Reserve Bank in a happy place, confidence eases: CommSec's Savanth Sebastian

GEUST OBSERVER

The Reserve Bank Board minutes provide little in the way of new information for consumers or businesses.

It is clear the Board members remain relatively optimistic on the domestic economy and believes that recent rate cuts were having an impact in lifting consumption.

However while the minutes acknowledge the depreciation of the Australian dollar, there was still the usual jawboning on the need for a lower Aussie dollar, with Board members noting that “an appreciating exchange rate could complicate the necessary adjustments in the economy”.

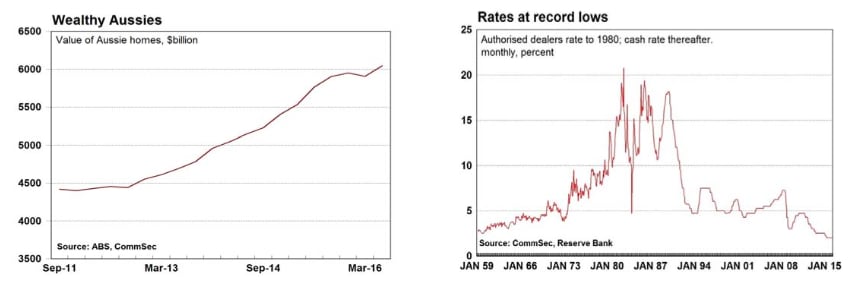

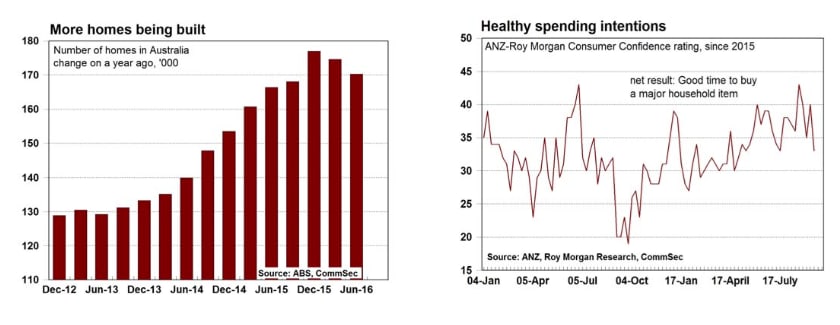

Interestingly the minutes suggested that the Central Bank was clearly less concerned about the housing sector – essentially a property bubble is no longer on its wall of worry. Nevertheless policymakers did discuss the substantial lift in apartment building that is taking place particularly across the Eastern states.

The pipeline of dwelling construction will support growth however does increase risks of an oversupply of apartments in 12-18 months times.

The next round of inflation data is released in late October and essentially means that the mostly likely scenario for another rate cut would be at the November Board meeting – provided inflation remains well below the 2-3 percent target band.

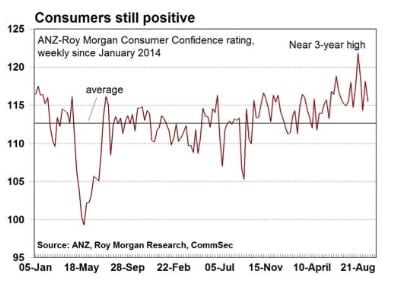

The modest decline in the weekly consumer sentiment reading is not concerning – particularly given confidence levels have lifting substantially in prior weeks. Overall consumers are in a happy place, particularly with household budgets in good order.

What do the figures show?

Reserve Bank Board minutes

The key quotes from the Board minutes:

Economic growth: “data suggested that growth had been around estimates of potential growth over the first half of 2016, despite further large falls in business investment. Interest-sensitive sectors of the economy were being supported by accommodative monetary policy.”Housing sector: “Housing market conditions overall appeared to have eased since the previous year, although the dwelling construction cycle remained in a strong upswing. The best available information suggested that housing prices had risen modestly over the past year and turnover had been below average. Consistent with this and supervisory measures that had strengthened lending standards in the housing market, housing credit growth had slowed over 2016. Members noted that there continued to be a considerable volume of apartments scheduled to be completed over the next couple of years, particularly in the eastern states”.

Summary: “Taking into account the recent data, and having eased monetary policy at its May and August meetings, the Board judged that the current stance of monetary policy was consistent with sustainable growth in the Australian economy and achieving the inflation target over time...”

Consumer confidence

The ANZ/Roy Morgan consumer confidence rating fell by 2.2 per cent to 115.5 in the week to September 18. Confidence is up 0.9 per cent over the year and well above the average of 112.6 since 2014. All five components of the index fell in the latest week:- The estimate of family finances compared with a year ago was down from +12 to +10;

- The estimate of family finances over the next year was down from +27 to +25;

- Economic conditions over the next 12 months was down from +2 to +1;

- Economic conditions over the next 5 years was down from +10 to +9;

The measure of whether it was a good time to buy a major household item was down from +40 points to +33 points.

Residential property prices

The Bureau of Statistics (ABS) has released its Residential Property Price indexes.

“The price index for residential properties for the weighted average of the eight capital cities rose 2.0 percent in the June quarter 2016. The index rose 4.1 per cent through the year to the June quarter 2016”.

Annually, residential property prices rose in Melbourne (+8.2 percent), Canberra (+6.0 percent), Hobart (+4.9 percent), Brisbane (+4.3 percent), Sydney (+3.6 percent) and Adelaide (+3.5 percent) and fell in Darwin (-6.5 percent) and Perth (-4.8 percent)”.

What are the implications for interest rates and investors?

Future rate cuts are wholly dependent on inflation. If the next inflation figures are even slightly above RBA and market forecasts, then the Reserve Bank Board members will stay on the interest rate sidelines. For the record CommSec has a further interest rate cut pencilled in for the November meeting.