Selling at a loss separates investors and owner occupiers: CoreLogic RP Data

The largest difference in sales at a loss between owner occupiers and investors for the June quarter is in the ACT, according to CoreLogic RP Data, followed by Melbourne and Brisbane.

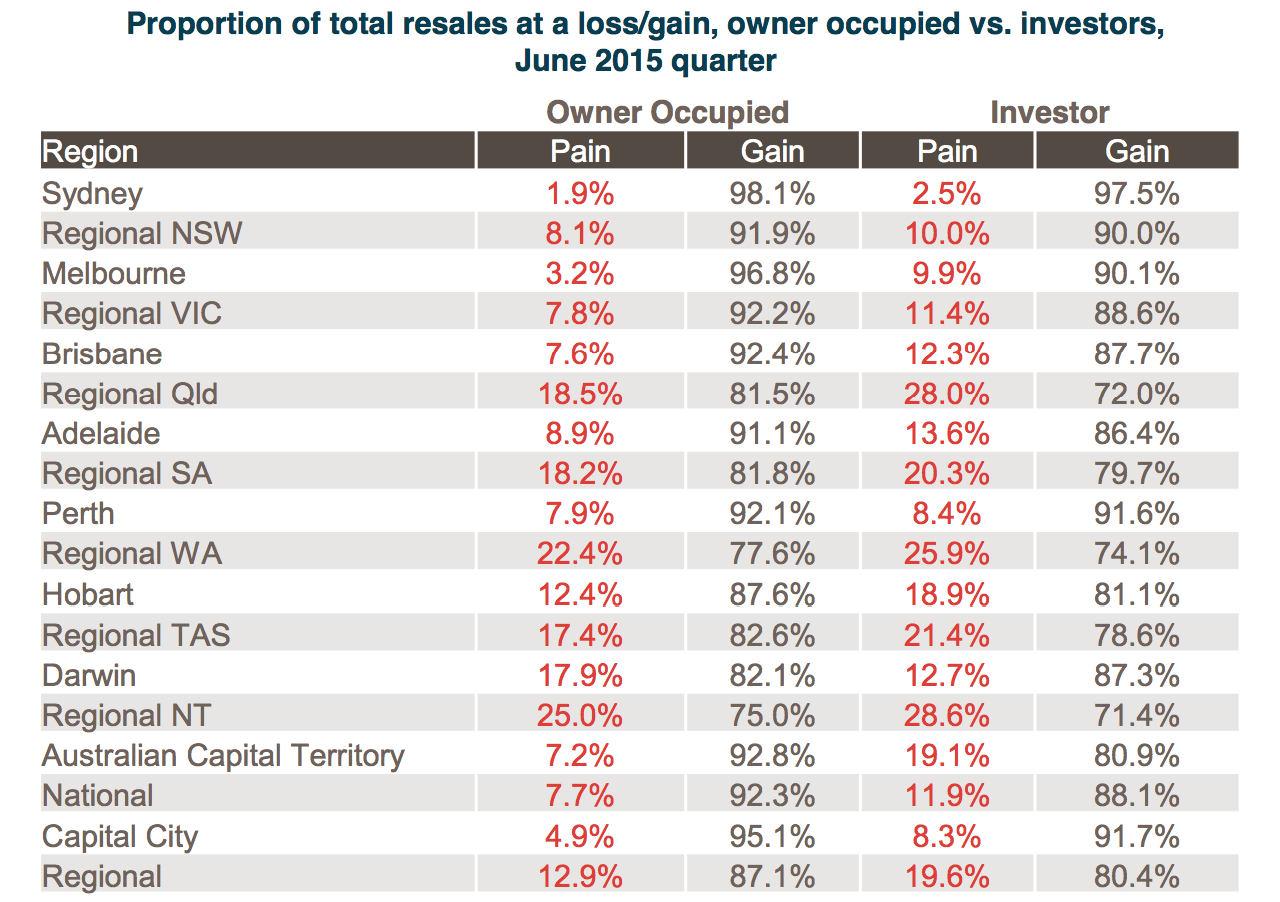

CoreLogic RP Data's Pain & Gain report found 4.9% of capital city homes which were resold by owner occupiers were at a loss, with 8.3% of investor owned homes selling at a loss.

"The biggest discrepancy between sales at a loss for owner occupiers and investors was found in the ACT (7.2% vs 19.1%), Melbourne (3.2% vs 9.9%) and Brisbane (7.6% vs 12.3%)," it noted.

"Throughout the second quarter of 2015, 7.7% of owner occupiers and 11.9% of investors resold their properties at a loss. Across each capital city and rest of state market except for Darwin, the proportion of loss making resales was greater for investors than it was for owner occupiers.

"When it comes time to re-sell a property owner occupier stock is much more likely to turn a gross profit than investment stock. This is most likely due to the fact that investment is more prevalent in the unit market than detached houses. Arguably, transacting at a gross loss is easier for an investor to accept, as the loss can be offset against future capital gains."