Piff, Paff, Pouf the mining construction boom vanishes: Pete Wargent

Pouf!

In case it wasn't obvious, that was the sound of the mining construction boom vanishing into a cloud of coal dust.

Let's take a run through recent Lending Finance figures to see what we can learn.

In case it wasn't obvious, that was the sound of the mining construction boom vanishing into a cloud of coal dust.

Let's take a run through recent Lending Finance figures to see what we can learn.

Total lending softens again

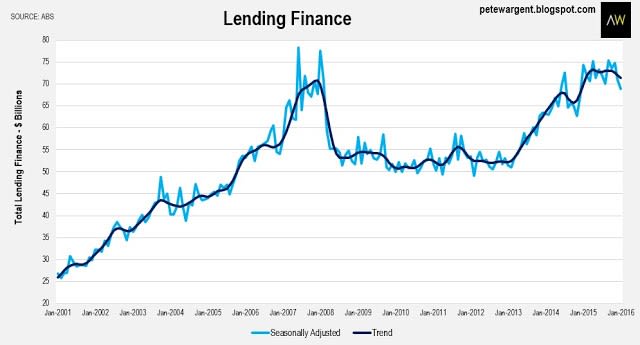

The data for January showed that total lending has pulled back a little from record highs in trend terms.

The seasonally adjusted lending finance result in September 2015 had been the highest in 7.5 years, but January saw another weaker month of lending recorded, in part due to the dampening of property investor loans.

The seasonally adjusted lending finance result in September 2015 had been the highest in 7.5 years, but January saw another weaker month of lending recorded, in part due to the dampening of property investor loans.

In seasonally adjusted terms total lending was down by -2.9 per cent from December, with the trend inching down over the past four months from a high of $72.9 billion to $71.3 billion.

In trend terms total lending is now only +2.1 per cent higher than one year ago, and appears to be softening.

In trend terms total lending is now only +2.1 per cent higher than one year ago, and appears to be softening.

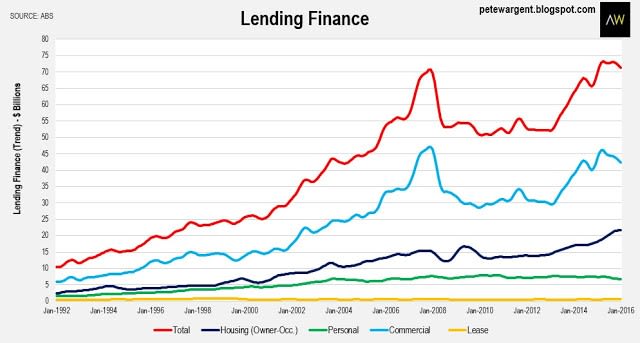

One of the key narratives over the past six months or so has been that while property investor loans have been stymied, owner-occupier lending has by and large ramped up to take its place.

Indeed this has happened to the extent that APRA is now beginning to sense that some of these loan reclassifications might just be a bit fishy.

Owner-occupier commitments pulled back a bit in January, although major renovation activity is now increasing at last.

Indeed this has happened to the extent that APRA is now beginning to sense that some of these loan reclassifications might just be a bit fishy.

Owner-occupier commitments pulled back a bit in January, although major renovation activity is now increasing at last.

Yet overall trend owner-occupier housing commitments of $21.6 billion are an exceptionally strong +18.8 per cent higher than one year ago.

Business lending pulled back by a seasonally adjusted -2.5 per cent in January, reflected by the commercial finance trend in the chart below, the softer figures in part reflecting a huge year-on-year decline in commercial loans to the mining sector, although agriculture finance has been rising solidly since 2013.

Lease finance, which represents only a small part of total lending finance, increased by 3.7 per cent in January.

Here's the summary chart, presented in trend terms:

Lease finance, which represents only a small part of total lending finance, increased by 3.7 per cent in January.

Here's the summary chart, presented in trend terms:

Industry & state trends

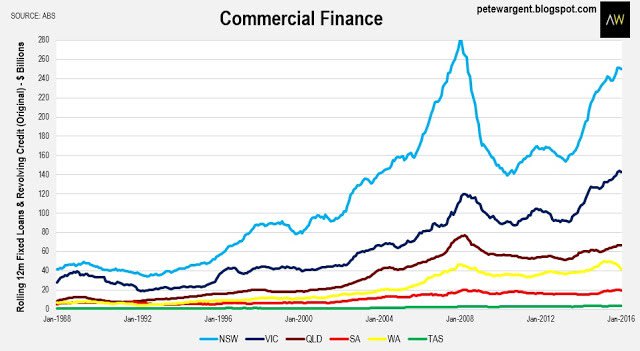

Looking at commercial fixed loans by industry shows that with a couple of mega projects now dropping off the annualised data, commercial financing to the mining sector has shrunk by more than a quarter.

