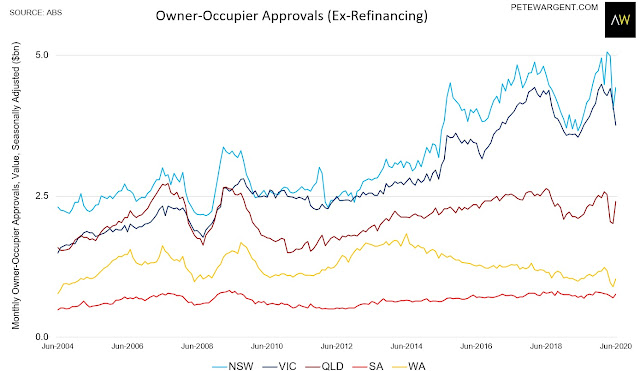

There was a resurgence in homebuyer finance in June, but not in Victoria, where finance commitments dropped sharply.

Unfortunately for Melbourne, this trend will only continue through July and August...and into September.

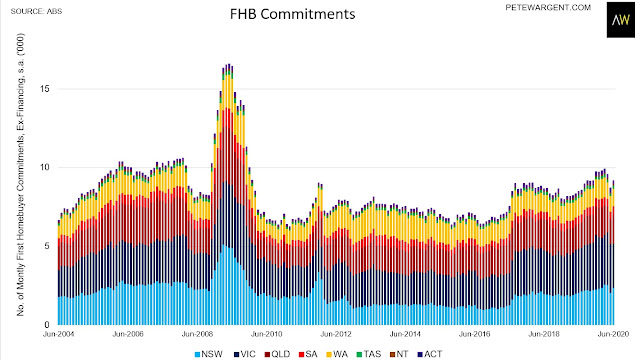

First homebuyer commitments zipped higher, but there was another sharp 9 per cent drop in Victoria, following on from a similar decline in the month of May.

Overall, stripping out refinancing housing finance jumped +6.2 per cent, despite Victoria's woes.

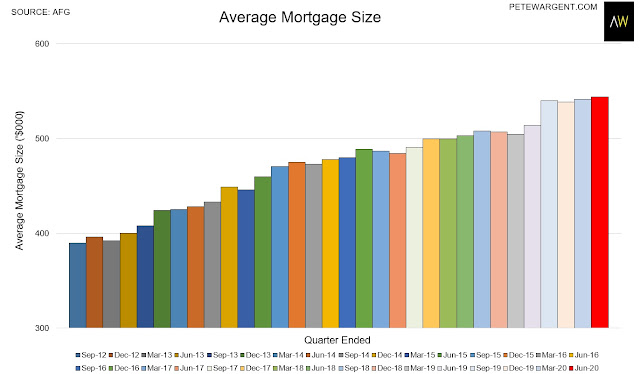

The average mortgage size has been a bit all over the place of late, possibly due to there being more first homebuyers in the market.

AFG's quarterly numbers showed a record high mortgage size in Q2, albeit only just.

Basically flat would be another way to describe the figures (and the same for the ABS data).

There was enormous strength in the average mortgage size in New South Wales, which hit a record high, but not so in Victoria.

Overall, a decent rebound ex-Melbourne.

Note that this bounce was also before the HomeBuilder boom kicks in.

New South Wales will also see a surge in activity up to $1 million resulting from the stamp duty discounts announced on July 27.

Victoria recorded some 725 cases of COVID-19 over the past 24 hours, ensuring that the Stage 4 lockdown will almost certainly run for weeks to come.