The becalmed market: Pete Wargent

It looks increasingly as though 2016 is going to be a becalmed year for Sydney's property markets.

Some articles doing the rounds this week suggested that apartment prices had already fallen in Sydney, but as you would expect different market sectors and sub-regions have behaved somewhat differently.

Some articles doing the rounds this week suggested that apartment prices had already fallen in Sydney, but as you would expect different market sectors and sub-regions have behaved somewhat differently.

Mainly these declines would relate to new stock or "off-the-plan" or high-rise apartment purchases, some of which in my opinion is quite over-priced and quite risky, and some outer suburban or secondary locations where auction clearance rates have tanked.

Residex released its April market update on Friday which showed that median apartment prices in Sydney had increased by +11.5 per cent over the year to March, to a fresh all-time high of $691,500.

Following a +2.4 per cent increase in March, the median unit price growth has all but overhauled median house price growth in the harbour city, which has slowed to +12.2 per cent over the year to March.

This need not be such a surprise - at this stage in the cycle the stamp duty on detached housing in desirable locations has become increasingly prohibitive, acting as a drag on price growth.

This need not be such a surprise - at this stage in the cycle the stamp duty on detached housing in desirable locations has become increasingly prohibitive, acting as a drag on price growth.

Sydney's median house price is now $1,042,500 which is +$271,500 higher than when the latest round of doomsday predictions were rolled out at the beginning of 2014. And this median price is also +$381,500 than in the middle of 2012 when some other crash predictions were being bantered around.

With the additional stamp duty burden ramping up by nearly $18,000 over the past four years, rational buyers will increasingly look towards properties they can add value to, or scale down their entry price accordingly.

While auction results are still throwing out some enormous results (for example, this Potts Point terrace was resold for a thunderous $13 million this week, almost doubling the record price for a Sydney terraced house) it does look as though the wider market away from the inner suburbs has now slowed in accordance with APRA's wishes.

With the additional stamp duty burden ramping up by nearly $18,000 over the past four years, rational buyers will increasingly look towards properties they can add value to, or scale down their entry price accordingly.

While auction results are still throwing out some enormous results (for example, this Potts Point terrace was resold for a thunderous $13 million this week, almost doubling the record price for a Sydney terraced house) it does look as though the wider market away from the inner suburbs has now slowed in accordance with APRA's wishes.

According to Residex medians, there was a continued steady growth in the year to March for Brisbane houses (+3.5 per cent) and Brisbane units (+4.2 per cent).

Economy more upbeat

There have been quite a few positive signs for the economy of late - an extraordinarily strong NAB business survey saw conditions at their equal highest level in 8 years, and the AIG Performance of Manufacturing Index gauge surging to its highest reading in 12 years.

Lately there has been a strong bounce in commodity prices, sending some of the oversold major resources companies on a serious bull run.

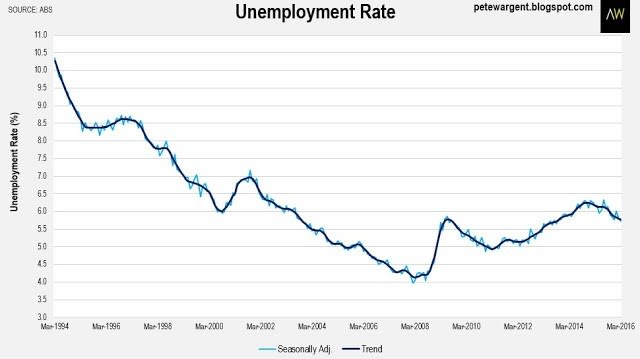

The March Labour Force figures showed that the national unemployment rate has kept ticking down to its lowest level in two-and-a-half years, and quite a bit sooner than had been expected.

More detailed employment figures due out on Thursday will confirm that Sydney's economy is rather enjoying its infrastructure and building boom.

Lately there has been a strong bounce in commodity prices, sending some of the oversold major resources companies on a serious bull run.

The March Labour Force figures showed that the national unemployment rate has kept ticking down to its lowest level in two-and-a-half years, and quite a bit sooner than had been expected.

More detailed employment figures due out on Thursday will confirm that Sydney's economy is rather enjoying its infrastructure and building boom.

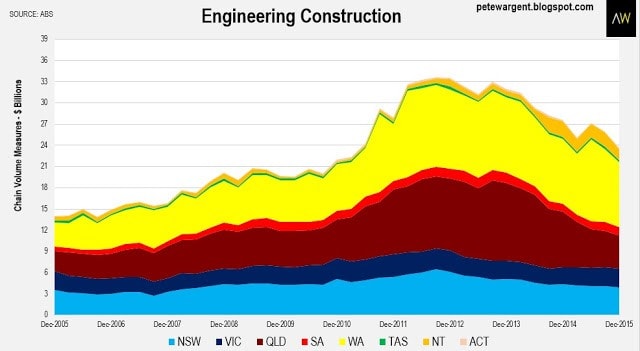

As for the much-feared "mining cliff", well that has all but been and gone, meaning that resources construction will no longer be such a significant drag on the economy in about 12 to 18 months time.

The latest available data only runs to December 2015, but as we are now about three-and-a-half years beyond the peak estimates have shown that some three quarters of the decline may now be in the rear view mirror, while record residential construction activity has helped to offset the decline.

That said, Western Australia and the Northern Territory still evidently have quite a way to fall back yet.