Fortunately for the economy at the national level, mining represents only a relatively small part of the total and a number of other industries have helped to pick up the slack, although this is unlikely to be much compensation for the struggling regions.

At the state level, Victoria (+13 per cent), Queensland (+11 per cent), and New South Wales (+8 per cent) have all enjoyed a solid uplift in commercial finance over the last year in rolling annual terms, but the other resources states of Western Australia and the Northern Territory have seen activity decline.

Looking at commercial fixed loans by industry shows that with a couple of mega projects now dropping off the annualised data, commercial financing to the mining sector has shrunk by more than a quarter.

Fortunately for the economy at the national level, mining represents only a relatively small part of the total and a number of other industries have helped to pick up the slack, although this is unlikely to be much compensation for the struggling regions.

At the state level, Victoria (+13 per cent), Queensland (+11 per cent), and New South Wales (+8 per cent) have all enjoyed a solid uplift in commercial finance over the last year in rolling annual terms, but the other resources states of Western Australia and the Northern Territory have seen activity decline.

Investor lending stymied

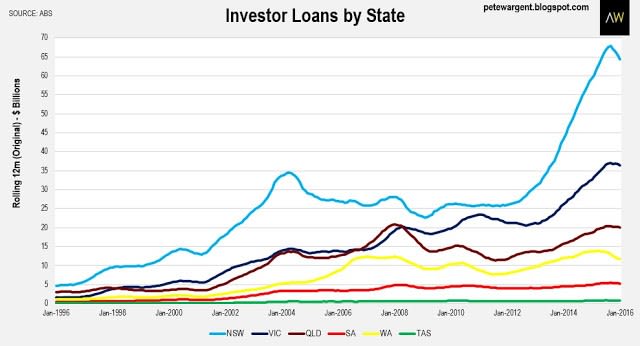

As noted above, property investor lending has been dampened, to be replaced by a rise in home loan activity.

Nowhere has this been more so in evidence than in Sydney where home loan commitments have exploded higher, mirroring a corresponding decline in investor loans.

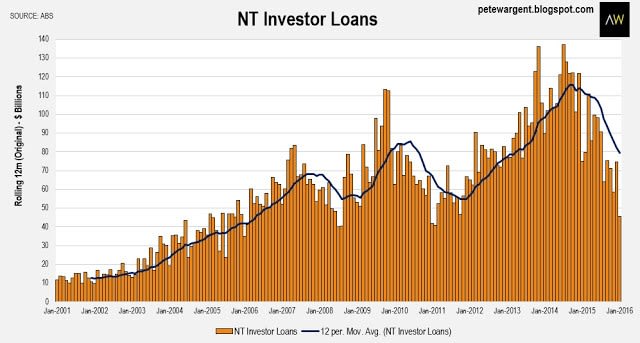

The property investor loans figures are not seasonally adjusted, and so are presented below on a rolling annual basis.

Lately the best performing states for property investment loans have been Queensland, Tasmania, and South Australia, not least because these states did not experience the great boom that New South Wales and Victoria did.

On the other hand investor activity in the Northern Territory continues to plummet back to monthly volumes last seen five years ago.

The rolling annual total of property investor loans in the "Top End" has declined by 29.4 per cent in the past year alone, to now be down by 33.9 per cent from the September 2014 peak.

There is a significant dwelling price correction in the post for Darwin, with rents also having fallen sharply.

The wrap

The wrap

Overall, January proved to be a softer month for lending, as might have been expected following on from Wednesday's housing finance data.

These figures present further evidence of the conspicuous and precipitous decline in mining construction.

Total lending finance has eased over the past few months, although the headline figure remains strong enough in historical terms.

Total lending finance has eased over the past few months, although the headline figure remains strong enough in historical terms.

PETE WARGENT is the co-founder of AllenWargent property buyers (London, Sydney) and a best-selling author and blogger.

His latest book is Four Green Houses and a Red Hotel.

Pete Wargent

Pete Wargent is the co-founder of BuyersBuyers.com.au, offering affordable homebuying assistance to all Australians, and a best-selling author and blogger.