The impact of spring weather on Melbourne auctions: Secret Agent

GUEST OBSERVER

It’s 8am on a 10 degree winter morning and all you can hear is the heavy rainfall outside.

You cannot think of anything better than to forgo your house hunting plans and stay in bed for the day; after all, it’s the weekend. But just yesterday you were sunbathing in the park, planning your list of inspections for this very day and daydreaming of what your new home would be like. Now you decide that you will do this next week, when you can view properties in more comfortable conditions.

It's amazing how the weather can alter your mood and even what you decide to do for the day. What better way to welcome the month of Spring than with a report about weather! Temperature plays a key role in this report. We are all looking forward to the next few months as mornings become brighter earlier and the days hit temperatures over 20 degrees celcius again.

When it comes to selling and buying houses, Melbourne's favourite method is still the auction. On a sunny Saturday morning, many houses being auctioned can draw quite the crowd. In this report, Secret Agent looks at the impact of the weather, in particular temperature, on auction results. Does temperature have an impact on price or does a cold day merely weed out the number of onlookers?

Weather and Mood

Weather can affect our mood in various ways and, through this, influence our behaviour and decisions. Rainy days can make us feel sad and dull. Sunlight can diminish tiredness and boost positive moods. Simply thinking about the warm Spring days ahead makes Secret Agent happy.

An investigation into the relationship between morning sunshine and market index stock returns each day at 26 stock exchanges internationally found that there is a strong positive correlation. (Hershleifer and Shumway, 2001) Other weather conditions such as rain or snow were not found to have any relationship with returns.

Sunny weather is better for forging new relationships too. A psychologist in France performed an experiment in which he approached women on sunny and cloudy days and asked them for their phone number. The women were more receptive to his flirtatious behaviour on sunny days with 22% giving him their number, as opposed to cloudy days where only 13% were happy to. (Gueguen, 2013)

Temperature can also impact our behaviour independent of sunshine or rain. One study looking at the relationship between weather and helping behaviour found that a moderate temperature of about 20 degrees celsius is said to be ideal for most people. (Cunningham, 1979) Once you deviate from this happy medium, people felt a greater degree of discomfort and were less likely to help.

Heat is said to bring out the worst in people. Rates of aggression and violence are higher on hotter days of the year. A Dutch experiment involved placing police officers in a simulated burglary in hot and cold conditions. They found that police officers were more likely to draw their weapons and shoot the suspect in the hot environment than in a colder one. On a baseball field, pitchers are more likely to hit batters on a hot day. (Anderson, 2001) A study analysing the content of news reports filed out of Beijing during the Olympics found that the Air Pollution Index and daily temperatures had an impact on the negativity of the reports, with more negative words used as temperature and air pollution rose. (Zhong and Zhou, 2012)

This prompted us to think that temperature may also have an effect on auction results that is independent of seasonal factors. Secret Agent decided to test this out to determine if daily temperature influences property prices in an auction environment.

The study collected the auction sale results of all townhouses and houses sold in inner Melbourne in the past year from August 2014 up until August 2015. For this purpose, inner Melbourne was defined by the suburbs listed in the Quarterly Turnover section of this report (page 10).

There were 1740 houses sold with disclosed sale prices and these were incorporated into a comparative analysis with average daily and monthly temperatures. These results were then checked using hedonic regression techniques to isolate the temperature variable and determine its true effect on a property sale price. This was performed on properties where there were records of the land area, number of bedrooms and number of bathrooms. The model included 1032 properties and accounted for the size of the house (land area and number of bedrooms/bathrooms), inflation, geographical location (South, North, East or West as well as distance to the nearest beach or CBD) and seasonality (Summer, Autumn, Winter, Spring sale date).