Good news, and futures markets are now less than convinced of the need for a further interest rate cut in this cycle.

Financial Stability Review (FSR)

In other news the Reserve Bank of Australia (RBA) released its April 2016 Financial Stability Review (FSR) on Friday.

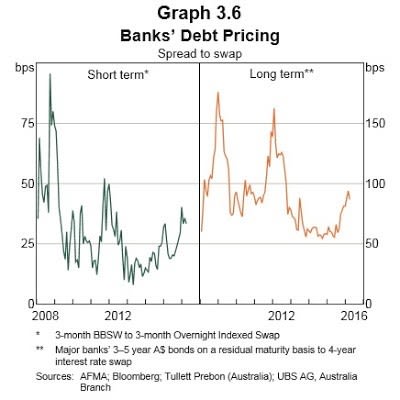

The RBA noted that spreads on Australian banks' wholesale funding costs had increased a little over the past six months, partly due to one-off factors related to international regulation.

That said, spreads have declined a bit of late as the outlook has brightened, and having successfully issued some $50 billion in bonds since the beginning of the year Australian banks are set to comfortably meet their funding requirements through this calendar year.

Despite the moderate increase in spreads, banks' long and short debt pricing spread to swap remains a world away from where it was in, say 2012, let alone from the unholy spike of 2008.

In any event Australian banks are now less exposed to wholesale funding risk because first deposit funding and now equity funding have been stepped up respectively.

There has been very little impact on deposit rates.

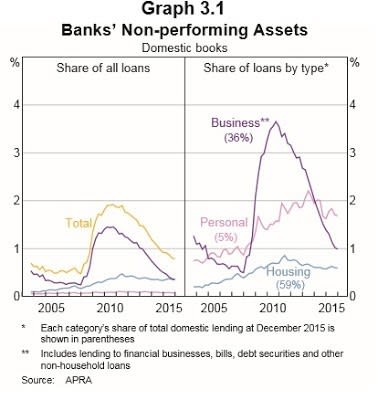

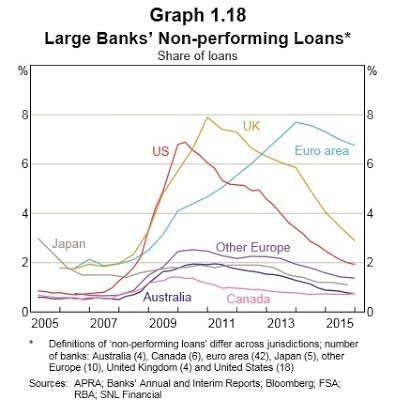

Non-performing asset ratios on domestic books are generally speaking in pretty good nick, having continued to improve in the latter half of 2015.

For the majors non-performing loans are also in very good shape, although the resources regions and mining towns of Western Australia and Queensland are expected to cop some default action, an unfortunate occurrence which has been known about for some time.

The RBA highlighted the potential for apartment oversupply and possible related settlement risks, while noting that there has been little evidence of the latter to date, and also little evidence of any meaningful slowdown in demand from China.

Despite the high levels of apartment construction, I'm coming around the view that with more than half of the dwelling stock effectively financed by offshore investors - overwhelmingly from China - such a ratio of apartments may never make it to the rental market that the actual impact on supply could yet prove to be a fizzer.

No stress?

The RBA remains relatively unperturbed with household debt levels, for although gross household debt has increased so too have aggregated mortgage buffers (balances held in offsets and redraw facilities), up to an enormous 17 per cent of outstanding loan balances - that's the equivalent of more than 2.5 years of mortgage repayments at current interest rate levels.

The RBA reiterated that most household debt is held by the households that can afford to service it, with half of household debt held by the top quintile of income earners. Meanwhile, indicators of stress on overall loan portfolios remain low.

However, this review did acknowledge that the households without mortgage buffers are often those in the lower income brackets, which may present a market risk in time.

As such, housing markets in lower socio-demographic areas may be at greater risk if either interest rates or unemployment rates rise.

This certainly rings true in the case of Sydney where house prices in the west and at the city fringe have recorded particularly punchy price growth since 2012 - a dynamic which tends to mask any underlying household mortgage stress - but with auction results pointing to ongoing weakness, the fundamentals out west all look rather fragile.

Despite the high levels of apartment construction, I'm coming around the view that with more than half of the dwelling stock effectively financed by offshore investors - overwhelmingly from China - such a ratio of apartments may never make it to the rental market that the actual impact on supply could yet prove to be a fizzer.

No stress?

The RBA remains relatively unperturbed with household debt levels, for although gross household debt has increased so too have aggregated mortgage buffers (balances held in offsets and redraw facilities), up to an enormous 17 per cent of outstanding loan balances - that's the equivalent of more than 2.5 years of mortgage repayments at current interest rate levels.

The RBA reiterated that most household debt is held by the households that can afford to service it, with half of household debt held by the top quintile of income earners. Meanwhile, indicators of stress on overall loan portfolios remain low.

However, this review did acknowledge that the households without mortgage buffers are often those in the lower income brackets, which may present a market risk in time.

As such, housing markets in lower socio-demographic areas may be at greater risk if either interest rates or unemployment rates rise.

This certainly rings true in the case of Sydney where house prices in the west and at the city fringe have recorded particularly punchy price growth since 2012 - a dynamic which tends to mask any underlying household mortgage stress - but with auction results pointing to ongoing weakness, the fundamentals out west all look rather fragile.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.