RBA relaxed and comfortable, for now: Shane Oliver

GUEST OBSERVER

Global share markets rose over the last week helped by a combination of good economic data and announcements from President Trump progressing his deregulation and tax reform agenda.

Bond yields mostly fell though helped along in Europe by dovish comments from ECB President Draghi. Commodity prices were mixed with oil down but metals up and iron ore at its highest since 2014. The $US rose and this saw the $A pull back.

The message from the first few weeks of Donald Trump’s presidency is that while he and his administration is generating a lot of noise on a lot of issues as long as he continues to make periodic announcements progressing his pro-growth policies – rolling back Dodd-Frank, working towards a “phenomenal” tax plan, making “life good” for airlines, etc – then share markets will respond positively. So while all the noise around the travel ban, whether the Lindt Café siege was “underreported” (I was in Memphis on an Elvis pilgrimage at the time and the siege had plenty of coverage on US TV!), etc, is interesting, investors should continue to turn down all this noise when making investment decisions.

While unwinding the Dodd-Frank financial regulations will take time and face constraints (as it will likely require the support of 8 Democrat Senators, although it may be possible to find work arounds), tax reform is likely to proceed more quickly as Congress has already done significant work on it and it can pass through the Senate using budget reconciliation rules that only require a simple Senate majority – which the GOP has. It now looks likely that the Trump administration will submit a tax plan to Congress in a few weeks – this is almost certain to include a cut in the corporate tax rate (to 20% or so) and possibly also a cut to personal income tax rates. Its less clear whether a “border adjustment tax” (rebating tax on exports and taxing imports) will be included. Taking the US corporate tax rate from 35% to 20% will put massive pressure on Australia at 30% and other countries to follow suit (the OECD average is around 25%).

In Australia, the Reserve Bank left interest rates on hold as expected, but in its Statement on Monetary Policy made little significant changes to its growth and inflation outlook seeing December quarter GDP growth rebound, growth averaging around 3% over the next few years and inflation heading back to 2% by year end.

The Bank’s post meeting statement, a speech by Governor Philip Lowe and the Statement on Monetary Policy all presented a relatively upbeat assessment on the economic outlook. While we have growth outlook, our view remains that it will take longer for inflation to return to target than the RBA is allowing, particularly with wages growth remaining at record lows and the $A trending higher. As a result we remain of the view that the RBA will cut rates again this year, probably in May after the next round of inflation data.

Given the improving global growth and inflation outlook though and the desire to avoid adding to financial stability risks, our call for another RBA rate cut is a close one.

Surprisingly, the RBA’s level of concern around the property market does not appear to have increased despite a further pick up in lending to property investors and rapid price growth in Sydney and Melbourne. This appears to partly reflect the RBA’s assessment that lending standards have tightened, the supply of property is set to rise with longer than normal lags and that part of the recent upswing in investor credit may reflect investors paying for properties bought of the plan some time ago. There still remains a case for a precautionary lowering in APRA’s 10% investor credit growth limit though.

Major global economic events and implication

US job openings, hiring and quits remained basically unchanged at relatively high levels, jobless claims fell to ultra-low levels and the trade deficit narrowed slightly in December. 71% of US S&P 500 companies have now reported December quarter profits with 75% beating earnings expectations with an average surprise of +3.6% and 51% beating on revenue. Earnings are now expected to be up 6.3% from a year ago.

Japanese data showed a slight fall in confidence and continuing weak wages growth but improved machinery orders, a rise in Japan’s leading index and an ongoing decline in bankruptcies and the first annual rise in producer prices since March 2015.

Chinese foreign reserves fell below $US3trillion for the first time since 2011 and are down from a high of $US4trillion highlighting that China continues to see capital outflows and is using its reserves to slow the decline in the Renminbi (are you listening President Trump?).

The Reserve Banks of India and New Zealand both left interest rates on hold and both look to have a neutral stance for now but with the RBNZ pencilling in one hike in 2019.