Temperature and Sale Price

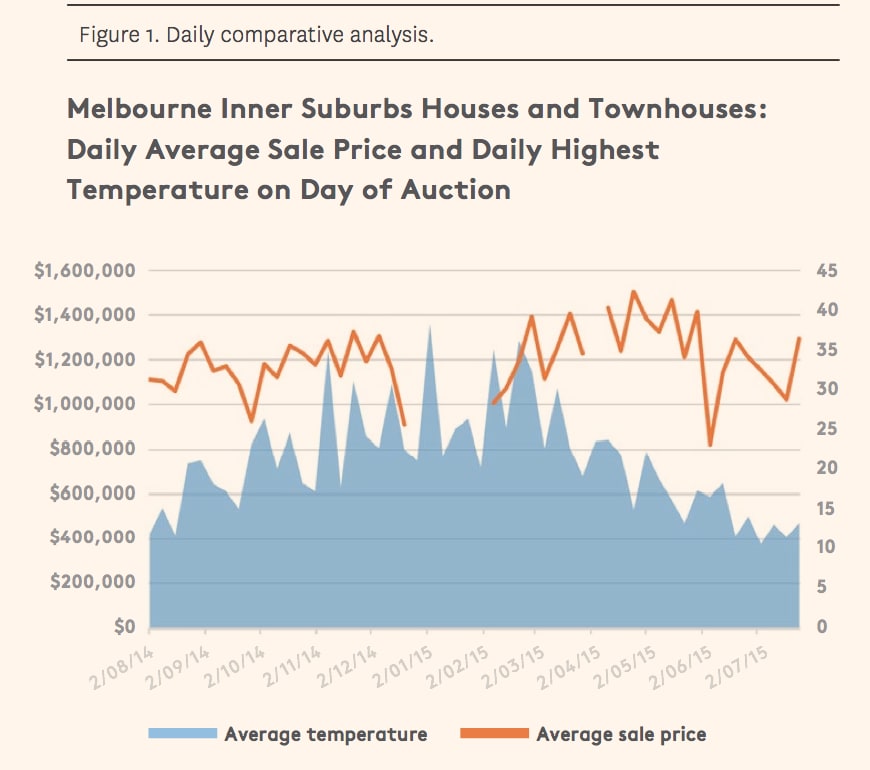

The analysis aimed to find a correlation between the average daily and monthly temperatures with auction sale prices. Figure 1 shows the comparison between the average sale price with the highest temperature reached on that day. Here there seems to be no real connection. While temperatures increase from August to February and then decline again throughout 2015, the average sale price on auction weekends moves more sporadically, with the overall trend a slight increase in average prices over time.

Note that on some weekends, especially in the January period, there were not enough sales to get an accurate average estimate. Statistically speaking, the correlation coefficient between the daily temperature and sales price found was 0.1. The correlation coefficient tells us how interdependent two variables are and always falls between 1 and -1. A measure of correlation between daily sale price and temperature of 0.1 is considered a very weak, positive correlation. Positive in this case means that, as temperature increases, average sale price increases as well, but it is weak because it is close to 0, at which point there is no relationship.

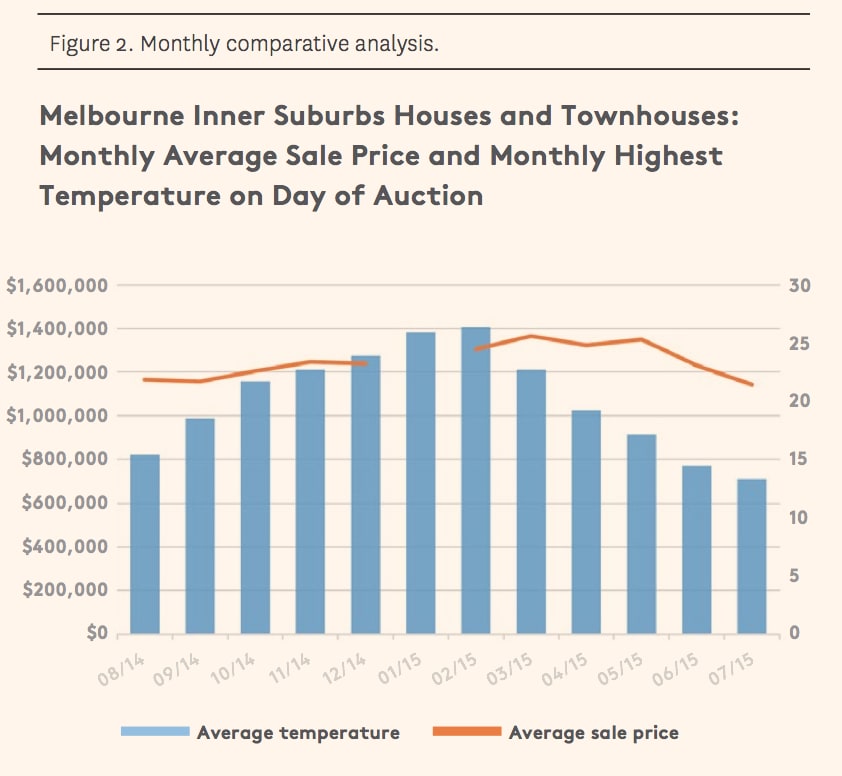

Looking at the monthly averages (Figure 2), a connection between the average temperature and sale price of houses and townhouses starts to emerge: as temperature increases, so does the average sale price. The measure of correlation between monthly sale price and temperature in this case is 0.46. This correlation coefficient is weak, positive. While it is larger than the daily average correlation, implying the monthly data is more strongly interconnected, the number is still closer to 0 than it is to 1, making it a weak correlation.

