Sydney unit rents rise to record high? Pete Wargent

There's a theory that hosing down investor demand should have no impact on rents.

That's because in theory for every property that isn't bought by an investor, an owner-occupier buys instead, and thus the balance of supply and demand for rental properties remains unchanged.

In the real world capital city property markets don't work like that. In reality, many are renters either by choice or by circumstance, such as new graduates, transient employees, international or interstate visitors, and other folk who prefer taking a rental close to the city to ownership in the outer suburbs. Many others simply don't have an available deposit saved, so buying is not an option for them.

In the real world capital city property markets don't work like that. In reality, many are renters either by choice or by circumstance, such as new graduates, transient employees, international or interstate visitors, and other folk who prefer taking a rental close to the city to ownership in the outer suburbs. Many others simply don't have an available deposit saved, so buying is not an option for them.

As such rental growth is to a large extent determined by the growth in demand for rentals - underpinned over time by population growth - and by the relative activity of investors. For example, rents in Australian capital cities (and especially Sydney) boomed in 1986 and again in 2008 both of which were periods when investor buying had crashed in half.

For this reason it will be interesting to see what impact APRA's crackdown has on apartment rents in Sydney.

I've rented out several properties in Sydney in recent months, all of them for more than last year. However, the properties in question are in high demand areas such as on the Sydney harbourside, and as such are not likely to be very representative of what is happening in construction pockets like, say, Parramatta or Green Square.

Domain reported last week that as at March 2016 Sydney apartment rents were up by +4.0 per cent of 2016 from one year ago to a record median high of $520/week, with apartment rents now nearly as high as median house rents of $530/week in the harbour city. CoreLogic-RP Data has Sydney apartment rents +3.4 per cent higher than one year ago, and SQM Research records an increase of +5.7 per cent.

To date this may in part simply be due to newer stock coming online, which typically is advertised for rent at higher prices than the older stock it often replaces. And we shouldn't be expecting runaway growth in rents any time soon, since investor activity is still at a historically high level, even after APRA's dampening of the buy-to-let sector.

While it's still early days, this trend is certainly one to watch. Markets are quite complex beasts when you drill into the detail, with endless subtle balances and counter-balances, and in an expensive capital city such as Sydney with a growing population rental growth is likely to continue to have an inverse relationship to investor activity.

Another trend that is worth watching I looked at here, and that is that inner Sydney vacancy rates have tightened while vacancy rates in secondary and outers areas of Sydney are rising.

A question for today, then: could it be that foreign buyers of apartments are leaving their inner city units vacant?

FIRB data curve ball

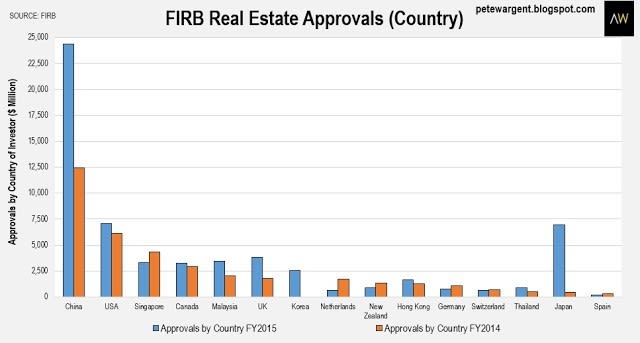

In the 1980s Japanese buyers famously bought heavily into Gold Coast property, but then promptly withdrew funds as the economic outlook soured. As I mused in some detail here, the FIRB data shows that through this cycle there has been an unprecedented surge in Chinese investment in Australian real estate, on a scale never before seen.

If you've been following some of my pieces over the years, you'll know that I aim to identify new trends well before you read about them in the wider media, which of course sometimes means being wrong.

On the topic of localised apartment oversupply, such as in Sydney's inner south, for example, I was yapping on about this emerging risk way back in 2013, long before it ever became a standard media topic du jour.

In that spirit, here's a possible anti-counter-contrarian view for you: maybe the high-rise building approvals boom won't prove to be such a big a deal after all? There are plenty of risk areas around, for sure, including some already alluded to above, but here are some lines of reasoning to consider:

-immigration is rising again - and therefore so is population growth - while the construction boom will soon pass its peak

-in the most populous capital cities at least, annual population growth never really slowed down anyway: it's still tracking at monumentally strong levels in Greater Sydney (+83,300 in FY2015) and Melbourne (+91,600)

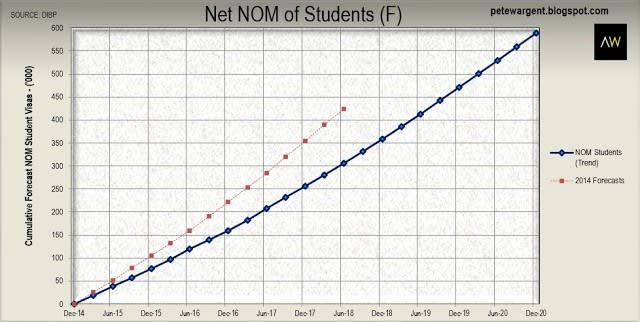

-the numbers of international students forecast to immigrate into the largest cities is vast - I mean, really vast

-although the take-up of permanent residency by international students to date has not yet been as strong as had been suggested by earlier forecasts, the cumulative intake over the next five years is expected to be truly enormous.

