Stock versus flow in inner-Sydney apartments: Pete Wargent

There are certainly some weird ideas out there about property supply.

Take the example of Pyrmont, if only because I lived there for many years, and as a property owner in the suburb, it's one of the locations I know pretty well.

From time to time I've heard it said that suburbs like Pyrmont have "too much supply".

I guess I can kind of see why you might think that if you'd just landed in Sydney, for with about 13,000 residents jammed in to one tight square kilometre, it's the densest suburb in Australia.

Thing is, the bit of the suburb where people want to live was developed about 25 years ago now!

There's been very little of note lately, though.

From memory that was a little unit development on Pyrmont Bridge Road, and there's been a bit going on at Ultimo.

Oh, and then there was Lend Lease's 391 apartments in the new 40-storey tower at Darling Square, although they sold out in, what, five hours?

If you were to fast forward to a decade's time I expect that Wentworth Park and White Bay will be developed with apartments, probably the fish markets too one day, while if Mirvac get their way there will be a commercial/residential tower on top of what is now the Harbourside tourist trap.

These types of developments can take years to become a reality, though.

At the end of the day, there isn't an oversupply issue here because more and more people want to live in the area by the year.

Ultimately there are shedloads of people like me who'd enjoy a lazy 5-minute stroll into the city in the morning instead of driving through miles of petroleum fumes and vehicular logjam.

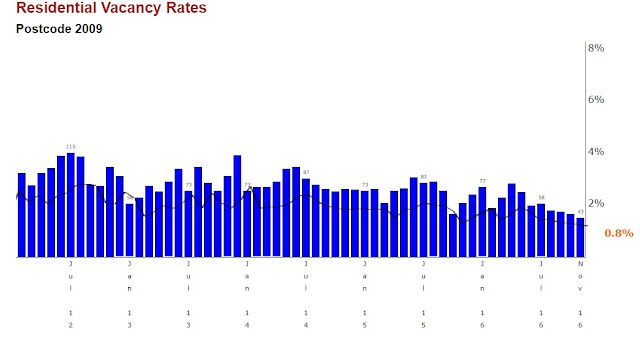

After accounting for the inevitable frictional vacancies, vacancy rates in Pyrmont are essentially zero.

Source: SQM Research

There will be the new developments over time, but we're more or less always playing catch up with demand.

You could say the same of, say, Coogee in the beachside eastern suburbs, or Manly to the north. Stacks of demand, not much of note being built.

Even in inner-city Erskineville, which has seen development aplenty both within the suburb and all around it, vacancy rates are very tight, because it's such a convenient and popular location to live in. Loads of demand.

Source: SQM Research

Those are the kind of suburbs I don't mind owning property forever in, through the cyclical peaks and troughs.

Apartment glut

Now, this is not to say that things aren't a little different elsewhere.

Where exactly? Follow the cranes!

Wentworth Point is just a mass of new apartments, and without being unkind, I can't imagine what it would be like to live there.

I guess you'd soon get used to it, though, since as far as I could tell there's only one road in and out (like the Twiglet zone: "Easy to enter, impossible to leave")!

Vacancy rates are up, up and away...

Source: SQM Research

In Parramatta, there have been high rise towers going up all over the show throughout the last year, a huge concentration risk of generic, high rise, shoebox apartments.

With net multi-unit completions rising fast in 2015 and 2016, vacancy rates have already increased to well above 3 per cent, and there's always an inherent risk of understatement in reported vacancy rates at this stage in the construction cycle.

There were another 3,500 dwellings approved in the last financial year too, and overwhelmingly, they were multi-unit in nature at 2,750. Golly gosh...

I also read somewhere this week that Blacktown is about to "boom".

Hmm, well that depends how you define 'boom', I guess! A construction boom, maybe. A boom in traffic congestion?

That too! I'm somewhat less than convinced about there being a 2017 property boom in the conventional sense, though.

One thing that you can say in favour of the LGA of Blacktown is that at least there is a level of diversity of development stock between apartments and detached dwellings.

Even so, with more than 11,700 dwellings approved over the last three years and a huge construction pipeline, it looks likely to me that vacancy rates will only be heading north putting more downward pressure on rates.

There are plenty more suburbs like Parramatta and Blacktown that face a surfeit of new stock as mentioned here previously, including in the Hills District.

And that's before we even mention the wild exuberance in Western Sydney house prices, with suburb records being smashed by the month in 2016 just as mortgage rates are now beginning to creep back up.

It'll be very interesting to watch all of this play out in 2017.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.