Interest-only loans stay low: Pete Wargent

EXPERT OBSERVATION

The regulatory throttling of mortgage lending maintained its firm stranglehold in the first quarter of 2018, with interest-only lending remaining at just 15.7 per cent of new residential term loans by value (a far cry from 45.6 per cent at the September 2015 peak).

Both the stock and flow of interest-only loans has been significantly reduced by the introduced macroprudential measures.

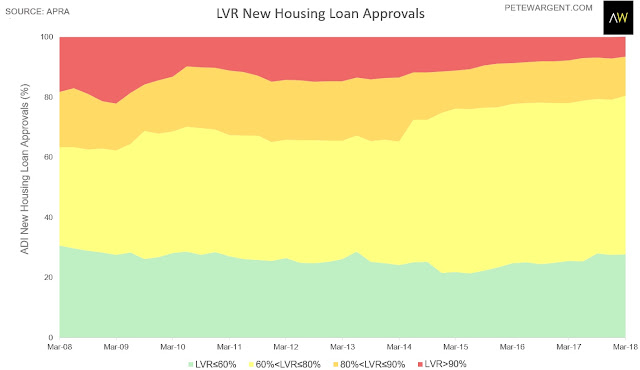

Tighter loan-to-value (LVR) ratios also continued to be applied in Q1, with just 6.8 per cent of new residential lending at LVRs of 90 per cent or greater in the March 2018 quarter.

Loans approved outside serviceability were well down from the December 2017 quarter spike, but remained at an elevated level implying that tighter standards almost certainly continued to bite throughout the first half of 2018.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.