June 2016, down from the earlier forecast of 2-3%.

What does it all mean?

The Reserve Bank intimated on Tuesday that the economic outlook was improving while at the same time noting inflation was lower than expected. Clearly that gives the Reserve Bank scope to cut rates, if it was needed. But the Reserve Bank is not giving any indication that it intends to act on that ‘easing bias’ any time soon.The Statement on Monetary largely fleshes out points noted in the monetary policy decision on Tuesday and Reserve Bank Governor’s speech on Thursday.

No doubt the Reserve Bank would like growth a little stronger than current levels, that way the jobless rate could come down. Still, moderate growth with low inflation and stable unemployment isn’t a bad combination either.

CommSec expects rates to stay low for the foreseeable future.

Economic outlook: “Overall, the forecasts for GDP are little changed from the August Statement. GDP growth has been revised down slightly towards the end of the forecast period to reflect updated forecasts for resource exports, which are still expected to make a substantial contribution to growth.”

“The forecast for growth in economic activity over the next two years is not materially different from what was presented in the previous Statement. GDP growth is expected to be between 2 and 3% over the year to June 2016, rising to 23⁄4–33⁄4% over the year to June 2017, which is around its long-run average.”

“While quarterly inflation outcomes can be volatile, the broad-based nature of the weakness in the September quarter suggests that inflationary pressures are a bit more subdued than earlier anticipated. As a result, the inflation forecasts are lower in the near term. Underlying inflation is now expected to be around 2 per cent over most of next year before picking up to be around 21⁄2 per cent. Inflation expectations remain a little below average..”

“Domestic inflation pressures are likely to remain well contained and the depreciation of the exchange rate is expected to place gradual upward pressure on tradable prices.”

What is the importance of the economic data?

The Reserve Bank releases its Statement on Monetary Policy each quarter. The Statement is the Reserve Bank’s assessment of economic and financial conditions and also contains the latest inflation views. The Statement is crucial is assessing the short-term outlook for interest rates.

What are the implications for interest rates and investors?

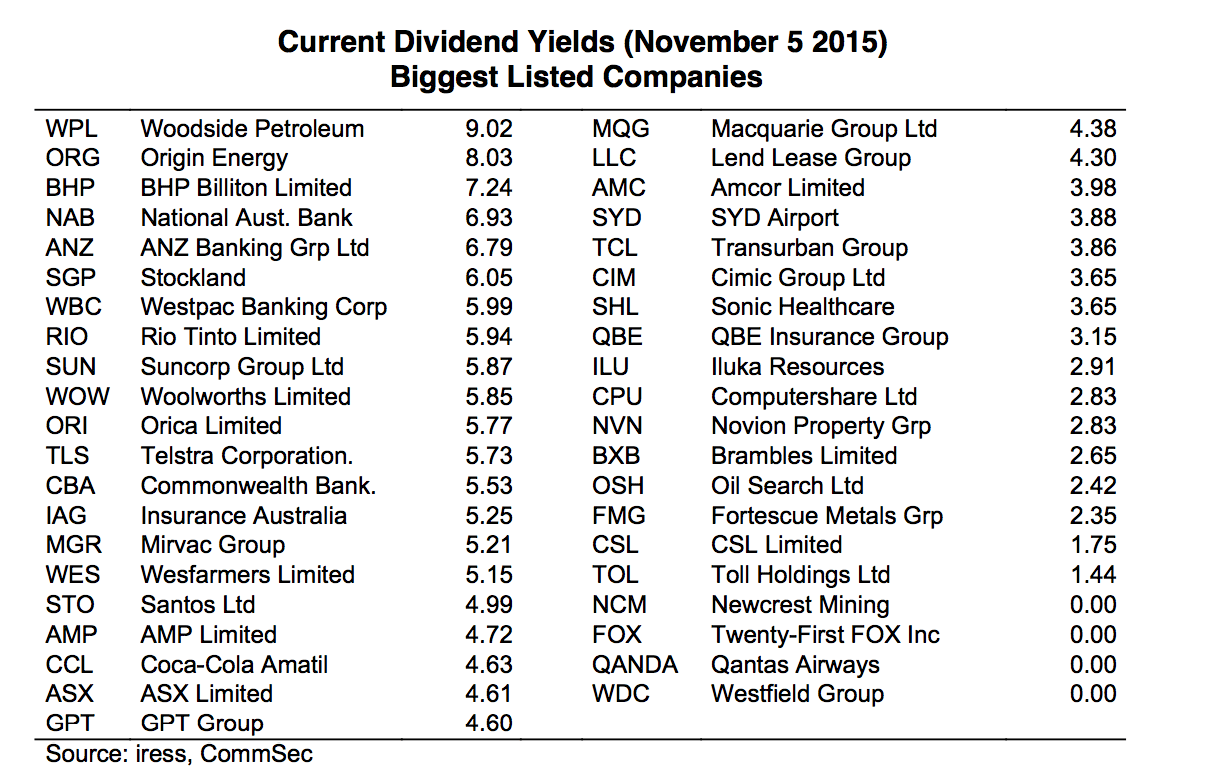

If interest rates are going to stay low or move lower, investors need to shop around for the best returns on their investments. There are some solid dividend yields on offer such as: ANZ 6.8 per cent, NAB 6.9 per cent, Westpac 6 per cent, CBA 5.5 per cent, Telstra 5.7 per cent, BHP Billiton 7.2 per cent, Woodside Petroleum 9 per cent. In terms of the high yielding resource company dividends the question relates to the sustainability of recent dividends.In terms of online savings accounts, returns of up to 3.5 per cent can be achieved for periods up to four months (cash rate 2 per cent)

CommSec expects no change in the cash rate over the next year.