The most recent Statement on Monetary Policy (SOMP) suggested that several housing market indicators have eased.

If the Reserve Bank of Australia (RBA) is more relaxed, then that's generally good news for homeowners.

There have also been loads of macro and share market analysts calling the peak of 'the market', whatever that means, but then again they do that every year, so I don't pay any attention to those.

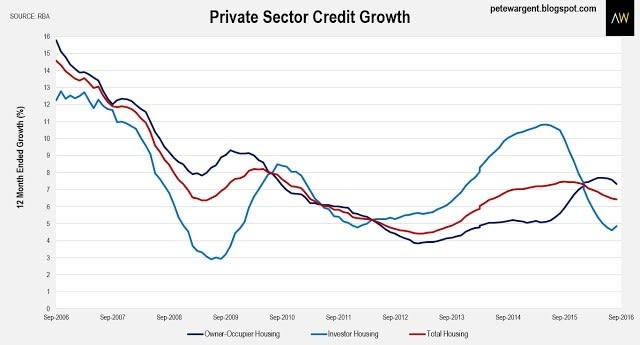

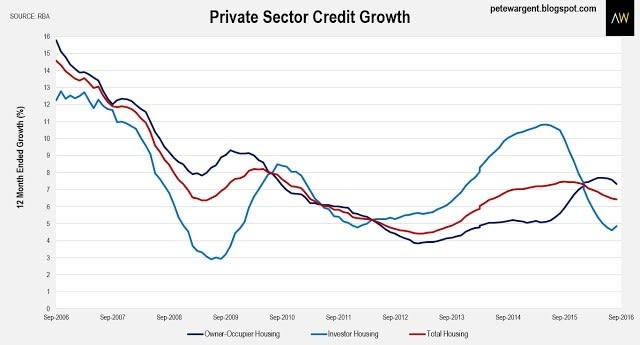

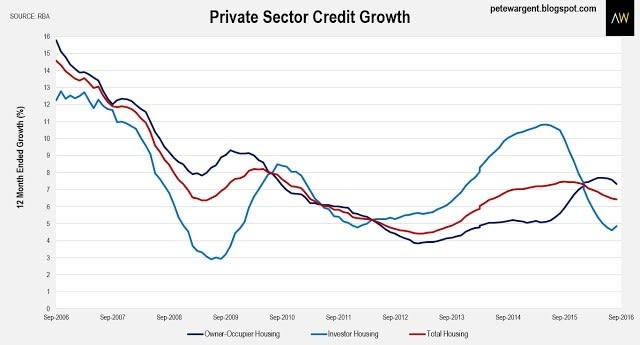

Certainly, the RBA's private sector credit growth figures show that housing credit is growing less quickly than it was.

That said, housing credit is still growing at a sprightly enough +6.4 percent, and recent months have shown that investors are well and truly on the march again.

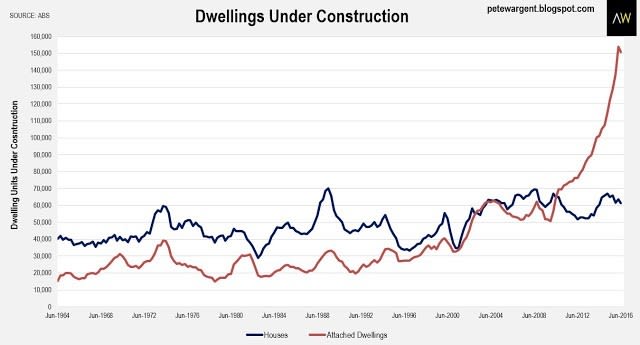

Another issue with the theme of slowing credit growth is that the figures cannot easily account for debt relating to off-the-plan purchases which have yet to settle.

And there are lots of these!

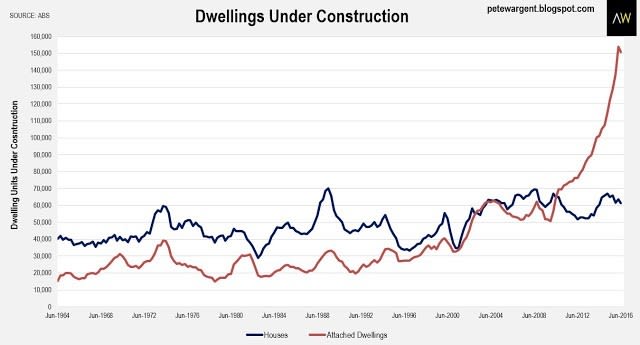

The figures to the end of June showed that there were more than 212,000 dwellings under construction, including about 150,000 units, apartments, and townhouses.

Without knowing how many of these dwellings have been bought by non-residents and how many are off-the-plan purchases it's impossible to say what the impact on credit growth will be for certain, but it may be non-trivial.

Of course, there are about 9.75 million dwellings in Australia it's certainly not the RBA's job to set monetary policy for every housing market sector in Australia.

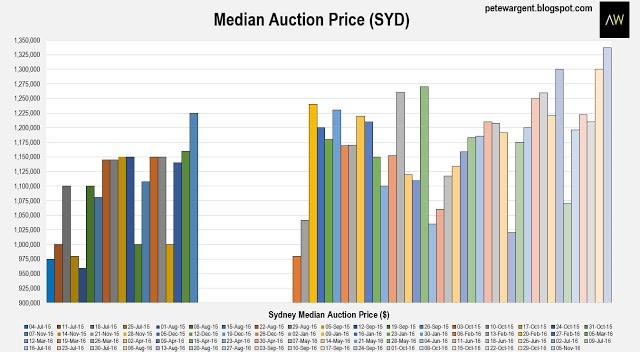

However, another sticking point for the 'easing' theory is that inner

Sydney's housing markets aren't easing.

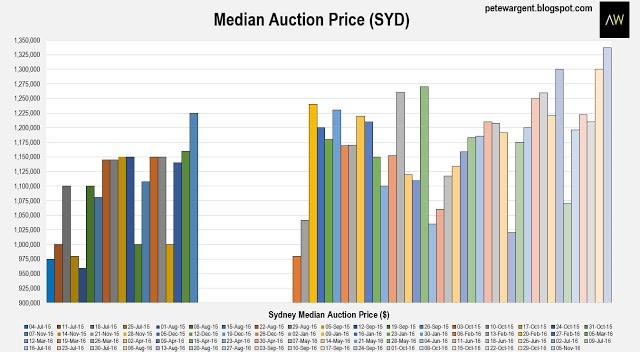

A simple look through the weekend's auction results tells you that prices have jumped again in recent weeks.

Having copped oodles of stick for reporting double digit price growth in

Sydney, CoreLogic may yet prove to be ahead of the pack, and see the other data providers follow suit.

The eastern suburbs market is insanely strong (Paddington,

Surry Hills,

Bondi), suburbs on the city fringe to the inner west are clearly smoking records when viewed through a hedonic pricing lens, and the harbour city's lower north shore is on fire.

Meanwhile, the northern beaches are probably the hottest suburbs of the lot.

I don't really have the time or inclination to follow the suburbs further out too closely, so can't really comment with any authority on that.

The high volume of apartments under construction will have an impact eventually, although mostly these are pre-sold.

I also note in passing that

Sydney's median auction price last week was $1,337,000.

It's never been higher.