Tips and traps for property investors: Pete Wargent

It's the end of financial year!

It was a really strong finish to the year for share markets today, closing up by 1.8 percent. However, the Aussie stock markets finished the financial year down by an underwhelming 4.1 percent.

With the tax year now having come to an end, it will soon be time to lodge those tax returns.

Holiday homes under scrutiny this year

Last year, the Australian Taxation Office (ATO) designed and implemented new compliance strategies for foreign investors in Australian property, including stakeholder engagement (with advisers, agents, and associations), improved data matching, and a broad investigation strategy into illegal foreign purchases.

This year - as well as those claiming excessive work-related expenses such as travel expenses, self-education, uniform, mobile phone, and internet costs – it is resident Australians with rental properties that are more likely to be under scrutiny from the ATO at tax time - in particular those will holiday homes.

During the past year ATO Commissioners have advised Farifax Media and SBS News that they have been in contact with thousands of owners of rental properties in order to clarify their entitlements or request clarification about claims that they've made.

The ATO has further reportedly sent correspondence to some holiday home owners recommending that they "review the nature of their claims" before dropping in their next returns...oops!

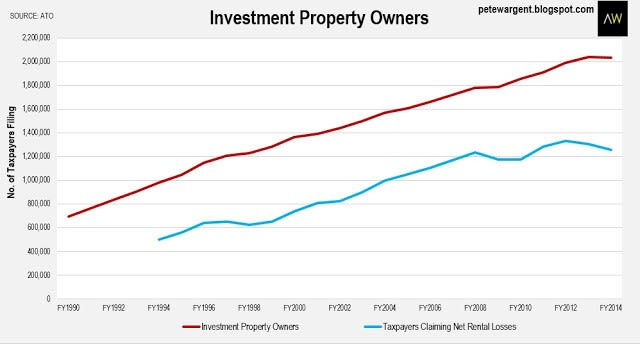

With well over 2 million Australians lodging tax returns declaring ownership of a rental property - spread widely across all income brackets – the landlord sector is substantial, and there are potentially significant liabilities to be raised by the ATO.

Click to enlarge

Owners of holiday homes should take a good deal of care not to make claims for net rental losses for periods when their property has not actually been made available for rent.

In particular owners of holiday homes claiming deductions for a full year when the property has been vacant for long periods might expect to get a tap on the shoulder from the tax office.

According to ATO legislation the principles that apply to a rental property also apply to a holiday home if it is rented out - if you rent out your holiday home, you can claim expenses for the property based on the proportion of the income year it was rented out or was genuinely available for rent.

However, if a holiday home is advertised in ways that limit its exposure to potential tenants, then the property may not be deemed “genuinely available” for rent – for example, if the property is not widely advertised, or if the advertised rents are set at unrealistically high levels.

Since the ATO’s interest was flagged some months ago, net rental losses declared or claimed on holiday homes could be lower this year as this loophole is sewn up...

Airbnb and online networks

There may also be some confusion relating to the rise of online networks such as Airbnb, with more Australians than ever before choosing to rent out their own homes, or a part of their homes.

Remember, rental income is assessable and therefore you may have tax to pay at year end - don't try to be sneaky and under-report rental income it or you may be penalised!

For Airbnb hosts there are two types of allowable deductions. Firstly, there are costs directly associated with generating rental income or with the rental area (for eaxample, photography, commercial cleaning costs, food for tenants, Airbnb fees and commissions, or food made available to tenants).

And secondly there are costs which may be apportioned, often based upon the applicable floor area, including your mortgage or rent, utilities, internet and phone costs, insurance, and so on.

Keep records and receipts through the financial year and make sure you set aside some money for the tax liability!

Also, be aware of the potential legal and liability risks or short term tenancies and other tax implications thereof, such as capital gains tax (the principal place of residence is normally exempt, but generating rental income from the home may trigger a change in this status).

Repairs and maintenance

There is also often genuine confusion for some property investors over what deductions can be claimed.

Perhaps the most common mistake made by landlords on lodged tax returns is claiming deductions for repairs and maintenance for expenses which are actually capital costs.

Property investors are not allowed to claim repairs and maintenance deductions for defects or pre-existing damage that was in evidence at the time they acquired the property. Such improvements are considered to be capital in nature.

Where investors are unsure they would be well advised to check the rules relating to deductions made available by the ATO for free online, or to engage a tax agent or property specialist tax accountant that is familiar with the rules.

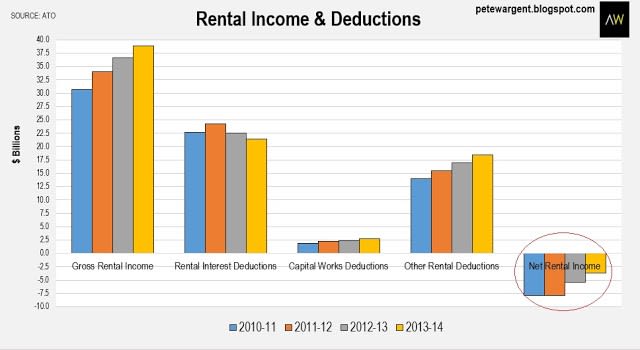

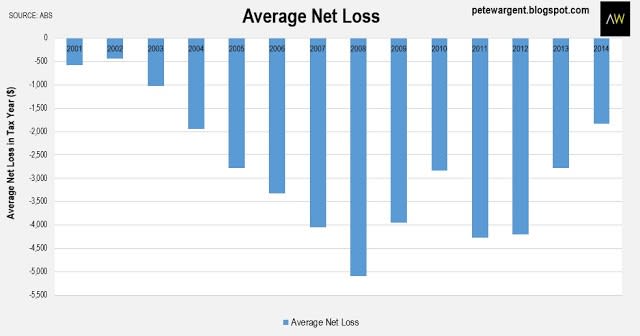

Net rental losses declining

Declared net rental losses have declined sharply in recent times, falling by more than half over the last two tax years for which data is available, largely due to lower interest rates.

The average net loss claimed by investors has fallen by 64 per cent since 2008 as mortgage repayments have become cheaper. These figures will continue to decline in 2015 and 2016 with interest rates having fallen.

While the ATO will doubtless generally be looking for expenses claimed in error as part of their investigative reviews or audits, it is worth noting that many investors also fail to claim deductions which they are entitled to.

In particular, not all owners of rental properties are aware of the potentially generous capital allowances and tax depreciation deductions for plant and equipment which are available under the tax legislation.

If you are in doubt, a property specialist tax accountant can help you to avoid making costly mistakes!

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.