Bank funding costs declined in 2015: Pete Wargent

Contrary to what you might think, and despite recent upward pressures, bank funding costs fell in 2015.

The Reserve Bank of Australia (RBA) took a detailed look at this in its ever-enlightening Bulletin this week.

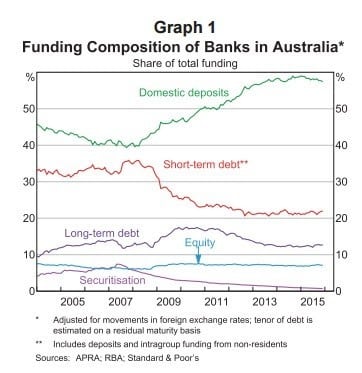

The funding composition of Aussie banks is made up of liabilities, comprised predominantly of domestic deposits which today make up a greater share of total funding than was the case prior to the financial crisis.

The Reserve Bank of Australia (RBA) took a detailed look at this in its ever-enlightening Bulletin this week.

The funding composition of Aussie banks is made up of liabilities, comprised predominantly of domestic deposits which today make up a greater share of total funding than was the case prior to the financial crisis.

The remainder of banks' funding composition comprises short term debt, long term debt, equity, plus now a small amount of securitisation.

Domestic deposits, which are a more stable form of funding, made up close to a 60 per cent share of the total by 2014, but this allocation has declined a little lately as the cost of wholesale debt became cheaper, and as banks raised equity in response to forthcoming changes to prudential regulation.

Here's that composition in a chart provided by the RBA:

Debt funding costs

While the official cash rate acts as an important "anchor" for bank funding costs, changes in the returns or compensation demanded by investors to hold debt can also influence banks' funding costs appreciably.

While the official cash rate acts as an important "anchor" for bank funding costs, changes in the returns or compensation demanded by investors to hold debt can also influence banks' funding costs appreciably.

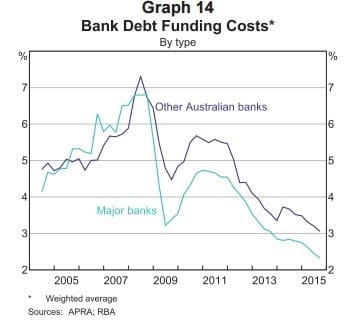

Debt funding costs for major banks fell materially by 70 basis points ("bps") in 2015, in part driven by 25bps interest rate cuts delivered in February and May respectively.

Most of the decline in funding costs relative to the cash rate took place in the first half of the last calendar year, with costs reasonably stable in the second half of 2015.

From yonder Bulletin, a chart of said debt funding costs once more, depicting the large decline in debt funding costs since 2008.

From yonder Bulletin, a chart of said debt funding costs once more, depicting the large decline in debt funding costs since 2008.

Notably markets are pricing a relatively higher weighted average debt funding cost for the non-major Aussie banks, a dynamic which did not exist so clearly before the financial crisis.

Wholesale funding

In respect of wholesale funding, the volume of bank bond issuance in the last calendar year was pretty much in line with the year which preceded it, though banks issued a bit less in covered bonds and residential mortgage-backed securities (RMBS).

In respect of wholesale funding, the volume of bank bond issuance in the last calendar year was pretty much in line with the year which preceded it, though banks issued a bit less in covered bonds and residential mortgage-backed securities (RMBS).

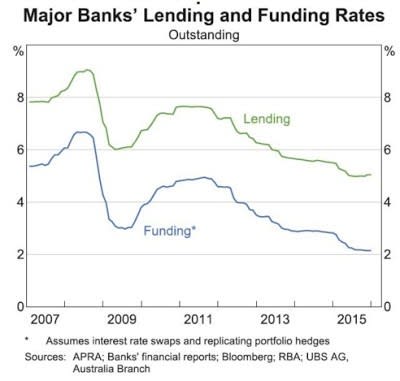

In terms of the actual mix of wholesale funding, that didn't change all that much either through last year, though a bit of shift from offshore long term to short term debt did see a slight reduction in funding costs for the majors, according to the RBA:

"Through 2015 declines in wholesale funding rates and the rolling over of existing higher-rate funding lowered the funding costs of major banks by 8 basis points more than the reductions in the cash rate".

Overall, then, the cost to banks of issuing new wholesale debt fell significantly at the beginning of 2015, and this lower level was sustained through most of the year.

This gradually flowed through to outstanding wholesale funding costs as the new cheaper debt replaced higher cost funding reaching maturity.

This gradually flowed through to outstanding wholesale funding costs as the new cheaper debt replaced higher cost funding reaching maturity.

Towards the end of 2015, the cost of issuing new debt increased, which is angle that all the "bank funding costs are soaring" articles are coming from, although seen in context, funding costs remain a good deal lower than they have been over the years.

Summarily, yields on new short term debt increased a bit to be higher than those on outstanding short term debt, but the cost of new long term debt was a little below the cost of corresponding outstanding debt.

Although equity tends to be a relatively small share of banks’ aggregate balance sheets (at about 6 to 7 per cent), equity is generally speaking more expensive than debt, thus relatively small shifts in equity funding can have proportionately large effects on total funding costs.

The major banks raised a significant amount of equity in 2015, in anticipation of upcoming changes to prudential regulation, about $21 billion worth in total, according to the RBA.

Lending rates

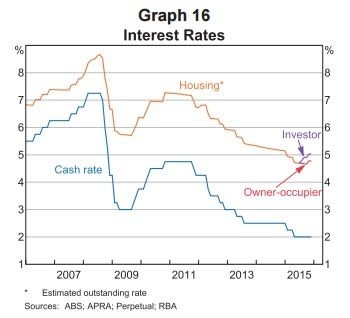

As for mortgage rates? Housing rates generally declined in line with the cash rate in the first half of last year, with the average outstanding interest rate on mortgages falling by about 50bps.

As has been well covered in the financial media, in the second half of the year banks tweaked their lending rates such that the average outstanding housing interest rate for investor loans was only moderately lower over 2015, while rates for owner-occupiers declined by about 30bps. over the year.

The implied spread of major banks - that being the difference between average lending rates and debt funding costs - increased by around 20bps over 2015, this change driven by a combination of the decline in average funding costs relative to the cash rate and an increase in the average lending rate.

However, the Reserve Bank noted that lending rates and debt funding costs do tend to move in line with each other in the longer run.

The wrap

Despite a moderate increase in debt funding costs recently and a range of equity raisings, funding costs are still lower than they were.

With global interest rates so low, futures markets still expect the cash rate in Australia to be cut again by November this year, although banks may elect to retain a portion of any 25bps cut delivered in order to shore up their balance sheets further.

Alternatively banks may looking at increasing mortgage rates a little via out of cycle hikes.

The wrap

Despite a moderate increase in debt funding costs recently and a range of equity raisings, funding costs are still lower than they were.

With global interest rates so low, futures markets still expect the cash rate in Australia to be cut again by November this year, although banks may elect to retain a portion of any 25bps cut delivered in order to shore up their balance sheets further.

Alternatively banks may looking at increasing mortgage rates a little via out of cycle hikes.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.

Tags:

Banking