Australian economic events and implications

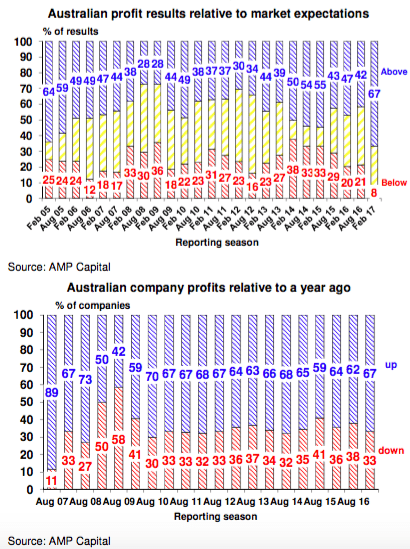

Its too early to read much into the December half profit reporting season because less than 20 major companies have reported to date. But so far so good with 67% exceeding earnings expectations compared to a norm of 44%, 67% of companies seeing profits up from a year ago and a stronger than expected result from Rio Tinto confirming that the turnaround in resources sector profits is on track.

On the data front in Australia, December quarter retail sales volumes rebounded 0.9% adding to confidence that consumer spending and hence GDP growth rebounded in the December quarter. While retail sales unexpectedly fell 0.1% in the month of December, this reflected a sharp fall in hardware, building and garden supplies (possibly reflecting the wind down of Masters) so is unlikely to mean much. Meanwhile new home sales were flat in December according to the HIA but still appear to be tracing out a gradual downtrend since their high in 2015 and December housing finance commitments saw a slight swing back in favour of owner occupiers but not much given the strong gains in investor lending in prior months.

What to watch over the next week?

In the US, the focus is likely to remain on the noise coming out of Washington but also on Fed Chair Janet Yellen's Congressional testimony (on Tuesday and Wednesday) which is likely to repeat the message from the Fed's last meeting that it remains on track to hike further this year but that the process is likely to be gradual. Her response to questions regarding the impact of the new president will no doubt be watched closely but the Fed is basically in wait and see mode on that front. Expect headline CPI inflation (Wednesday) to

have increased further to 2.4% year on year in January but core inflation to fall slightly to 2.1% yoy, solid growth in underlying retail sales in January, flat industrial production, continuing strength in the home builders' conditions index (all Wednesday) and flat housing starts (Thursday). December quarter earnings results will continue to flow.

Japanese December quarter GDP data (Tuesday) is expected to show growth at 0.3% quarter on quarter or 1.8% yoy.

Chinese inflation data for January (Tuesday) is likely to show a further rise in CPI inflation to around 2.3% yoy and a further uplift in producer price inflation to 6.5% yoy as the slump in commodity prices a year ago continues to drop out.

In Australia expect continued strength in business conditions according to the NAB's January survey, a bounce in consumer confidence (Wednesday) and January jobs data to show a 10,000 gain in employment but unemployment holding at 5.8%.

The Australian December half profit reporting season will ramp up further with 61 major companies reporting (including JB HiFi, CBA, Wesfarmers, Origin and Telstra). Earnings upgrades for resources stocks on the back of the rise in commodity prices has seen the consensus expectation for 2016-17 earnings growth rise to 17%. Resource company profits are expected to more than double, but profit growth across the rest of the market is likely to be around 5% led by retailers, utilities, telcos and building materials companies. Key themes are likely to be: a massive turnaround for resources companies; constrained revenue growth for banks and industrials; and an ongoing focus on dividends.

Outlook for markets

Shares remain vulnerable to a short term pull back as sentiment towards them remains very high, Trump related uncertainty will be with us for a while and various European elections could create nervousness in coming months. However, we see share markets trending higher over the next 12 months helped by okay valuations, continuing easy global monetary conditions, fiscal stimulus in the US, some acceleration in global growth and rising profits.

Still low yields and capital losses from a gradual rise in bond yields are likely to see low returns from bonds. Australian bonds are preferred to global bonds reflecting higher yields and as the RBA remains well behind the US in moving into a tightening cycle.

Commercial property and infrastructure are likely to continue benefitting from the ongoing search by investors for yield, but this demand will wane as bond yields trend higher over the medium term.

National capital city residential property price gains are expected to slow to around 3-4% this year, as the heat comes out of the Sydney and Melbourne markets and rising apartment supply hits.

Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.5%.

The $A has had a short term bounce as the $US corrected from overbought levels. This could go further and see a retest of $US0.78. However, the downtrend in the $A from 2011 is likely to resume as the interest rate differential in favour of Australia narrows & it undertakes its usual undershoot of fair value. Expect a fall below $US0.70 by year end.

SHANE OLIVER is head of investment strategy and economics and chief economist at AMP Capital and is responsible for AMP Capital's diversified investment funds.