Softer sentiment amongst consumers with a mortgage fall of 6.3 percent in August: Bill Evans

GUEST OBSERVER

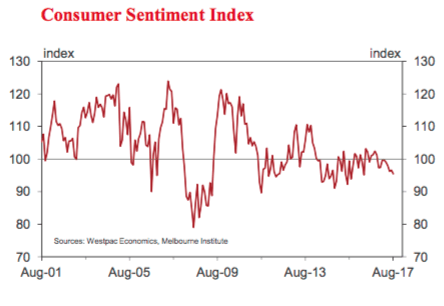

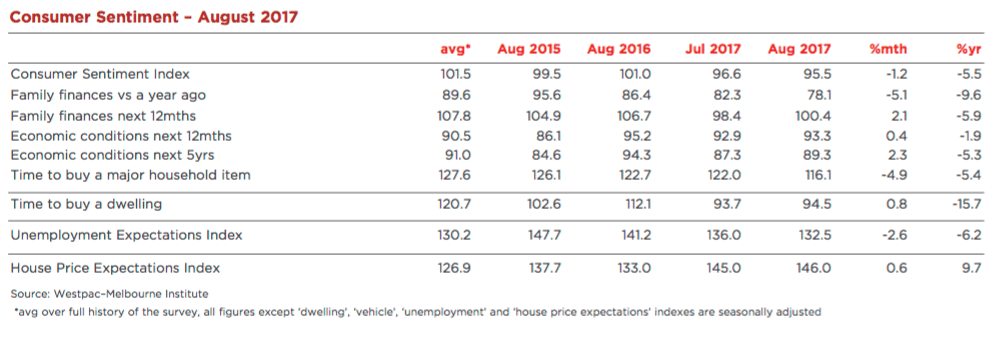

The Westpac Melbourne Institute Index of Consumer Sentiment declined by 1.2 percent in August from 96.6 in July to 95.5 in August.

The consumer mood has deteriorated over the last year with August marking the ninth consecutive month where pessimists are outnumbering optimists. We have not seen such a succession of weak reads since 2008.

The survey detail suggests increased pressures on family finances; concerns around interest rates; and housing affordability in NSW and Victoria are more than outweighing increased confidence around jobs.

The further weakening in consumer sentiment comes despite some positives leading into this month’s survey. The RBA again opted to leave interest rates unchanged at its August meeting while the Governor sent a clear signal in a recent speech that rates were on hold in the immediate future. Other positives include: a continued improvement in labour market conditions; lower petrol prices (average pump prices down 15c/litre nationally since early June) and a booming Australian dollar, which briefly touched USD 0.80.

The Index components point to clear pressure on family finances. The sub-index tracking views on ‘finances vs a year ago’ fell 5.1% to 78.1, the lowest level since June 2014, when consumers were shocked by the Abbott government’s first Budget. Much of the weakness is likely to reflect a mix of weak growth in wages; increases in key costs such as electricity and emerging concerns about rising interest rates.

Despite the bleak picture around current finances, consumer expectations are more upbeat. The sub-index tracking expectations for ‘finances over the next 12 months’ firmed 2.1% to 100.4 in August. A reading over 100 indicates that optimists slightly outnumber pessimists. Consumers were also a touch more positive on the economy: the ‘economic conditions, next 12 months’ sub-index nudged up 0.4%; and the ‘economic conditions, next 5 years’ sub-index posted a stronger 2.3% gain, though coming off a sharp 9.6% drop over the previous two months.

However the weak picture on current finances appears to be affecting consumer attitudes towards major purchases. The ‘time to buy major a household item’ sub-index fell 4.9%, unwinding most of the 6% improvement seen over June- July. Notably, the pull-back has come despite increasingly aggressive price discounting amongst retailers and a likely further improvement in purchasing power from a higher Australian dollar – up over 6c US from its low in May to nearly US 0.80.

Some of the softening in sentiment in August may be a delayed reaction to recent mortgage rate increases – the major banks raised rates on ‘interest only’ mortgages in late June. After posting a surprisingly firm 4.7 percent rise in July, sentiment amongst consumers with a mortgage fell 6.3 percent in August. Note that despite the increase in ‘interest only’ rates, the average standard variable mortgage rate declined a little between June and August.

Perhaps more importantly, most consumers expect rates to move higher over the next year. Responses to an extra question this month around the outlook for mortgage rates show that, of those consumers with a view, 71 percent expect rates to be higher in 12 months; 27 percent expect rates to be steady; and just 2.6 percent expect further rate cuts. That compares to 60 percent expecting higher rates when the question was last run in February and just 37 percent this time last year.

The one relative bright spot for consumers continues to be around jobs. The Westpac Melbourne Institute Unemployment Expectations Index declined 2.6 percent to 132.5 in August (recall that lower reads mean fewer consumers expect unemployment to rise in the year ahead). The Index is now at its lowest level since November 2011.

Sentiment around housing improved slightly in August. The ‘time to buy a dwelling’ index edged 0.8% higher but remained at a low level by historical standards. The detail shows mixed moves across different regions with buyer sentiment falling towards very low levels in Sydney and Melbourne – where affordability pressures remain acute – but surging in Western Australia, where affordability has improved markedly.

Consumer expectations for house prices also firmed slightly overall. The Westpac Melbourne Institute Index of House Price Expectations rose 0.6%, extending last month’s 8.6% bounce. Expectations consolidated in the major eastern states but rose strongly in WA which posted its second strongest reading since late 2014.

The Reserve Bank Board next meets on September 5. There is no doubt that the Board will continue to leave the cash rate on hold. The more interesting question is whether, as expected by markets and signalled by consumers’ responses in this survey, the RBA will raise rates next year. High business confidence and improving employment conditions along with the Bank’s own upbeat growth forecasts support the case for higher rates. On the other hand we continue to see evidence of a downbeat consumer and signs that the housing markets are set to slow under the weight of stretched affordability.

Our view is that these factors will slow growth and, along with an inflation rate which remains stubbornly below the Bank’s target zone, will preclude the need for higher rates next year.

BILL EVANS is chief economist of Westpac.