-the most timely available indicators of education arrivals suggest an unprecedented boom is well underway, with another new record high hit in the month of February.

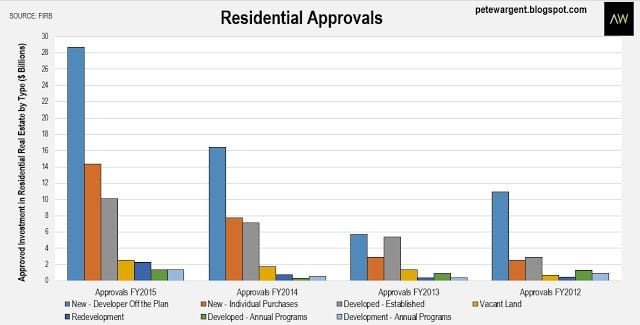

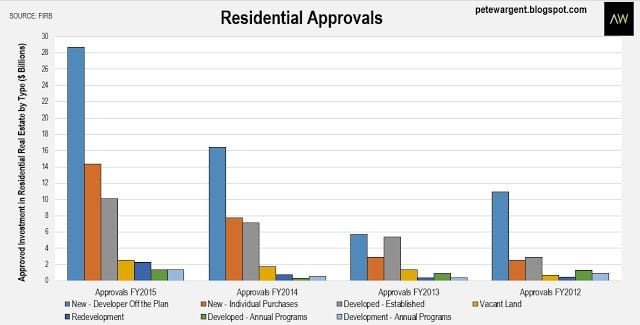

-with about 58 per cent of new construction approvals accounted for by foreign buyers, especially driven by buyers from the Chinese mainland, many may choose not to rent their apartments out, and as such, might not add to the new supply of rental stock at all.

Absorption?

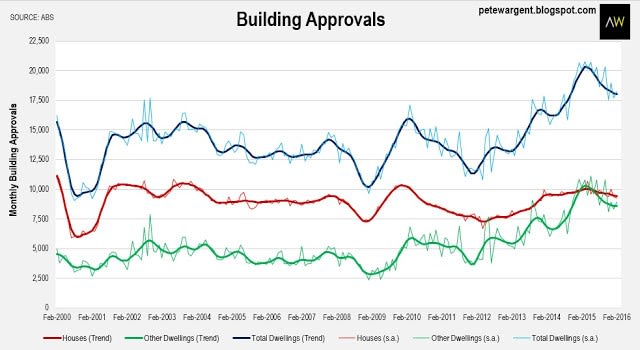

Mostly these are familiar points. Certainly both Sydney (35,231) and Melbourne (32,614) have approved a historically high number of attached dwellings over the past year.

However, some of these apartments are destined to forever remain in the "approved but not yet commenced" column, approvals are now trending down again, and in the grand scheme of things although there are certainly many cranes on the horizon, these are not outlandish numbers for cities of such a large and expanding population (Greater Sydney will blaze past 5 million in the next few months).

Moreover, the latest FIRB data show that the Chinese appetite for the purchase of new dwellings through this cycle is statistically unique. What if those Chinese buyers opt to rent out the apartments only on a short-stay basis? Or save them for their soon-to-be international student offspring? Or, most likely, simply never bother to ever bring them to market at all?

Suddenly Australia's apparent inner city apartment glut, represented by the green line below, could prove to be yet another doomsday scenario that never eventuates.

This is mostly conjecture, and it's not necessarily a base case, or even probable. And there are plenty of risks for the new and high-rise apartment markets in particular, as we have known now for some years.

Settlement risks are now considerably higher than they were, with increased deposit requirements. And what if there are legislative changes in China which force sales and repatriation of funds? This may not seem rational or realistic, but then again nobody forecast the scale of the Chinese investment boom in the first place, so who really knows what comes next?

In my opinion, most mainland Chinese investors deliberately invest in Australian and other overseas property markets with no intention of repatriating funds. In many cases, the financial return may not be the only objective, or even the primary objective.

Keep a close eye on asking rents and vacancy rates. If the inner city markets do begin to tighten contrary to expectations, then this may be an indicator that mainland Chinese buyers are electing not to bring their shiny new apartments to the rental market, at the same time as domestic investor activity is being throttled.

An interesting week of news ahead, commencing this morning with the Housing Finance data for February.

January had been a weaker month for housing loan approvals, but then January is never a big month for activity, so the February figures will give us a much clearer picture of likely activity levels of 2016.

The market consensus forecast is for a moderate rebound in the number of approvals in the month, which broadly fits with what I've been seeing and hearing, that being a steady increase in home loan activity in aggregate.

On Thursday, the ABS will release the latest March Labour Force figures, which will be the most important data of the week.

Last month the reported seasonally adjusted unemployment rate declined to 5.8 percent, but there is a fair chance that this volatile monthly reading could revert higher, with analysts expecting a bit of a rebound in both employment and the participation rate (following last month's surprise drop from 65.14 percent to 64.9 percent).

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.