The results of the hedonic analysis support the above comparisons. Holding all other variables constant (size of house, inflation, geographical location and seasonality), Secret Agent found that the average temperature does not have a statistically significant impact on the average sale price of a house or townhouse at an auction in inner Melbourne.

One of the limitations to our study was the fact that data was only analysed for the past year. Results may have been more profound if more sales were included, however there is some external evidence to support our findings. Other research has found that temperature and weather affect people differently depending on what type of weather they prefer. (Klimstraet al, 2011) This could mean that the effects are balanced out in an auction environment since a number of people with different weather personalities would be present each Saturday.

Research has also shown that whilst men responded to unexpected weather by changing their plans, women tended to stick to their plans even if they did so disgruntled. In other words, weather may affect mood but this does not necessarily change someone’s behaviour. (Connolly, 2008)

Conclusion

Our results show that there is a small chance that temperature may influence auction sale prices in inner Melbourne. A weak positive correlation was found in our comparative analysis of monthly average temperatures and property prices.

When these results were tested using a hedonic regression model, no statistically significant result was found between temperature and property price. Results could become more significant with a larger sample size.

While you might spend hours trying to choose the right weekend of the year to put your house up for auction, it seems you might not need to worry so much. The eventual sale price will be largely unaffected by temperature. Rain or shine, those who are really interested in buying your home will still show up and place their bids. On the other hand, if you are in the market to buy a house, don’t expect to find a bargain simply because the weather is bad. Other buyers who are just as savvy will also be undeterred by bad weather to find the right home.

Traditionally, August is a very important month for Melbourne property. It’s the prime season for many vendors to scrutinise results to guide their decision making around a potential sale. With interest rates low and pressure to sell minimal, conditions need to be strong to encourage vendors to throw their hat in the ring and go to market.

Overall, results for prime property passed the test with many precedent-creating sales occurring. However, auction clearances started to trend downwards, perhaps a reflection of the larger volume of stock on offer.

The big challenge that remains is the uncertain global conditions. The Australian sharemarket recorded its worst month since the financial crisis of 2008, falling in the order of ten percent. The sharemarket is a reminder that assets can drop in value very quickly should valuations become too far stretched from historical levels. Whether equity or property, in today's market conditions one needs to be very careful around valuations, and operate on a margin of safety in case of sudden changes that occur within a chosen asset class. Our concern is that, of recent nose-bleed auction results, some of these properties could be worth far less in a year's time should the Australian economy falter, or the availability of cheap and easy credit starts to become scarce.

The Australian Prudential Regulation Authority (APRA) which oversees banks and credit unions has recently enforced tighter lending standards for investors, which is starting to have a flow-on impact on the market. We are noticing that investors, who operate with a slight delay from their pre- approval assurances, are starting to down-gear their budgets to accommodate these changes. The Spring market will be challenged with investors winding back their bidding limits. The countering force to this is to be expected with further demand coming from international buyers, especially those from China.

The other worry at the moment is the dwindling strength of the Chinese economy. The sharemarket has collapsed with a sharp correction, resulting in large losses for many investors. The weakening Chinese sharemarket conditions may actually continue to drive Melbourne and Sydney markets higher as nervous investors from China seek a safer place to park funds.

In terms of sale performance for the month, houses in the inner suburbs were the best performing according to Secret Agent's research, with houses in Brunswick, Brunswick East and Northcote on the boom list. In August 2015, houses and townhouse prices in the inner North were 20% higher in real terms than in August 2014. This is a remarkable change within a 12 month period.

However, the rate of price growth is slowing, which suggests that our market is peaking. Townhouses have started to show a general decline in price with exceptions within certain pockets of Melbourne. Apartments are faltering, with Brunswick, Kensington, Flemington, North Melbourne, Port Melbourne, Prahran, Southbank and Travancore in recession, with two consecutive quarters of falling values.

While we are still witnessing record prices paid, our data suggests that conditions are slowing and its effects may be felt more deeply in the later half of spring.

Quarterly Scorecard JUN, JUL & AUG 2015

The Secret Agent report is authored by Jodie Walker, Richard Rossman and Ken Premtic. They can be contacted here.